What Happened? Hecto Innovation Acquires Walletone

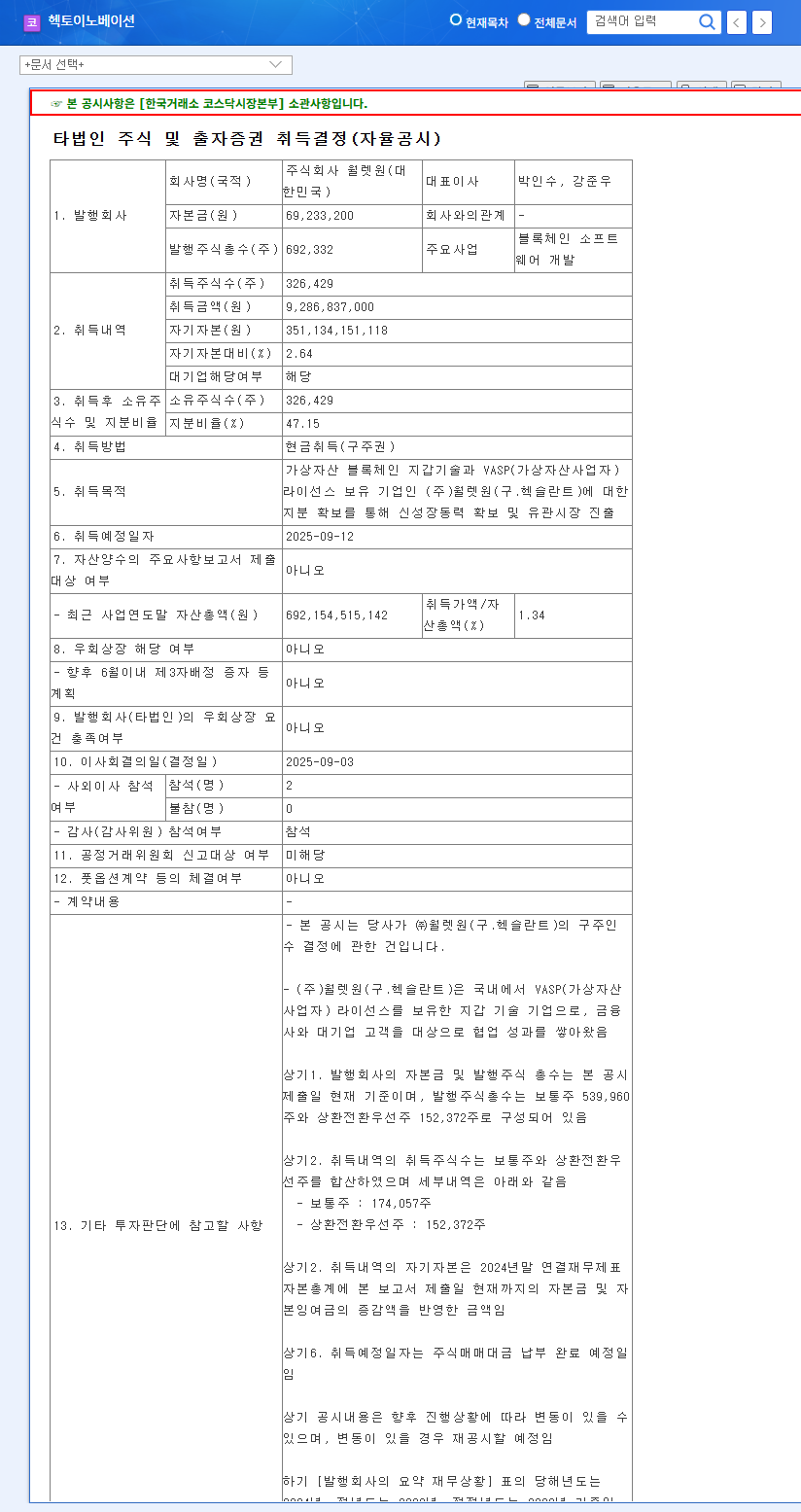

Hecto Innovation announced on September 3, 2025, its decision to acquire a 47.15% stake in Walletone (formerly Hexlant), a blockchain software development company, for 9.3 billion KRW. The acquisition is scheduled for September 12th.

Why the Acquisition? Seeking New Growth and Fintech Expansion

Hecto Innovation is currently experiencing a decline in sales across its IT information services, fintech, and healthcare business segments. The acquisition of Walletone is a strategic move to secure a new growth engine by entering the blockchain and virtual asset market. Walletone’s virtual asset wallet technology and VASP license are expected to create synergy with Hecto Innovation’s existing fintech business.

What’s Next? Opportunities and Risks Require Careful Analysis

- Positive Aspects: Securing new growth engines, fintech business expansion, strengthening technological competitiveness

- Negative Aspects: Increased financial burden, uncertainty in business integration and synergy creation, possibility of continued sluggishness in existing businesses

The blockchain and virtual asset market holds high growth potential, but also significant uncertainties, including regulatory changes, rapid technological advancements, and market volatility. Therefore, it’s crucial to assess Hecto Innovation’s ability to navigate these changes and effectively generate synergy.

What Should Investors Do? Close Monitoring and Analysis Are Essential

Investors should closely monitor and analyze the success of synergy creation with Walletone, efforts to improve profitability of existing businesses, efficient fund management, and responses to changes in the macroeconomic and industry environment. This acquisition could be a turning point for Hecto Innovation, but its success hinges on future actions.

Frequently Asked Questions

How will the Walletone acquisition impact Hecto Innovation?

The acquisition is expected to provide Hecto Innovation with a new growth engine by entering the blockchain and virtual asset markets, and expanding its fintech business. However, there are also risks, such as increased financial burden and market volatility.

What is the current state of Hecto Innovation’s existing businesses?

Hecto Innovation is experiencing declining sales across its IT information services, fintech, and healthcare segments, facing challenges with declining profitability.

What should investors pay attention to?

Investors should closely monitor the success of synergy creation with Walletone, efforts to improve existing businesses’ profitability, efficient fund management and financial soundness, and responses to changes in the macroeconomic and industry environment.