1. What is BCNC Co., Ltd.’s ₩16 Billion Investment About?

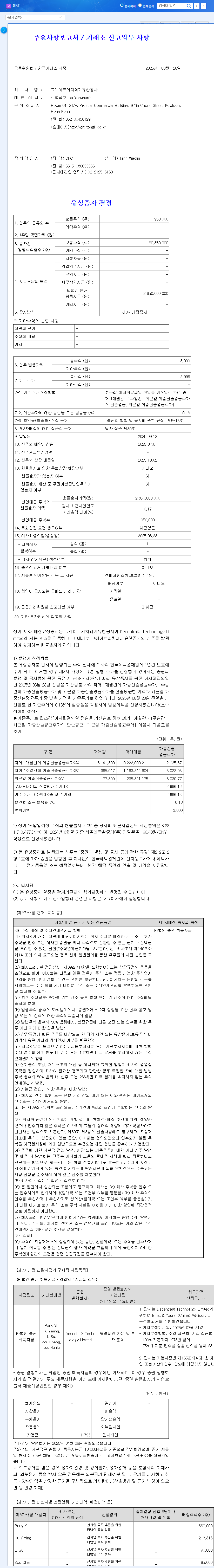

On September 24, 2025, BCNC Co., Ltd. announced a ₩16 billion investment in new semiconductor material production facilities and equipment. The investment period is from September 24, 2025, to December 31, 2026.

2. Why the Investment? (Background and Objectives)

This investment aims to expand the production capacity of synthetic quartz components and new materials (CD9, single crystal/polycrystalline silicon) to respond to the growth of the semiconductor industry and address the trend of miniaturization. The ultimate goal is to secure future growth engines and improve profitability by localizing high-value-added materials that currently rely heavily on imports.

3. Positive Effects and Potential Risks of the Investment?

- Positive Effects: Strengthened business competitiveness, expanded production capacity, securing future growth engines, expected improvement in profitability.

- Potential Risks: Possibility of increased financial burden, uncertainty in investment execution and performance, exchange rate volatility, intensified market competition, macroeconomic volatility.

4. Key Points for Investors

While this investment presents long-term growth potential, given its size, risk management related to financial soundness, exchange rate fluctuations, and market competition is crucial. Investors should closely monitor the following:

- Investment execution status and progress rate

- Production volume and order trends after new facility operation

- Debt repayment plan and interest expense trend

- Exchange rate fluctuations and the effectiveness of hedging strategies

- Competitor trends and market share changes

FAQ

What is BCNC Co., Ltd.’s main business?

BCNC Co., Ltd. produces semiconductor materials such as synthetic quartz, CD9, and single/polycrystalline silicon.

What is the size of this investment?

It is a ₩16 billion investment, representing 21.8% of the company’s capital.

How long will the investment period last?

The investment period is from September 24, 2025, to December 31, 2026, approximately one year and three months.

What are the main goals of the investment?

The main goals are to expand semiconductor material production capacity, secure future growth engines, and improve profitability.

What are the potential risks of the investment?

Potential risks include increased financial burden, uncertainty of investment performance, and exchange rate fluctuations.