1. The ₩95.4 Billion Contract: What’s It All About?

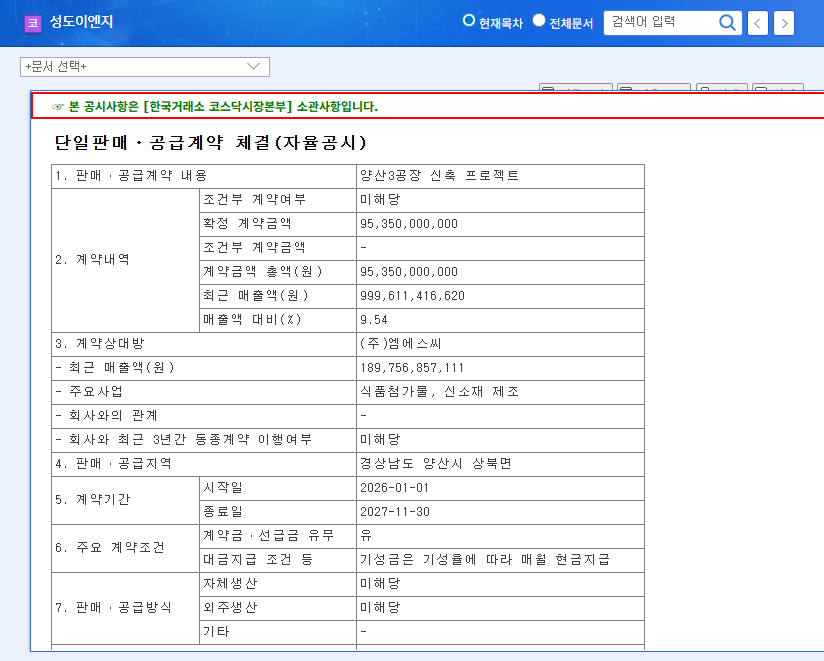

Sungdo Eng will undertake the construction of MSC’s Yangsan Plant 3 from January 2026 to November 2027. This is a significant contract, representing 9.54% of Sungdo Eng’s sales.

2. Why is This Contract Important?

This contract signifies more than just a new deal. On the positive side, it directly contributes to increased sales in 2026-2027 and demonstrates Sungdo Eng’s technological capabilities and project execution skills. It also has the potential to create synergy with the growth of the high-tech industrial equipment sector. However, there are also potential risks. The time remaining until the contract commencement leaves room for variables, and macroeconomic and exchange rate fluctuations, as well as the gap between market expectations and actual results, can impact the stock price.

3. So, What Will Happen to the Stock Price?

Sungdo Eng’s recent stock price has been volatile, and foreign ownership remains low. The macroeconomic environment is also unstable, which could negatively affect the overall stock market. While the ₩95.4 billion contract is a positive sign in this context, it might be difficult to expect a short-term surge in the stock price.

4. What Should Investors Do?

- Maintain a Long-Term Perspective: It’s advisable to invest with a long-term perspective, rather than being swayed by short-term fluctuations.

- Thorough Risk Management: Continuously monitor project progress, allowance for doubtful accounts, and the competitive landscape in the construction sector.

- Understand Market Expectations: Refer to analyst reports to grasp market expectations and inform investment decisions.

- Monitor Exchange Rates and Raw Material Prices: Keep an eye on the impact of these external factors on profitability.

Frequently Asked Questions

Will Sungdo Eng’s stock price rise with this contract?

Predicting short-term stock movements is challenging, but a positive long-term impact can be expected. However, consider various factors like macroeconomic conditions and market expectations.

What are Sungdo Eng’s main businesses?

Sungdo Eng’s core businesses are high-tech industrial equipment, gas & chemicals, and general construction.

What precautions should investors take?

It’s crucial to monitor project progress, allowance for doubtful accounts, and the competitive landscape of the construction industry, along with understanding market expectations and the macroeconomic environment.