1. What Happened? : Major Shareholder Change and Stake Sell-off

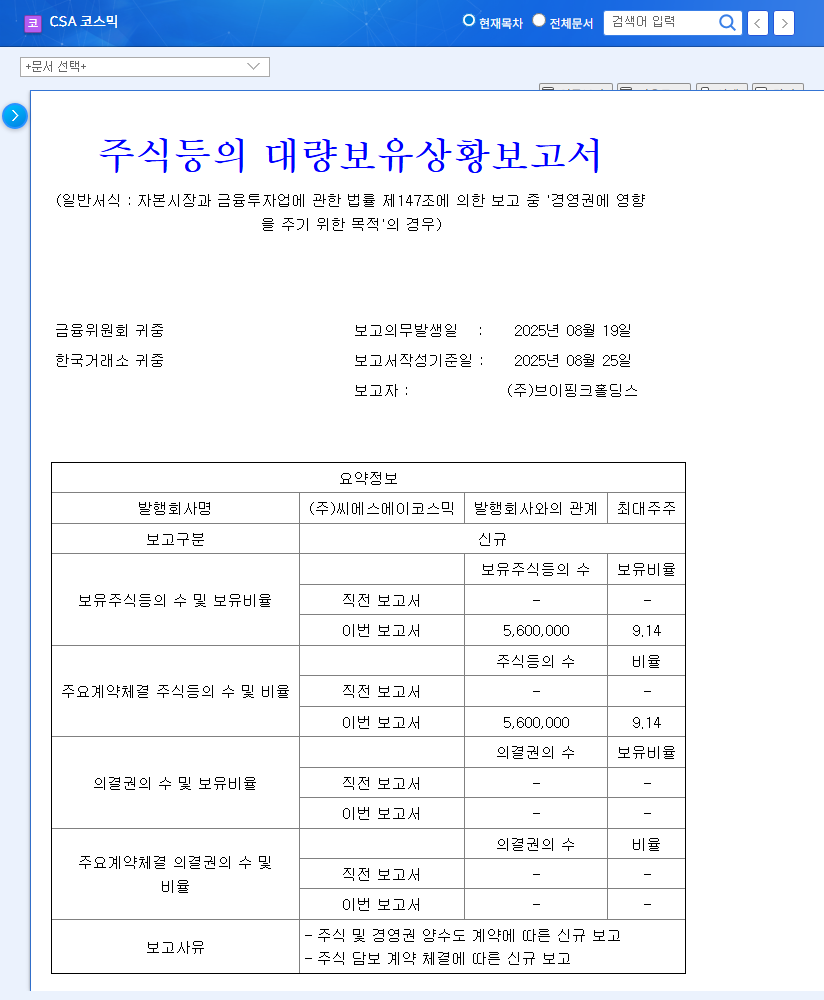

Homecast significantly reduced its stake in CSA Cosmic from 55.45% to 10.76%. This represents a transfer of management control, with Sweet K expected to become the new major shareholder. The issue is that this change occurs amidst a backdrop of declining performance.

2. Why Does it Matter? : Increased Uncertainty and Weakened Investor Sentiment

Frequent changes in major shareholders raise concerns about management instability and potential strategic shifts. CSA Cosmic’s 2025 half-year results show a significant decline, with sales down 60.5% year-on-year and both operating and net income turning negative. This change in ownership amplifies uncertainty about the company’s future, further dampening investor sentiment.

3. What’s the Impact? : Downward Pressure on Stock Price and Potential Fundamental Deterioration

The large-scale sell-off of shares is likely to put downward pressure on the stock price in the short term. Furthermore, investing in CSA Cosmic is risky given the uncertainty surrounding the new major shareholder’s management capabilities and business strategies. The issuance of KRW 8 billion in convertible bonds and a KRW 100 billion rights offering will help secure short-term funding, but the potential for long-term stock dilution must be considered.

4. What Should Investors Do? : Careful Observation and Risk Management

- Monitor the new major shareholder’s business plans: Carefully review Sweet K’s plans for business normalization and growth strategies.

- Check for a turnaround in the cosmetics business: Focus on tangible performance improvement efforts, such as new product launches and changes in marketing strategy.

- Monitor financial structure improvement trends: Continuously review changes in financial soundness following the rights offering and convertible bond issuance.

Investment in CSA Cosmic requires extreme caution at this time. Maintaining a speculative sell position or remaining on the sidelines and responding flexibly to changes in the situation is recommended.

Q. How will the change in CSA Cosmic’s major shareholder affect the stock price?

A. It is likely to put downward pressure on the stock price in the short term. Uncertainty increases and investor sentiment may weaken due to the unproven management capabilities and business strategy of the new major shareholder.

Q. Why is CSA Cosmic’s poor performance a serious concern?

A. The company’s 2025 half-year sales decreased by 60.5% year-on-year, and both operating and net income turned negative. The slump in the cosmetics business is the main cause, signaling a deterioration in the company’s fundamentals.

Q. Should I invest in CSA Cosmic?

A. A speculative sell or hold position is currently recommended. It is advisable to make investment decisions after confirming the new management’s business plans and performance improvements. Investments should always be made at your own discretion and responsibility.