1. What Happened? Incident at Hanwha Ocean’s Geoje Shipyard

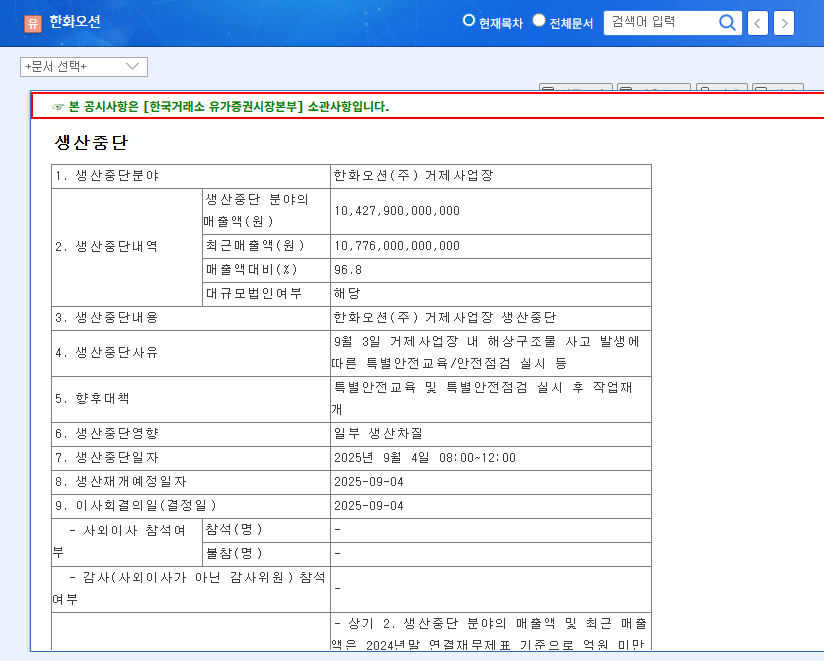

A marine structure accident occurred at Hanwha Ocean’s Geoje shipyard on September 3rd, leading to a 4-hour production halt. The scale of the halted production reached 104,279 billion won, which accounts for 96.8% of the company’s sales. Immediately following the incident, the company implemented special safety training and inspections, focusing on incident recovery and preventing recurrence.

2. Why Does it Matter? Short-Term Impact and Long-Term Growth Potential Coexist

This incident may cause short-term investor sentiment deterioration and stock price decline. However, considering the short 4-hour halt, the direct impact on the company’s fundamentals is expected to be limited. Rather, if this incident leads to strengthened safety management systems, positive long-term effects can be anticipated.

3. What’s Next? Focus on Enhanced Safety and Business Competitiveness

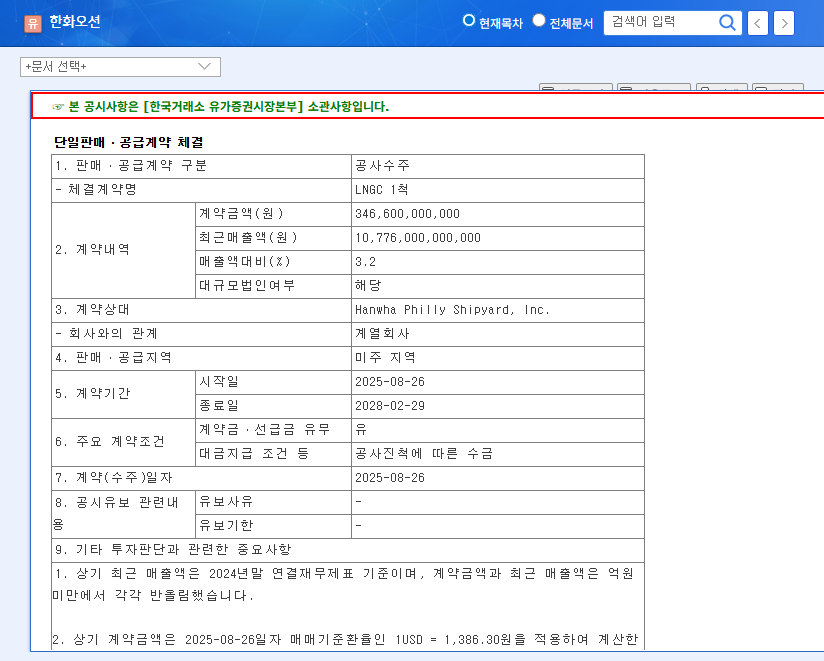

Since its name change, Hanwha Ocean has been pursuing stable growth by establishing a diversified portfolio, including commercial ships, offshore plants, E&I, and IT services. In particular, the development of eco-friendly ship technology and orders for LNG carriers are evaluated as positive factors. As of the first half of 2025, sales and operating profit increased by 33.6% and 164.9% year-on-year, respectively, showing clear growth.

However, this incident may raise market concerns about safety management. It is crucial for the company to regain market trust by promptly and transparently investigating the cause of the accident and establishing preventive measures. Furthermore, continuous monitoring of the progress of large-scale projects and efforts to strengthen safety management is necessary.

4. What Should Investors Do? Short-Term Observation, Consider Mid- to Long-Term Installment Purchases

Short-term investors: It is advisable to remain cautious and observe the market, mindful of the potential for short-term stock price decline due to the production halt announcement.

Mid- to long-term investors: Considering the company’s fundamentals and growth potential, the long-term investment appeal remains valid. It is worth considering a gradual installment purchase approach while monitoring the company’s efforts to strengthen safety management and improve performance.

FAQ

What caused the accident at Hanwha Ocean’s Geoje shipyard?

The exact cause of the accident is currently under investigation, and the company plans to disclose the investigation results transparently and promptly.

What is the estimated financial loss due to the production halt?

The direct financial loss from the short 4-hour production halt is expected to be limited, but the exact amount will be announced later.

What is the outlook for Hanwha Ocean’s stock price?

Short-term stock price volatility may increase, but in the mid- to long-term, the stock price is expected to recover depending on the company’s fundamentals and growth potential. It is important to closely monitor the company’s safety management efforts and performance improvement trends.