The latest HYUNDAI EVERDIGM Q3 2025 earnings report presents a complex picture for investors. While the headline news celebrates a return to net profitability, a deeper look reveals significant headwinds, including a sharp revenue decline and razor-thin operating margins. Is this a genuine turnaround or a temporary reprieve? This comprehensive HYUNDAI EVERDIGM analysis will dissect the provisional financial results, explore the underlying factors, and provide a clear outlook for stakeholders.

We’ll move beyond the surface-level numbers to evaluate the fundamental health of the company, its position within the challenging construction equipment market, and what the future may hold for the HYUNDAI EVERDIGM stock.

Breaking Down the Q3 2025 Financials

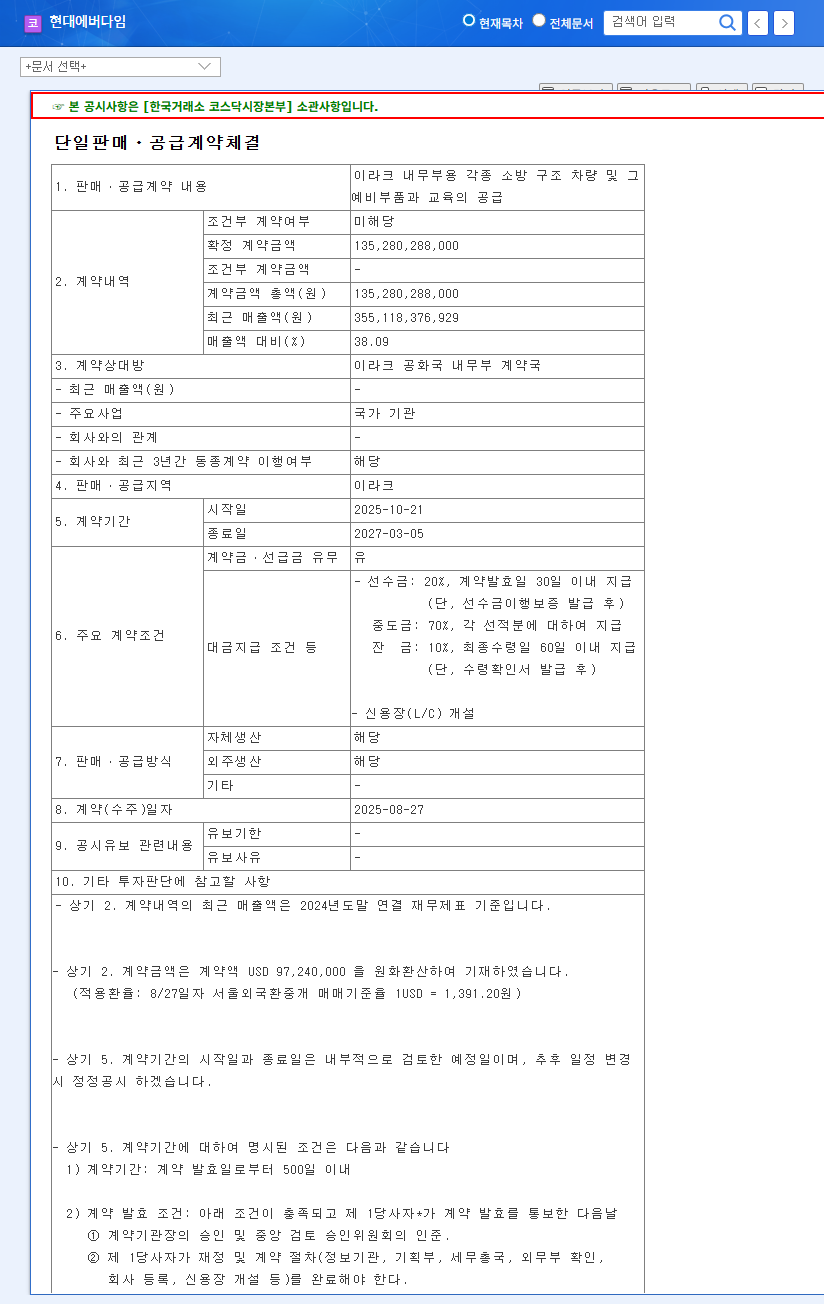

On November 6, 2025, HYUNDAI EVERDIGM released its provisional consolidated results, providing a critical data point for the market. The full details can be reviewed in the company’s Official Disclosure (DART). The key performance indicators are as follows:

- •Revenue: KRW 64.7 billion, marking a significant 24% decrease from the previous quarter (QoQ).

- •Operating Profit: KRW 0.5 billion, resulting in a precarious operating profit margin of just 0.77%.

- •Net Profit: KRW 1.7 billion, successfully turning to black after a loss in Q1.

The headline achievement is undoubtedly the net profit turnaround. This follows two consecutive quarters of positive operating profit and suggests a potential stabilization after a difficult start to the year. However, this positive note is overshadowed by the steep revenue contraction and an operating margin that leaves virtually no room for error.

