GS’s 500,000 Share Gift to Huh Seo-hong: What Happened?

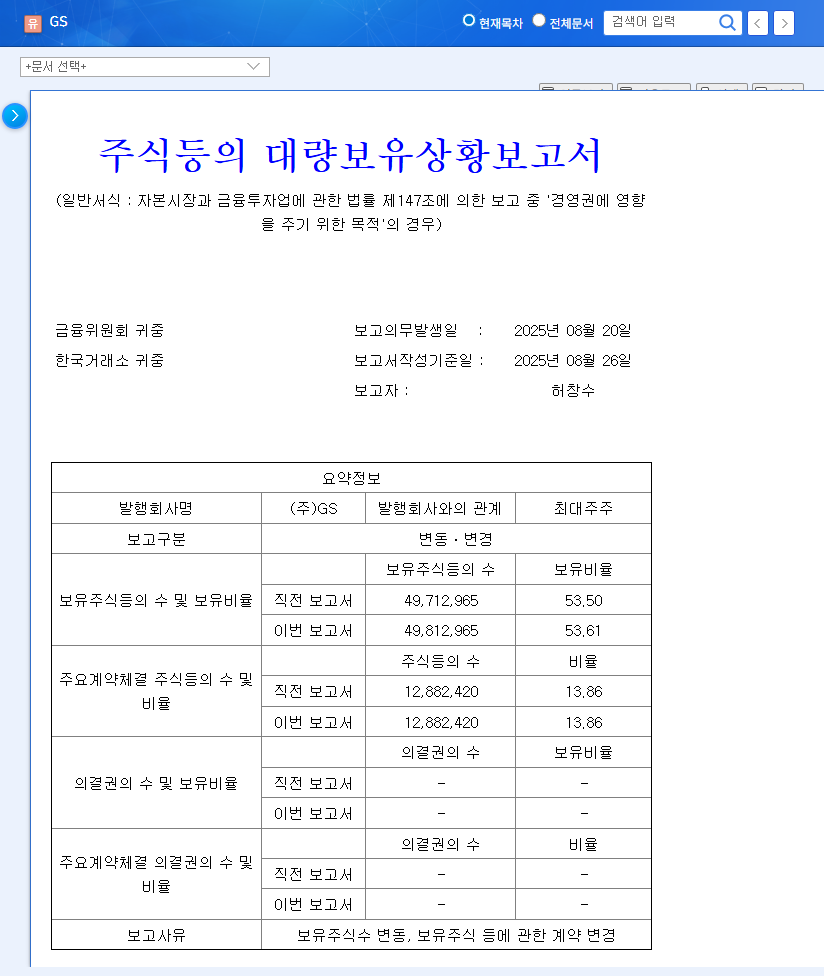

GS Chairman Huh Kwang-soo gifted 500,000 common shares to Huh Seo-hong. While this gift doesn’t change the stake held by the largest shareholder and related parties (remains at 53.61%), the market is focusing on the possibility of succession planning.

Background and Implications of the Gift

This gift is more than just a family transfer; it offers a glimpse into the future of the GS Group. The gift increases Huh Seo-hong’s stake, suggesting potential future influence within the group and the possibility of succession.

Impact on GS Stock

No significant short-term impact is expected, as there’s no change in the stake percentage and no immediate management change. However, the long-term focus should be on the succession process, the new management’s strategies, and the resulting changes in corporate value.

What Should Investors Do?

- Continuous Monitoring: Monitor GS Group’s stake changes, news related to management, and changes in management strategies.

- Strengthen Fundamental Analysis: Analyze fundamental factors such as subsidiary performance, new business achievements, and ESG management to assess corporate value.

- Consider Macroeconomic Variables: Analyze the impact of macroeconomic variables such as oil prices, exchange rates, and interest rate fluctuations on GS’s business.

FAQ

Who is Huh Seo-hong?

Huh Seo-hong is the grandson of GS Group founder Huh Man-jung and the eldest son of Honorary Chairman Huh Kwang-soo. He is currently the president of GS, and this gift is expected to further strengthen his position within the group.

Will this gift have a positive impact on GS stock?

No significant short-term impact is expected. However, the long-term impact could be positive or negative, depending on Huh Seo-hong’s management capabilities and new business strategies.

What are GS’s main businesses?

GS is a holding company with diverse businesses in energy, retail, and construction. Key subsidiaries include GS Caltex, GS Retail, and GS Engineering & Construction.