1. Hyosung Heavy Industries Q2 Earnings: Key Takeaways

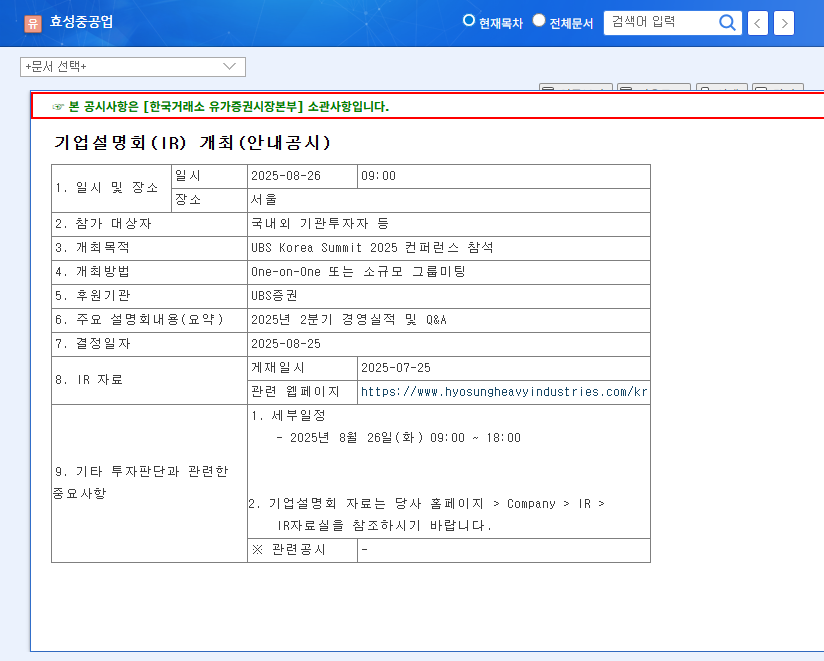

Hyosung Heavy Industries announced its Q2 2025 earnings, providing insights into its current business status and future outlook. The company also aimed to enhance transparency by disclosing additional information regarding past contracts. However, the ongoing losses remain a significant concern.

2. A Bright Future? Expectations and Reality of New Growth Engines

Contracts in overseas construction and power equipment are progressing steadily, and the normal progress of projects nearing completion is a positive sign. The pursuit of new growth engines, including data centers, hydrogen, and offshore wind power, presents potential future growth opportunities, but the actual generation of profits remains crucial.

3. Key Checklist for Investors: Risks and Opportunities

Investors considering Hyosung Heavy Industries should carefully evaluate the following:

- Profitability Improvement Plan: Assess the concrete strategies and feasibility of overcoming the continuous losses.

- Foreign Exchange Risk Management: Given the significant portion of overseas business, a robust hedging strategy against exchange rate fluctuations is essential.

- Performance of New Growth Businesses: Look beyond optimistic projections and analyze actual performance and market competitiveness.

4. Conclusion: Hyosung Heavy Industries, Investment Strategy A to Z

The future of Hyosung Heavy Industries presents both uncertainties and opportunities. The Q2 earnings announcement provided valuable information to investors, but continuous monitoring and analysis are necessary. Investors should carefully consider profitability improvement, foreign exchange risk management, and the performance of new growth engines when formulating their investment strategies.

Q: How did Hyosung Heavy Industries perform in Q2 2025?

A: The Q2 2025 earnings were announced during the IR presentation. Details can be found in the report. The continued losses are a concern for investors.

Q: What are the main businesses of Hyosung Heavy Industries?

A: In addition to overseas construction and power equipment, the company is pursuing new growth engines such as data centers, hydrogen, and offshore wind power.

Q: What should investors be aware of when considering Hyosung Heavy Industries?

A: Investors should consider the continued losses, foreign exchange volatility, and uncertainties surrounding the new growth businesses when making investment decisions.