In-Depth Analysis: The Good, The Bad, and The Uncertain

A thorough HYUNDAI EVERDIGM analysis requires us to weigh the conflicting signals within the HYUNDAI EVERDIGM Q3 2025 earnings report.

Positive Signals: A Glimmer of Hope

The shift back to net profitability is the most crucial positive factor. It indicates that despite top-line pressure, the company may be getting a handle on non-operating expenses or benefiting from favorable financial items. Furthermore, while segment-specific data for Q3 is pending, the strong 19.4% growth in the vehicle business noted in the semi-annual report could be a continuing source of strength, potentially offsetting weakness in other areas and contributing to the bottom-line improvement.

Persistent Challenges and Red Flags

The negative factors are substantial and point to deep-seated issues. The 24% QoQ revenue drop is alarming and likely reflects a deteriorating domestic construction market and increased global competition. For more context on global market trends, you can review industry reports from authoritative sources like Bloomberg. The extremely low 0.77% operating profit margin is a major red flag, suggesting that high Selling, General & Administrative (SG&A) expenses and elevated production costs continue to erode profitability. This indicates a critical need for structural cost reforms.

“While the net profit figure is a welcome sight, the market will remain skeptical until HYUNDAI EVERDIGM demonstrates a clear path to sustainable revenue growth and a healthier operating margin. The current profitability is too fragile to signal a full-fledged recovery.”

Outlook & Investor Action Plan

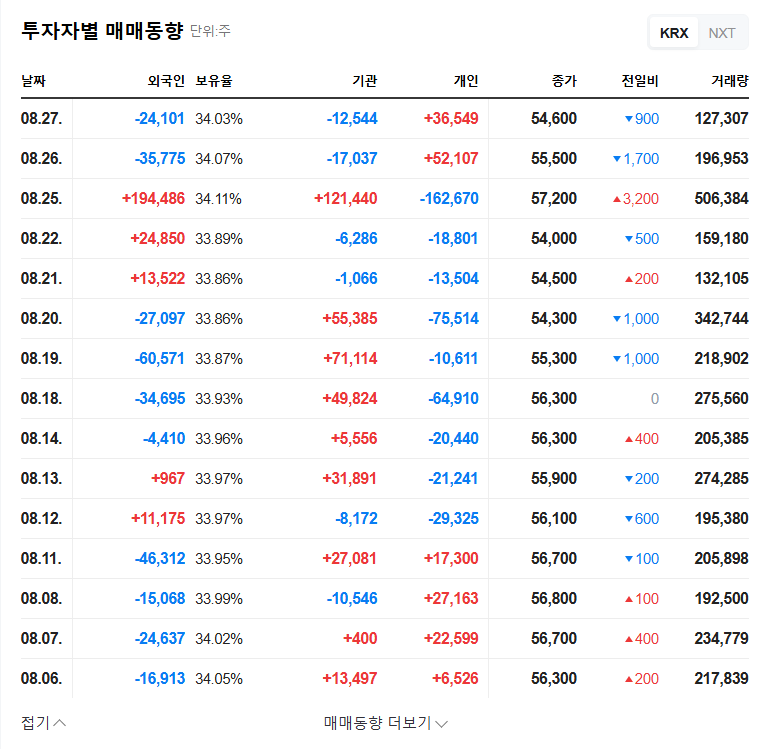

Given the mixed results from the HYUNDAI EVERDIGM Q3 2025 earnings, investors should adopt a cautious and vigilant approach. The short-term market reaction may be neutral to slightly positive, but long-term value creation depends on the company’s ability to address its core challenges.

Key Factors to Monitor Moving Forward

- •Profitability Improvement Strategy: Look for concrete evidence of cost-cutting measures. This includes monitoring SG&A expenses in future reports and listening for management commentary on initiatives to improve production efficiency.

- •New Order Pipeline and Execution: The successful delivery of the large contract with Korea Hydro & Nuclear Power (KHNP) is paramount. Furthermore, track announcements of new, significant orders which are essential for rebuilding the revenue base.

- •Market Diversification: With the domestic construction market facing a downturn, the success of the company’s overseas strategy is more critical than ever. Progress in penetrating new international markets will be a key growth driver.

- •Macroeconomic Headwind Management: Pay attention to how the company navigates financial costs from high interest rates and manages currency risk from KRW/USD and KRW/EUR volatility. Effective hedging strategies will be vital. You can compare these results with our previous Q2 2025 earnings analysis for context.

Conclusion: A Fragile Recovery

In conclusion, the HYUNDAI EVERDIGM Q3 2025 earnings report shows a company at a crossroads. The return to net profit is a commendable step, but it rests on a precarious foundation of declining sales and minimal operating profitability. A sustainable turnaround will require not just financial discipline but a robust strategy for revenue growth and market adaptation. Investors should look past the headline numbers and focus on the fundamental operational improvements in the upcoming quarters to truly gauge the company’s long-term potential.