1. HiteJinro IR: What Happened?

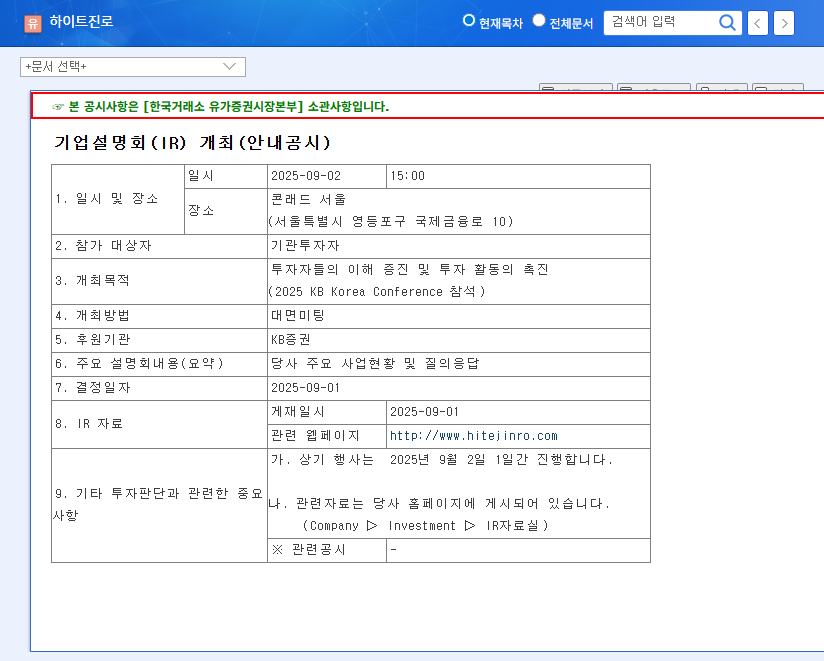

HiteJinro held an investor relations (IR) session on September 2, 2025, at the 2025 KB Korea Conference. The company shared its first-half 2025 business performance and future strategies with investors, followed by a Q&A session.

2. H1 2025 Performance Analysis: Why the Sales Decline?

Positive Factors: Steady sales of core products like ‘Terra,’ ‘Kelly,’ ‘Chamisul,’ and ‘Jinro,’ coupled with new product launches and efficient cost management, led to a 9.1% increase in operating profit.

Negative Factors: The overall economic downturn and weakened consumer sentiment resulted in a 2.1% year-on-year decrease in sales. A high debt ratio of 187.84% also raised concerns about financial stability.

3. Key IR Messages and Investor Impact: What Does it Mean?

HiteJinro focused on addressing investor concerns regarding the sales decline and presented strategies for growth in the second half of the year. The company emphasized new product launches, overseas market expansion, and strengthening ESG management.

Potential Positive Impacts: Increased information transparency could improve investor sentiment, highlighting the strengths of core business segments, addressing risk factors, and attracting potential investment.

Potential Negative Impacts: Results falling short of market expectations, increased concerns about intensifying competition and market contraction, and persistent financial health issues could negatively impact investor perception.

4. Action Plan for Investors: How Should You Invest?

Investors considering HiteJinro should carefully examine the company’s ability to recover sales growth, plans to reduce its debt ratio, and strategies to address intensifying competition. Closely monitoring the second-half earnings announcement and market conditions is crucial. A long-term investment strategy considering the company’s growth potential, rather than short-term stock fluctuations, is recommended.

How did HiteJinro perform in the first half of 2025?

Sales decreased by 2.1% year-on-year.

What is HiteJinro’s debt-to-equity ratio?

It is 187.84%.

What were the key takeaways from the HiteJinro IR?

The key takeaways included the announcement of H1 2025 results, sharing of growth strategies for the second half of the year, and a Q&A session with investors.