HHI Wins $300M Container Ship Contract

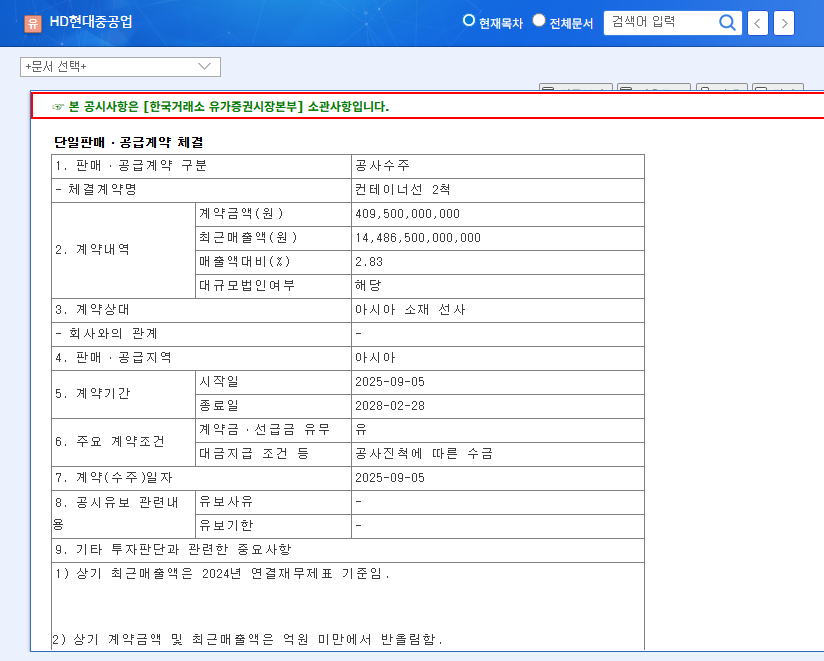

HHI has signed a contract with an Asian shipping company to supply two container ships for $300 million. This represents 2.83% of HHI’s revenue, and the contract period runs from September 5, 2025, to February 28, 2028.

Contract Significance: Strengthening Fundamentals and Growth Momentum

This order goes beyond a simple contract; it underpins HHI’s robust growth trajectory. Adding to the existing order backlog exceeding $34 Billion, this contract is expected to further solidify future revenue stability. The potential integration of eco-friendly ship technology is also anticipated to positively impact profitability.

Investment Outlook: Positive but Requires Risk Management

- Positive Factors: Solid order backlog, leadership in the eco-friendly ship market, improved sales and profitability, and enhanced financial soundness.

- Risk Factors: High interest expenses, sluggish offshore plant sector, and volatility in raw material prices and exchange rates.

While the contract is expected to provide positive momentum for the stock price, continuous monitoring of external factors like interest rate fluctuations and potential shipping market slowdown is necessary.

Investor Action Plan

Investors considering HHI should pay attention to the following:

- Future interest rate trends and exchange rate volatility

- Sustainable growth of the eco-friendly ship market

- Potential increase in orders for the offshore plant sector

- Competitor trends and market dynamics

Developing an investment strategy through consistent monitoring and managing risks is crucial.

FAQ

How will this contract impact HHI’s stock price?

This contract is expected to strengthen HHI’s fundamentals, improve investor sentiment, and provide positive momentum for the stock price.

What is HHI’s business outlook?

HHI maintains a positive business outlook based on a robust order backlog and its competitive edge in the eco-friendly ship market. However, attention should be paid to risk factors such as changes in the macroeconomic environment and intensifying competition within the industry.

What precautions should investors take?

Investors need to continuously monitor factors like interest rate trends, sustained growth of the eco-friendly ship market, and potential order increases in the offshore plant sector. Careful development of an investment strategy is essential.