SCL Science Acquires PentaMedix: What Happened?

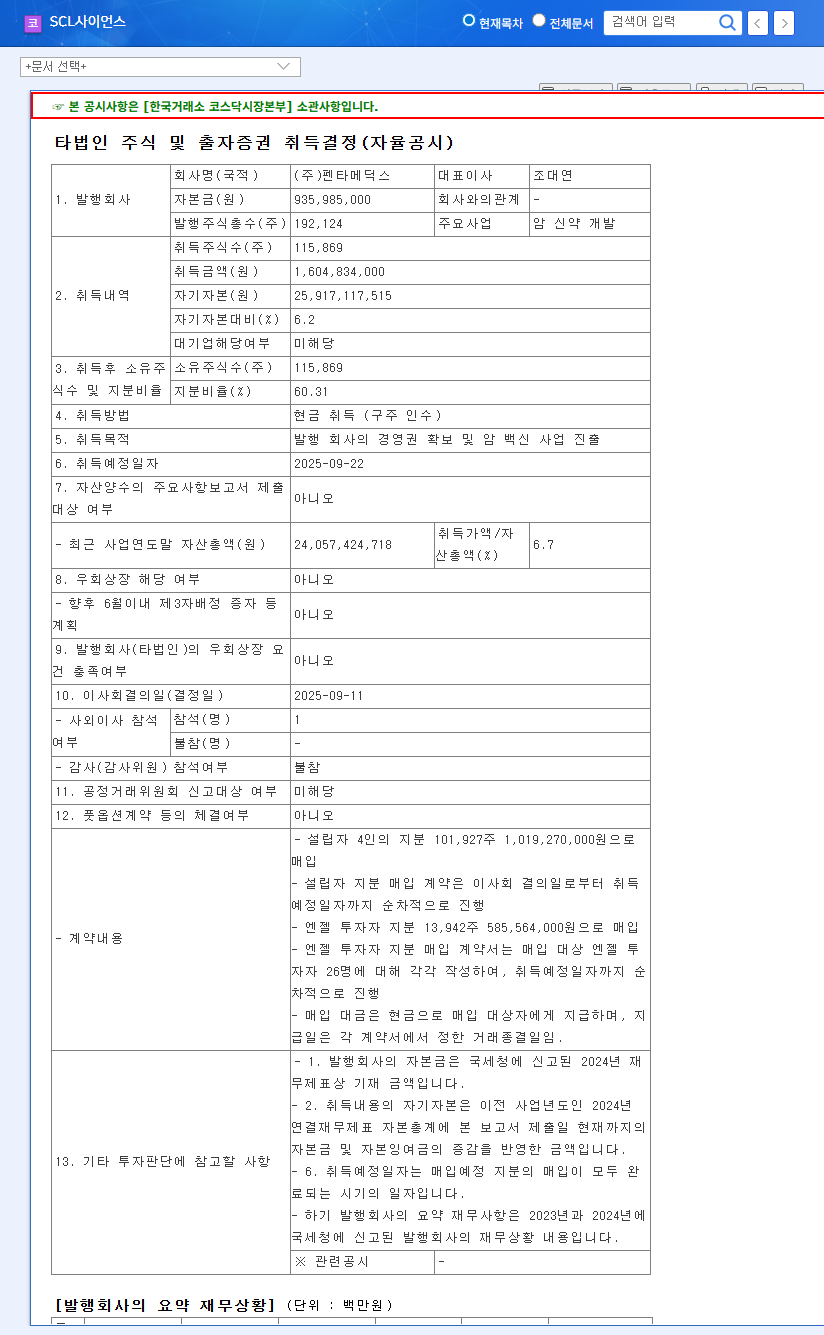

SCL Science announced on September 11, 2025, its decision to acquire 60.31% of PentaMedix, a cancer drug development company, for 1.6 billion KRW. The acquisition is expected to be finalized on September 22nd, marking SCL Science’s entry into the cancer vaccine business and granting it management control over PentaMedix.

Why is this Acquisition Important?

SCL Science has evolved from a hemostatic agent developer to a comprehensive healthcare company, expanding into bio logistics and digital healthcare. This acquisition signifies more than just expansion; it represents a strategic move into the high-growth biopharmaceutical sector and the acquisition of crucial drug development capabilities.

