What Happened?

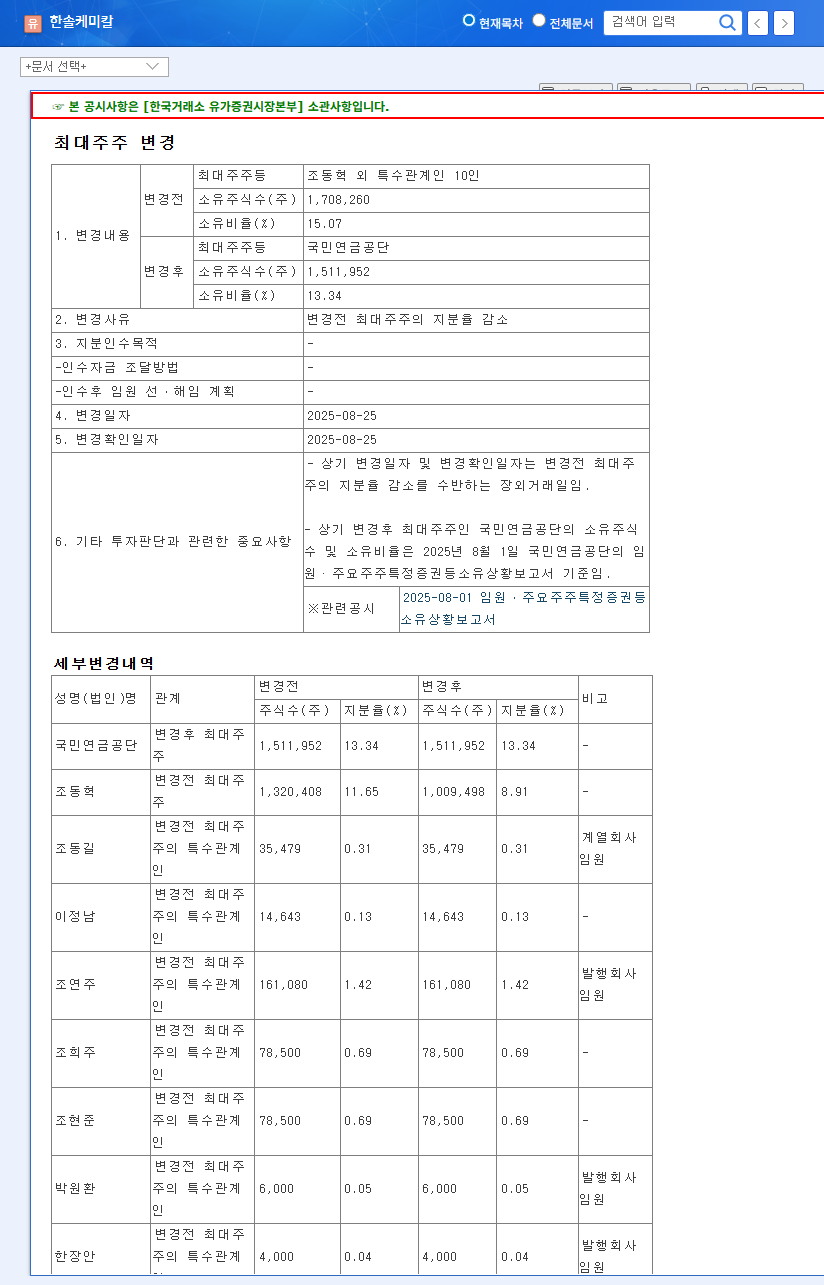

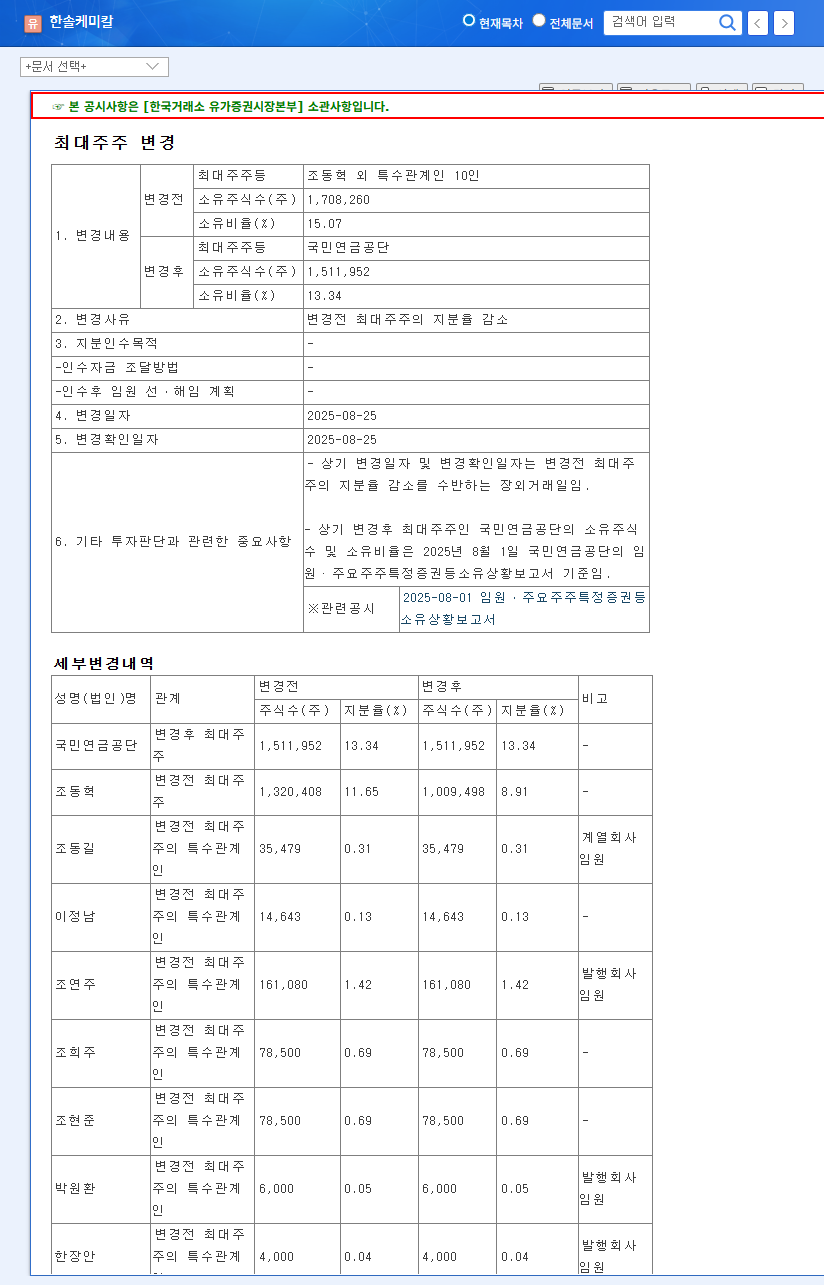

Hansol Chemical’s largest shareholder changed from Dong-Hyuk Cho and 10 other related parties to the National Pension Service (NPS). This change is due to a decrease in the stake held by the previous largest shareholder.

Why Is This Important?

The NPS is not just an investor, but an institutional investor that pursues corporate value enhancement from a long-term perspective. Therefore, this change in the largest shareholder could affect Hansol Chemical’s long-term investment strategy and management direction.

So What?

Positive Impacts

- Increased credibility among institutional investors

- Expectation of a stable shareholder structure

- Potential for strengthened ESG management

Negative Impacts and Potential Risks

- Impact on management strategy and decision-making

- Short-term stock price volatility

What Actions Should Investors Take?

Investors should closely monitor the NPS’s management participation methods and level, the continued growth of core business sectors, and changes in the macroeconomic environment. This will allow them to accurately assess Hansol Chemical’s future growth potential and establish investment strategies.

FAQ

How will Hansol Chemical’s stock price be affected by the NPS becoming the largest shareholder?

There may be short-term stock price volatility, but the long-term impact will depend on the NPS’s management participation methods and the company’s fundamentals.

How will the NPS be involved in Hansol Chemical’s management?

Specific details have not yet been revealed, but considering the NPS’s emphasis on ESG management, related changes are expected.

What is the outlook for Hansol Chemical’s future growth?

Growth is expected in the electronics and secondary battery materials sectors, but factors such as changes in the macroeconomic environment should also be considered.