The market is buzzing with the latest news surrounding the Hyundai Department Store stock, as its largest shareholder, Hyundai GF Holdings, has increased its stake. This move has investors asking a critical question: Is this a signal of renewed confidence and a precursor to a stock price surge, or a minor adjustment with little long-term impact? This comprehensive Hyundai Department Store analysis will dissect the event, evaluate the company’s core fundamentals, and explore the macroeconomic landscape to provide a clear investor outlook.

We will delve into the strategic intent behind this decision, the health of its diverse business segments, and the external pressures that could shape its future. For anyone considering an investment, understanding these interconnected factors is paramount.

The Shareholder Move: A Closer Look

What Exactly Happened?

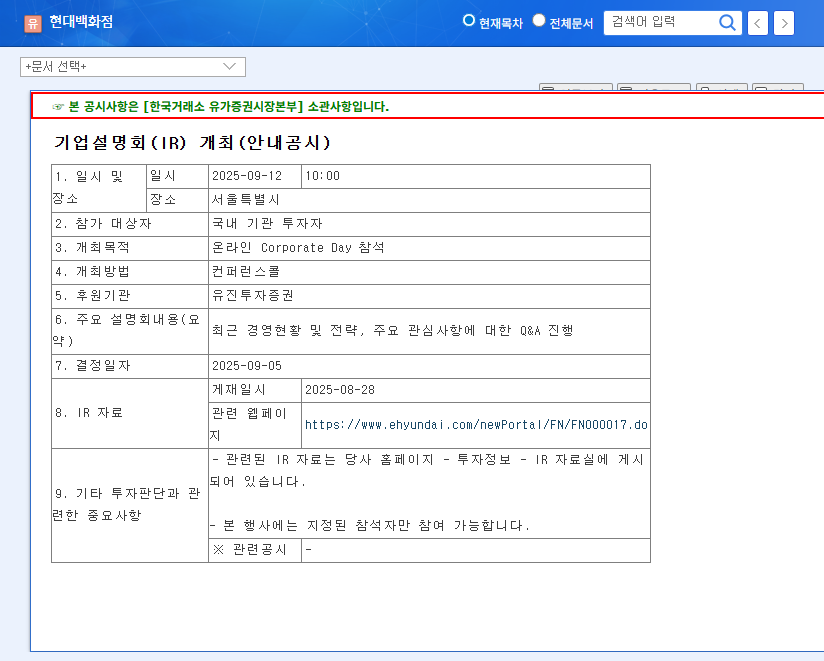

Hyundai GF Holdings Co., Ltd. formally announced an acquisition of additional shares in Hyundai Department Store. According to the public filing, this transaction increased their total ownership by 0.1 percentage points, from 41.24% to 41.34%. While seemingly small, the stated purpose of ‘Influence over Management Rights’ is a clear declaration of intent. You can view the Official Disclosure on DART for complete details.

The Strategic Rationale: Why Increase the Stake Now?

This move is widely interpreted as a strategic maneuver by Hyundai GF Holdings to reinforce its control and signal a long-term commitment to the company’s value. In a competitive retail environment, a stable and decisive management structure is crucial for executing ambitious growth plans, such as new store openings or digital transformations. This act serves to reassure the market that leadership is consolidated and focused on sustainable growth rather than short-term financial gains.

This stake increase, though minor in percentage, is a significant symbolic vote of confidence from the parent company, aiming to stabilize management and steer the company towards long-term value creation.

Fundamental Analysis of Hyundai Department Store

To truly understand the investor outlook, we must look beyond a single event and analyze the company’s operational health. Hyundai Department Store is a multi-faceted business with distinct strengths and challenges across its segments.

Strengths and Weaknesses

- •Robust Core Business: The department store division remains the company’s anchor, contributing over 52% of consolidated revenue. It has demonstrated resilience and continues to be a powerful engine for profitability.

- •Successful Turnaround (Zinus): The furniture subsidiary, Zinus, has successfully transitioned back to profitability, demonstrating effective business restructuring and operational improvements. This diversification provides a healthy buffer for the overall portfolio.

- •Duty-Free Segment Struggles: A significant headwind is the underperforming duty-free segment. It faces intense competition and high operating costs, which have been a drag on overall profitability. A clear strategy for improving this division is essential for future growth.

- •Solid Financial Health: The company maintains a healthy debt-to-equity ratio of 78.94%. However, increased investment has slightly raised the net borrowing ratio, and exposure to foreign exchange risk requires careful management.

Market Impact and Hyundai Department Store Stock Outlook

The key question for investors is how this news translates into stock performance. The impact can be viewed from both a short-term and long-term perspective.

Short-Term Sentiment vs. Long-Term Value

In the short term, the stake increase is a positive signal that could boost investor confidence. However, given the marginal 0.1% change, it is unlikely to be a catalyst for a major, immediate rally in the Hyundai Department Store stock price. The long-term trajectory will depend entirely on the company’s ability to capitalize on its stable management. If this leads to better strategies—especially in turning around the duty-free business—the positive impact on fundamental value will eventually be reflected in the stock price. For a broader view on market trends, investors often consult sources like Bloomberg’s market analysis.

Navigating Macroeconomic Headwinds

No company operates in a vacuum. Several macroeconomic variables present both risks and opportunities for Hyundai Department Store.

- •Interest Rates: With benchmark rates holding steady in both the U.S. and South Korea, borrowing costs are stable. However, any future hikes could dampen consumer spending on discretionary and luxury goods, impacting department store sales.

- •Exchange Rates: A volatile KRW/USD exchange rate can be a double-edged sword. A weaker won makes imported goods more expensive but could attract more foreign tourists to its duty-free shops, potentially boosting that segment.

- •Logistics Costs: Rising global freight indices signal increasing pressure on supply chain costs. This could squeeze margins on imported products sold across its retail platforms. For more on this, see our analysis of the Korean retail sector.

Investor Strategy and Final Recommendations

Considering all factors, the recent stake increase by Hyundai GF Holdings is a net positive, but it is not a standalone reason to invest. The long-term success of the Hyundai Department Store stock hinges on sustained fundamental improvements.

Short-Term Approach

The immediate impact is limited. A wait-and-see or phased buying strategy is advisable. Aggressively buying based on this news alone carries unnecessary risk.

Long-Term Perspective

Investors should focus on key performance indicators: sustained growth in the core department store segment, a clear path to profitability for the duty-free business, and the continued success of Zinus. The company’s ability to manage macroeconomic risks will also be critical. The stabilized management should, in theory, provide the foundation to tackle these challenges effectively.