- Synergy across Diagnostics, Treatment, and New Drug Development: Combining the diagnostic capabilities of its subsidiary, SCL Healthcare, with PentaMedix’s drug development expertise will enable SCL Science to offer integrated healthcare solutions.

- Securing Future Growth Engines: Cancer drug development, if successful, can generate substantial profits, making it a high-value business.

What’s Next? Opportunities and Risks

- New Growth Engine: Entry into the cancer vaccine market presents a significant opportunity for new revenue streams.

- Synergy Effects: Integration with existing businesses will enable the provision of comprehensive healthcare services, from diagnosis to treatment.

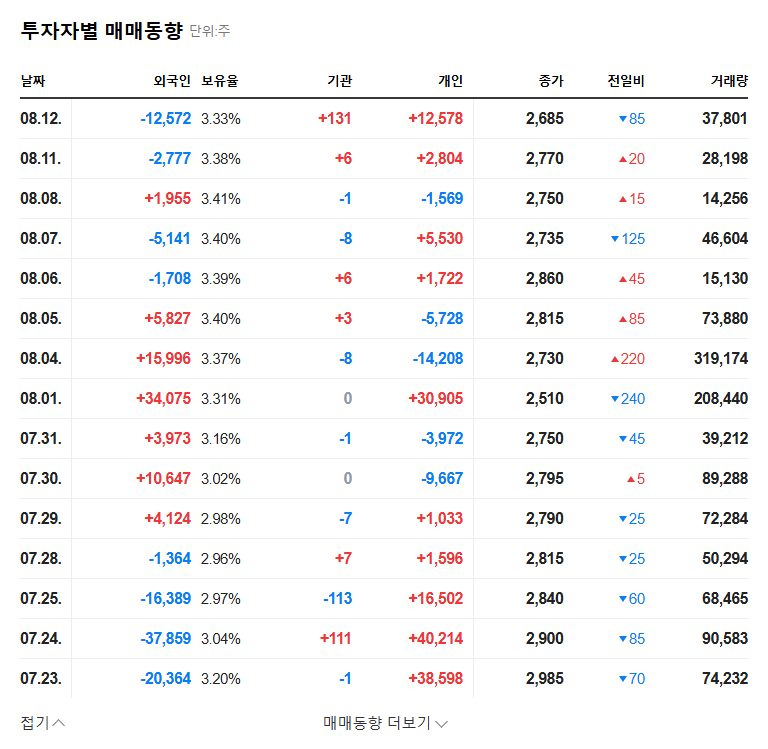

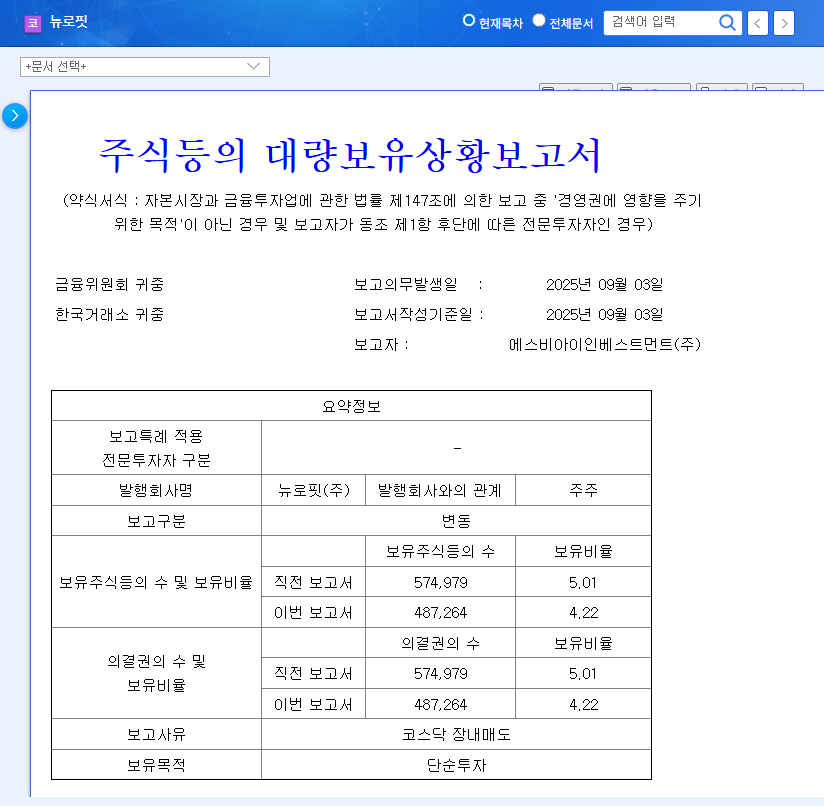

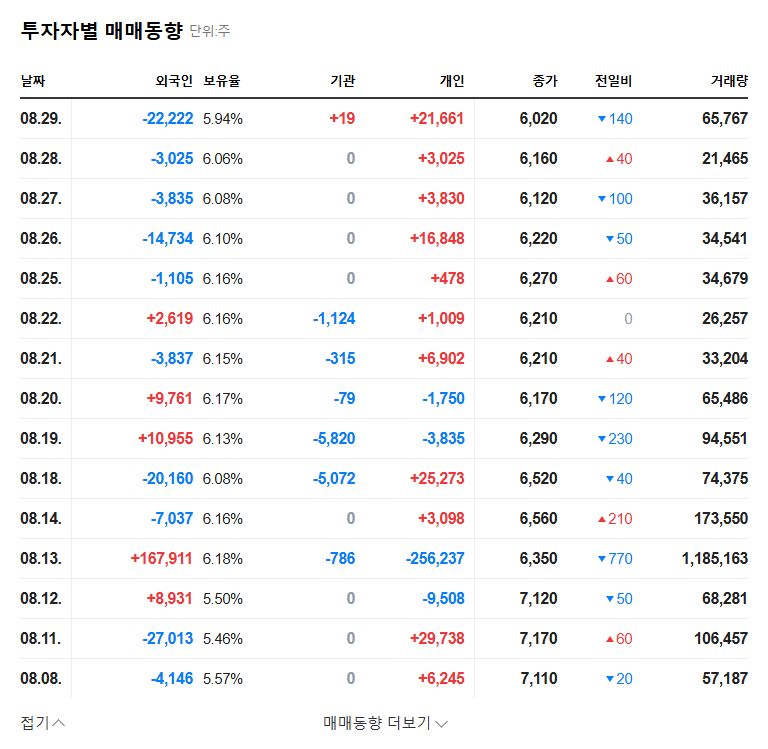

- Increased Investment Interest: The growing investor interest in the biopharmaceutical sector could potentially boost SCL Science’s corporate value.

- Increased Financial Burden: The 1.6 billion KRW acquisition cost and future R&D investments could strain finances.

- Uncertainty of Drug Development: Cancer drug development is a high-risk venture with a low success rate and long development timelines.

- Management Integration Challenges: Overcoming cultural and technological differences between the two companies and achieving synergy will be crucial.

What Should Investors Do?

While the acquisition of PentaMedix holds promise for long-term growth, investors need to consider the uncertainties associated with drug development and the financial risks involved. Close monitoring of the following factors is recommended:

- PentaMedix’s financial status and R&D pipeline

- Competitive landscape of the cancer drug market

- SCL Science’s funding plans and financial health

- Management efficiency and synergy creation strategies during the post-acquisition integration process

Disclaimer: This report is not intended as investment advice. All investment decisions should be made at the investor’s own discretion and responsibility.

Frequently Asked Questions (FAQ)

What is SCL Science?

SCL Science is a company engaged in various healthcare businesses, including hemostatic agents, bio logistics, and digital healthcare. With the acquisition of PentaMedix, they are now entering the field of cancer drug development.

How will the PentaMedix acquisition impact SCL Science?

The acquisition provides SCL Science with a new growth engine in biopharmaceutical development and potential synergy with existing businesses. However, it also presents risks, such as increased financial burden from R&D investments and the inherent uncertainty of drug development.

What should investors be aware of?

Investors should carefully analyze PentaMedix’s financials, R&D pipeline, the competitive landscape of the cancer drug market, and SCL Science’s funding plans before making investment decisions.