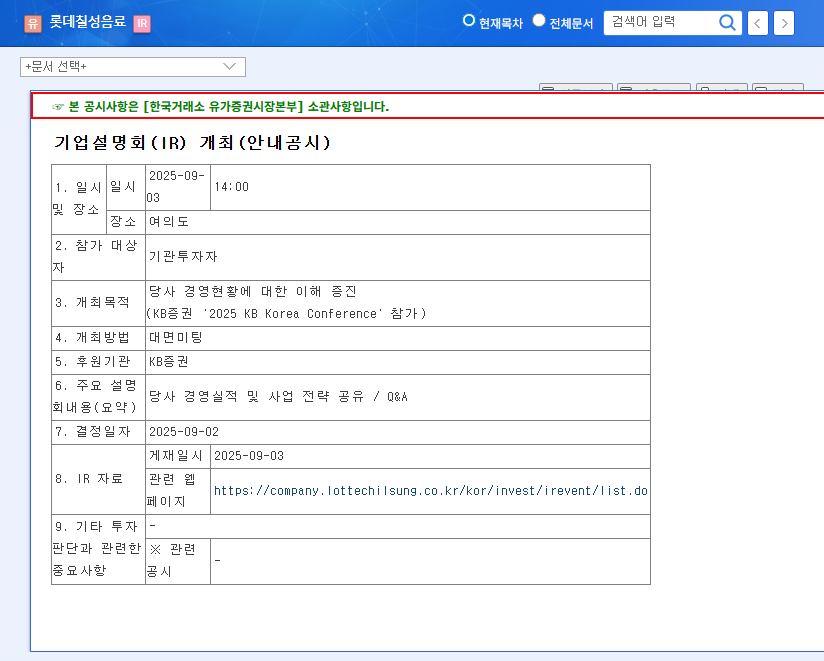

This comprehensive LOTTE CHILSUNG BEVERAGE investment analysis dives deep into the company’s financial health, market position, and future prospects ahead of its critical Investor Relations (IR) conference scheduled for November 10, 2025, at 9:00 AM. As investors and market watchers turn their attention to this event, we’ll dissect the key factors driving the Lotte Chilsung stock, from its strategic embrace of the ‘Healthy Pleasure’ trend to its game-changing success in the liquor market.

The purpose of the upcoming Lotte Chilsung IR is to provide a transparent overview of management status, business performance, and future strategies, followed by a Q&A session. This article offers a roadmap for investors, evaluating the opportunities and potential risks that will shape the company’s trajectory.

Core Growth Engines: Healthy Pleasure & Liquor Portfolio Expansion

LOTTE CHILSUNG BEVERAGE’s recent performance showcases a powerful dual-engine growth strategy. The company has skillfully capitalized on shifting consumer preferences while simultaneously innovating within traditional markets, creating a robust foundation for future expansion.

Capitalizing on the ‘Healthy Pleasure’ Trend

The global consumer shift towards health-conscious choices, dubbed the ‘Healthy Pleasure’ trend, is no longer a niche market. LOTTE CHILSUNG BEVERAGE has been a forerunner in this space, aggressively expanding its portfolio of zero-calorie and low-sugar products. The success of offerings like Chilsung Cider Zero, Pepsi Zero Sugar, and Milkis Zero has not only met market demand but has also significantly boosted the beverage division’s profitability. This strategic pivot demonstrates an acute awareness of consumer behavior and positions the company to capture sustained growth in a health-focused market.

The ‘SAERO’ Phenomenon and Soju Market Disruption

In the highly competitive alcohol division, the launch of ‘SAERO’ soju has been nothing short of a triumph. By introducing a zero-sugar soju with a smooth taste profile and modern branding, the company tapped into the same health-conscious sentiment driving its beverage success. This innovative product quickly gained market share, resonating with younger consumers and setting a new standard in the industry. The continued growth of ‘SAERO’ and related product lines is a testament to the company’s R&D capabilities and marketing prowess, providing a significant high-margin revenue stream. For a deeper look into this market, you can read our complete analysis of the South Korean soju market.

LOTTE CHILSUNG BEVERAGE has successfully built a resilient business model by dominating both the future of beverages with its ‘Healthy Pleasure’ lineup and a core segment of the liquor market with the innovative ‘SAERO’ brand. This dual focus provides a compelling growth narrative for investors.

Navigating the Headwinds: Key Risks to Monitor

Despite the strong fundamentals, a prudent Lotte Chilsung investment analysis must also consider the potential risks. The company operates in a dynamic environment where external factors can significantly impact profitability.

- •Rising Costs and Exchange Rate Volatility: The increasing prices of essential raw materials like sugar and aluminum, coupled with unpredictable currency fluctuations (KRW/USD), pose a direct threat to profit margins. Investors will be keen to hear management’s hedging strategies and cost-control measures.

- •Intense Market Competition: The beverage and alcohol markets are fiercely competitive, with pressure from established rivals and the growing presence of private-label brands. Maintaining market share requires continuous innovation and significant marketing investment.

- •Macroeconomic Uncertainty: A potential global economic slowdown could weaken consumer sentiment and discretionary spending, impacting sales volumes. As reported by leading financial news outlets like Reuters, consumer confidence is a key indicator to watch.

Shareholder Returns and Strategic Vision

A major focus of the upcoming Lotte Chilsung IR will be the company’s commitment to enhancing shareholder value. Management has outlined an ambitious shareholder return policy, which is expected to be a key highlight. According to the company’s Official Disclosure, targets include a 30% consolidated shareholder return rate, the introduction of interim dividends, and the potential for share buybacks. These measures, if communicated effectively, could significantly boost investor confidence and make the stock more attractive.

Furthermore, explanations regarding long-term strategic investments, such as the new facility for manufacturing food-grade liquid carbon dioxide, will be crucial. This move aims to secure the supply chain and achieve long-term cost competitiveness, demonstrating foresight in operational management.

Final Verdict: A Neutral to Positive Outlook

The upcoming IR for LOTTE CHILSUNG BEVERAGE presents a pivotal moment. The company stands on a solid foundation of impressive growth drivers, particularly its alignment with the ‘Healthy Pleasure’ trend and its successful disruption of the liquor market. The key to a positive market reaction lies in management’s ability to present a clear, persuasive, and transparent strategy for navigating the existing macroeconomic risks.

Investors should pay close attention to the details of risk management plans and the conviction behind the company’s shareholder return promises. While short-term volatility around the IR event is possible, the long-term direction of the Lotte Chilsung stock will ultimately be determined by the successful execution of its growth strategies and its resilience in the face of external economic pressures.