Harim Holdings Stock Forecast: Opportunity or Warning Sign?

The recent news of NH Investment & Securities significantly reducing its stake in Harim Holdings (121990) has sent ripples through the investment community. This move raises a critical question for anyone considering a Harim Holdings stock forecast: Is this a signal of underlying weakness, or merely short-term market noise creating a long-term buying opportunity? This article provides a deep-dive Harim Holdings analysis, dissecting the stake change, the company’s core fundamentals, macroeconomic factors, and a prudent investment strategy to help you navigate the path forward.

The Catalyst: Unpacking the NH Investment & Securities Stake Change

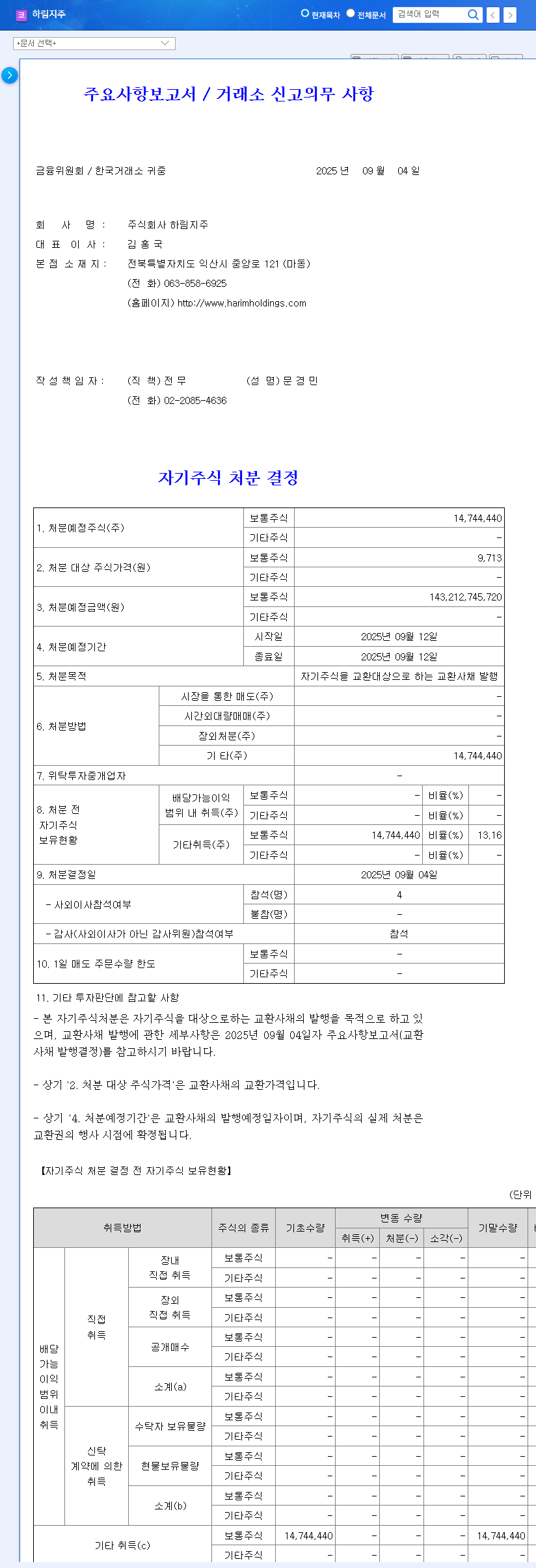

On October 2, 2025, a report surfaced detailing a major shift in share ownership. NH Investment & Securities declared a reduction in its holdings of Harim Holdings stock from 13.70% down to 5.00%. The stated reasons for the change included on-market sales and, more interestingly, an Exchangeable Bond (EB) transfer. According to the Official Disclosure (Source: DART), this EB transfer resulted in Cube Special Co., Ltd. acquiring a significant position. An EB allows the holder to exchange the bond for shares of a different company held by the issuer (in this case, Harim Holdings shares held by NH). This is a crucial detail, as it suggests a strategic transfer rather than just a simple market sell-off.

Core Fundamentals: A Look Under the Hood

A sound Harim Holdings investment decision cannot be based on a single event. As of the first half of 2025, the company presents a mixed but compelling fundamental picture.

Key Strengths & Growth Drivers

- •Pan Ocean’s Stellar Performance: The group’s marine transportation arm, Pan Ocean Co., Ltd., continues to be a powerhouse, bolstering financial stability. Its strategic expansion into LNG transport and investment in eco-friendly vessels are powerful long-term growth catalysts.

- •Dominant Market Positions: Harim maintains a firm grip on the domestic feed business and boasts immense brand power in the chicken industry. This ensures a stable revenue floor even during economic downturns.

- •ESG Management Focus: A growing commitment to Environmental, Social, and Governance (ESG) principles is enhancing the corporate image and can attract a wider base of institutional investors.

Headwinds & Potential Risks to Monitor

- •Profitability Pressures: The core feed and livestock segments are vulnerable to volatile raw material prices and currency fluctuations. This remains a key challenge for margin stability.

- •High Debt-to-Equity Ratio: With a consolidated debt-to-equity ratio of 180.50%, financial health is a critical point to watch. This level of leverage can amplify risks in a rising interest rate environment.

- •Project Uncertainty: The large-scale Yangjae Urban Advanced Logistics Complex development project carries significant potential, but also uncertainty related to licensing and timelines, which could impact future cash flows.

Navigating the Macroeconomic Landscape

No company operates in a vacuum. The global macroeconomic environment presents both challenges and opportunities for Harim Holdings. Fluctuating interest rates, currency volatility (USD/KRW), and commodity prices directly impact borrowing costs and operational expenses. Furthermore, the shipping sector’s health is tied to global trade volumes, often reflected in indices like the Baltic Dry Index (BDI). Investors should monitor these external factors closely, as they can significantly influence the company’s performance. For more on this, read our internal guide to macroeconomic indicators.

The optimal investment strategy involves looking past short-term stock price volatility. Focus instead on the sustained performance of core assets like Pan Ocean and the company’s progress in managing debt and improving profitability.

Frequently Asked Questions (FAQ)

How does NH’s stake change truly affect the Harim Holdings stock forecast?

While the sale could create temporary selling pressure, the transfer of shares via an Exchangeable Bond to another entity (Cube Special Co., Ltd.) might be viewed as a strategic repositioning rather than a vote of no confidence. It should be seen as market noise unless accompanied by a deterioration in fundamentals.

What are Harim Holdings’ strongest fundamental pillars right now?

As of H1 2025, the robust performance of its subsidiary Pan Ocean is the primary driver of growth and stability. Additionally, the company’s strong brand recognition and market share in the domestic feed and chicken businesses provide a reliable revenue base.

What is the biggest risk for a Harim Holdings investment?

The most significant risk is the combination of a high debt-to-equity ratio (180.50%) and profitability pressures from volatile commodity prices. This makes the company sensitive to rising interest rates and global supply chain disruptions. Careful monitoring of its financial health is essential.

What does Cube Special Co., Ltd.’s EB holding signify?

Holding an Exchangeable Bond (EB) implies a potential for future conversion into common stock. This can be interpreted as a bullish long-term signal, as the holder anticipates future appreciation in the value of Harim Holdings’ shares.

In conclusion, while the NH Investment & Securities stake sale warrants attention, a prudent investment approach requires a long-term perspective. The underlying strengths of Harim Holdings, particularly Pan Ocean, remain intact. Investors should treat any short-term price dips as potential opportunities, contingent on the company’s continued efforts to manage its debt and navigate a complex global economy.