The artificial intelligence revolution is fundamentally reshaping our world, and at its core lies the powerful engine of advanced semiconductors. Specifically, High Bandwidth Memory (HBM) has emerged as a critical bottleneck and opportunity in this new era. In a decisive move to capitalize on this trend, Hanmi Semiconductor, a global leader in semiconductor equipment, has announced a significant strategic expansion by establishing a new subsidiary in Singapore. This isn’t merely a geographic expansion; it’s a calculated maneuver to solidify its dominance in the burgeoning AI semiconductor market and strengthen its leadership in HBM equipment manufacturing. This analysis explores the profound implications of this decision for investors and the industry at large.

The Announcement: A New Strategic Hub in Singapore

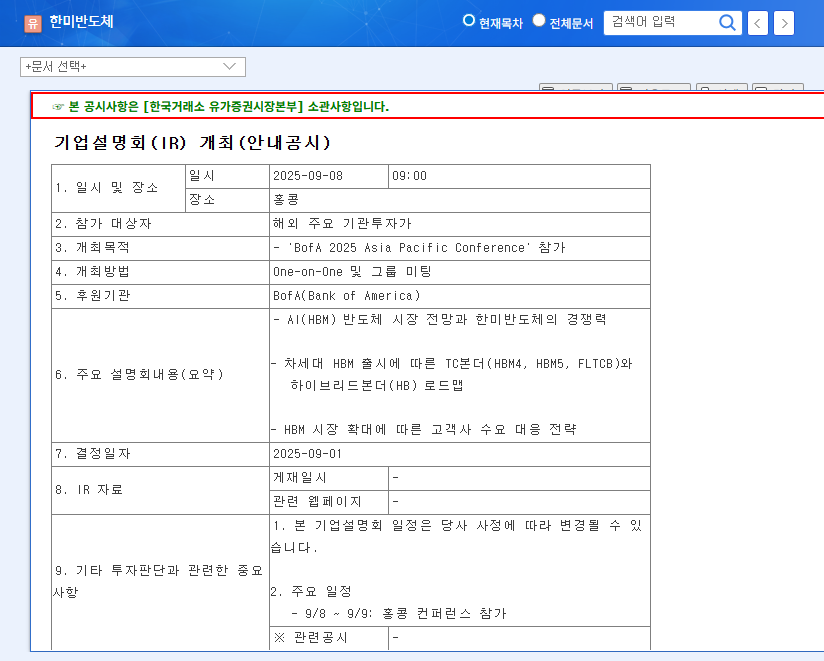

On October 2, 2025, Hanmi Semiconductor officially confirmed the establishment of ‘HANMI SINGAPORE Pte. Ltd.’, a wholly-owned local subsidiary. The initial investment of approximately SGD 648,798 (around 700 million KRW) will establish a base for the development, sales, and service of semiconductor manufacturing equipment and related components. This strategic decision was formally documented in the company’s public filing. (Official Disclosure: DART Source).

Why Singapore? The Strategic Imperative for AI Dominance

The choice of Singapore is a clear reflection of Hanmi Semiconductor’s forward-looking strategy. The primary drivers are twofold: to aggressively address the explosive growth of the AI and HBM markets and to foster closer, more responsive relationships with its key global customers, many of whom have a significant presence in the region.

By establishing a local presence, Hanmi Semiconductor can drastically reduce lead times, enhance collaborative engineering, and provide real-time support, creating a powerful competitive moat in the fast-paced semiconductor industry.

The Critical Role of HBM Equipment

The demand for AI processing power has led to a surge in the need for HBM, which involves vertically stacking memory chips to achieve incredible data transfer speeds. This complex process requires highly specialized equipment. Hanmi Semiconductor is a market leader in this domain with its flagship products, the DUAL TC BONDER and 6-SIDE INSPECTION systems. These tools are indispensable for manufacturing the next generation of AI chips. Being closer to fabrication plants and R&D centers in Asia allows Hanmi to align its product roadmap directly with the needs of tech giants, a crucial advantage in semiconductor investment analysis.

Analysis of Potential Impacts and Corporate Health

Growth Catalysts and Competitive Advantages

- •Strengthened Customer Relationships: Proximity to major clients will enhance local support and co-development efforts, leading to faster innovation cycles and increased new orders.

- •Capturing AI Market Growth: The Singapore hub will act as a launchpad to capitalize on the relentless growth of the AI semiconductor market, which, according to industry forecasts, is projected to expand significantly.

- •Revenue & Export Expansion: Enhanced sales and marketing activities in a key global market are poised to drive substantial global revenue growth and diversify income streams.

- •Solidified Tech Leadership: Faster feedback loops from local clients will inform next-generation HBM equipment development, reinforcing Hanmi’s technological edge.

Underpinned by Robust Financials

This strategic expansion is backed by an exceptionally strong financial foundation. As of its H1 2025 report, Hanmi Semiconductor demonstrated remarkable profitability with an operating profit margin of 47.6%. Furthermore, its financial health is pristine, evidenced by a low debt-to-equity ratio of 26.7% and a current ratio of 284.3%. This financial stability gives the company the flexibility to invest in long-term growth initiatives like the Hanmi Singapore subsidiary without undue risk. Investors interested in the fundamentals can explore our deep dive on analyzing semiconductor company financials.

Investor Outlook: A Long-Term Positive Catalyst

The establishment of the Singapore subsidiary is a pivotal strategy for Hanmi Semiconductor, aimed at securing future growth engines and bolstering its global competitiveness. While initial operating costs and local market competition present minor short-term risks, they are far outweighed by the long-term strategic benefits.

Given the company’s robust fundamentals, unique technological leadership in essential HBM equipment, and the powerful tailwinds of the AI revolution, this expansion is assessed as a profoundly positive event. It significantly enhances the company’s medium-to-long-term growth trajectory. Therefore, we maintain a positive outlook (‘Buy’ rating), and advise investors to monitor the increased order flow and market share gains resulting from this strategic global positioning.

Disclaimer: The analysis above is for informational purposes only. The final responsibility for any investment decisions rests solely with the individual investor.