1. What Happened? : $1.7B Redevelopment Project Win

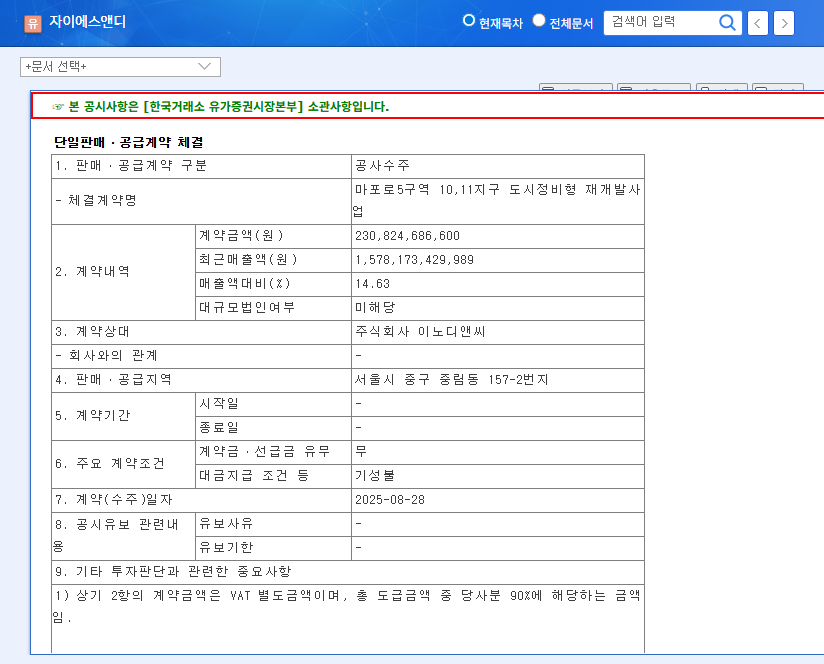

GS E&C signed a contract with INNODNC on August 28, 2025, for a $1.7 billion redevelopment project in Mapo-ro 5 District. This contract represents 14.63% of GS E&C’s revenue in the first half of 2025.

2. Why Does it Matter? : A Chance to Overcome Financial Difficulties

GS E&C has recently faced challenges, including declining sales and operating losses due to rising construction costs and provisions for repair defects. This large-scale project win could be a significant momentum for earnings improvement.

3. What’s Next? : Positive Impacts and Risks

- Positive Impacts: Increased sales, improved profitability, strengthened housing business competitiveness, increased order backlog, improved investor sentiment

- Risks: Execution risk, cost management challenges, housing market volatility, short-term financial burden

4. What Should Investors Do? : Careful Observation and Analysis Required

While this project win is a positive sign, investors should consider several factors. Continuous monitoring of project execution, cost management, and housing market conditions, along with a thorough risk analysis, are crucial for making informed investment decisions.

Frequently Asked Questions

How much will this project impact GS E&C’s earnings?

The $1.7 billion contract represents a significant portion (14.63%) of GS E&C’s first-half 2025 revenue. It is expected to have a substantial impact on earnings improvement, although the actual impact may vary depending on cost management and market conditions.

What is the outlook for GS E&C’s stock price?

This project win is likely to provide upward momentum for the stock price in the short term. However, the mid- to long-term outlook depends on various factors, including successful project execution, macroeconomic conditions, and housing market volatility.