1. What Happened? (Event Analysis)

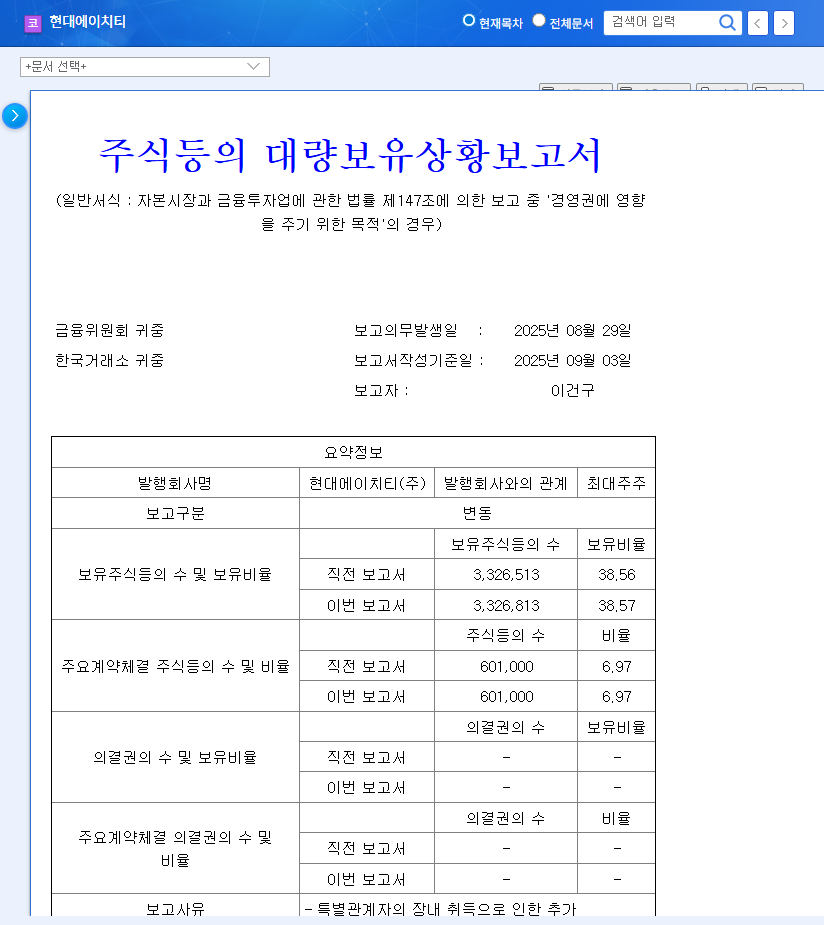

On September 3, 2025, Lee Geon-gu, a major shareholder of Hyundai HT, along with Park Chul-hee, increased their stake in the company. Lee Geon-gu’s ownership rose slightly from 38.56% to 38.57%, interpreted as a move to strengthen management control. While the change is minimal, it signals the management’s intent and commitment.

2. Why Did This Happen? (Background Analysis)

Hyundai HT possesses a stable business foundation based on its smart home systems. The company is actively pursuing new growth engines by venturing into electric vehicle charging stations and generational warehouses. This stake increase can be seen as a strong indication of management’s confidence in these new ventures. Furthermore, the company’s robust financial structure (debt ratio of 29.51% and net debt to equity ratio of -4.63%) demonstrates sufficient capacity for investments in these new businesses.

3. What’s Next? (Future Outlook)

Although a small stake increase, the stated purpose of ‘management influence’ can positively impact investor sentiment. Strengthened management control will likely boost new business initiatives, offering a positive signal for long-term investors. However, short-term stock volatility will depend on market conditions and the company’s fundamental performance.

4. What Should Investors Do? (Investment Strategies)

- Long-term investors: Considering Hyundai HT’s business diversification and financial stability, a long-term investment approach might be suitable.

- Short-term investors: Focus on monitoring the performance of new businesses and market reactions rather than short-term stock fluctuations to identify potential investment opportunities.

FAQ

How will Lee Geon-gu’s increased stake affect the stock price?

While minimal short-term impact is expected, it could positively influence management stability and new business development in the long run.

What are Hyundai HT’s main businesses?

Their core business is smart home systems, with expansion into electric vehicle charging stations and generational warehouses.

What are the key investment points for Hyundai HT?

Key investment points include a stable financial structure, competitiveness in the smart home market, and pursuit of new growth engines.