A significant development has captured the attention of investors in HYUNDAI MOVEX (현대무벡스). Hyundai Elevator, the company’s largest shareholder, has announced a substantial reduction in its stake, sending ripples through the market and prompting questions about the future of HYUNDAI MOVEX stock. How will this shift in ownership affect the stock price, and what is the most intelligent way for investors to navigate this uncertainty?

This comprehensive investment analysis goes beyond the surface-level news. We will dissect the event, evaluate the company’s robust fundamentals, and provide a clear, actionable investment strategy to help you identify both the risks and the hidden opportunities within this change.

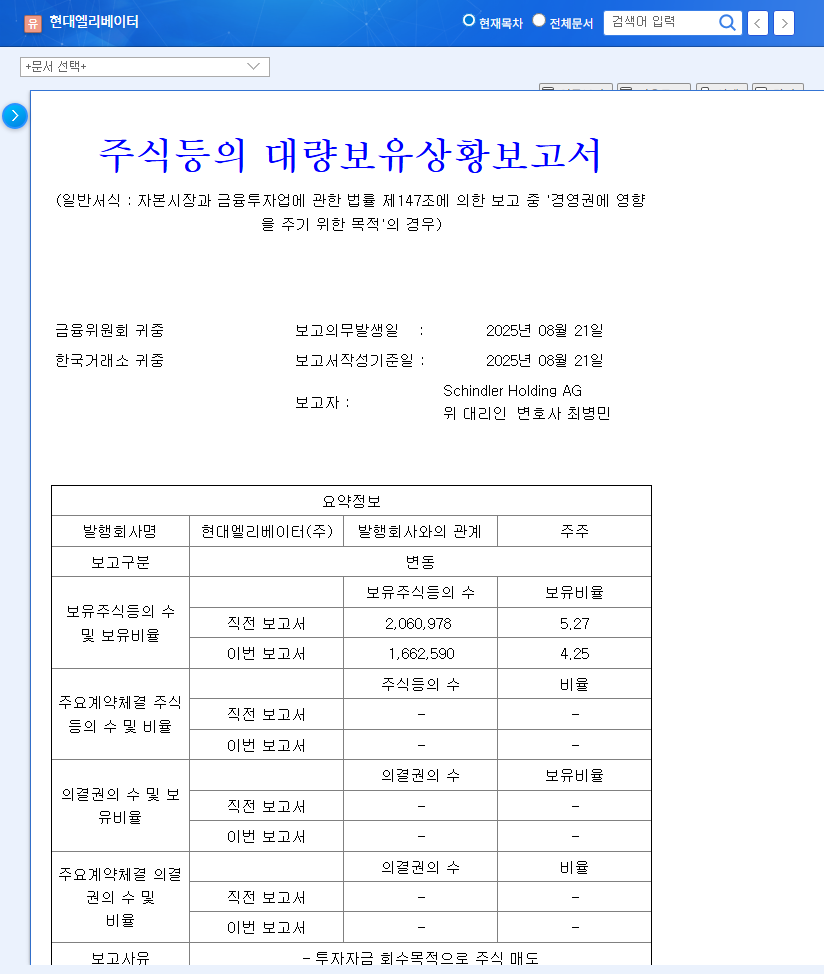

The Disclosure: Unpacking the Hyundai Elevator Stake Sale

On October 31, 2025, Hyundai Elevator formally disclosed a change in its large shareholding status for HYUNDAI MOVEX. The core of this announcement was the reduction of its stake by approximately 7 percentage points, from 60.22% down to 53.21%. This transaction was executed via an after-hours block trade and an on-market sale by a related party. Despite this sale, Hyundai Elevator’s stated purpose of holding remains ‘influence on management,’ indicating continued strategic control. You can view the complete filing in the Official Disclosure (DART Report).

Why Does This HYUNDAI MOVEX Share Sale Matter?

A major shareholder selling a significant block of shares can be interpreted in several ways. It could signal a strategic portfolio adjustment by Hyundai Elevator, perhaps to secure liquidity for other ventures or to focus more on its core elevator business. In the short term, such a sale often creates selling pressure and introduces uncertainty, which can negatively impact investor sentiment and the stock price.

While the short-term market reaction may be volatile, it is crucial to remember that Hyundai Elevator retains a majority stake of 53.21%. This ensures management stability and control remain firmly in place for the foreseeable future.

Over the long term, this could have positive effects. The increased free float of shares can enhance liquidity for HYUNDAI MOVEX stock, potentially attracting a new base of institutional and retail investors. For real-time market data and analysis, professionals often rely on platforms like Reuters Market Data.

Beyond the Headlines: Are HYUNDAI MOVEX’s Fundamentals Strong?

To form a sound investment thesis, we must look past the ownership change and analyze the company’s core business. HYUNDAI MOVEX demonstrates robust fundamentals, primarily powered by two key segments.

1. Logistics Automation: The Engine of Growth (78% of Revenue)

This is the company’s primary growth driver. Fueled by the global e-commerce boom and the push for greater efficiency in supply chains (Industry 4.0), the demand for logistics automation is soaring. HYUNDAI MOVEX is a market leader, expanding into high-value sectors like secondary battery manufacturing and cold storage solutions. Its growing international presence in China, Vietnam, the US, and Hungary further solidifies its market position.

2. Platform Screen Doors (PSD): A Stable Foundation (15% of Revenue)

The PSD business provides a steady stream of revenue. With a dominant domestic market share of over 50%, the company benefits from new subway line construction and the renovation of aging stations. Furthermore, successful projects like the Sydney Metro in Australia and crucial SIL certification are paving the way for expansion into the lucrative European market.

Financial Health & Shareholder Value

A look at the balance sheet reveals a stable financial position. While operating profit saw a slight decrease in Q2 2025 due to rising raw material costs, revenue continued to grow year-on-year. Crucially, the company’s debt-to-equity ratio has improved, indicating sound financial management. Moreover, the recent cancellation of 6.59 million treasury shares is a strong positive signal, as it enhances shareholder value by increasing earnings per share. For those unfamiliar with the benefits, you can learn more about how treasury stock cancellation works in our related article.

Investor Action Plan: Crafting Your HYUNDAI MOVEX Strategy

Given the short-term uncertainty from the Hyundai Elevator sale balanced against strong long-term fundamentals, we recommend a “Neutral” stance with a strategic approach.

- •Short-Term Strategy: Adopt a wait-and-see approach. Monitor how the market absorbs the newly available block of shares. A significant, sentiment-driven price drop could present a compelling phased buying opportunity for investors who believe in the company’s fundamental value.

- •Mid-to-Long-Term Strategy: Focus on the fundamentals. The growth trajectory of the logistics automation market is the primary catalyst for HYUNDAI MOVEX. Long-term investors should base their decisions on the company’s continued performance, technological innovation, and expanding order backlog.

- •Key Monitoring Points: Keep a close watch on any further announcements from Hyundai Elevator regarding its remaining stake. Also, analyze how any changes in ownership structure might influence future business strategy or M&A activity.

In conclusion, the HYUNDAI MOVEX share sale by its parent company is a pivotal event creating short-term market noise. However, the company’s strong position in high-growth industries, stable financials, and clear path for future revenue suggest that for the patient investor, this period of uncertainty could evolve into a long-term opportunity.