GKL Q2 Earnings Analysis: Key Highlights and Their Significance

GKL reported solid growth in Q2 2025. Revenue increased by 7% year-over-year, while operating profit surged by 34% and net income by an impressive 54%. This positive performance can be attributed to the tourism industry’s recovery post-pandemic and GKL’s effective management strategies. A stable debt-to-equity ratio of 0.40 and shareholder-friendly dividend policies are also positive factors.

Stock Price Trends and Market Reactions

GKL’s stock price has been recovering since the second half of 2023 and has maintained a steady upward trend. This upward momentum is expected to continue into the second half of 2025, although fluctuations are possible depending on market conditions and external factors. Recent trends such as the rise in KRW/USD and KRW/EUR exchange rates, fluctuations in international oil and gold prices, and other macroeconomic factors may indirectly affect GKL’s performance.

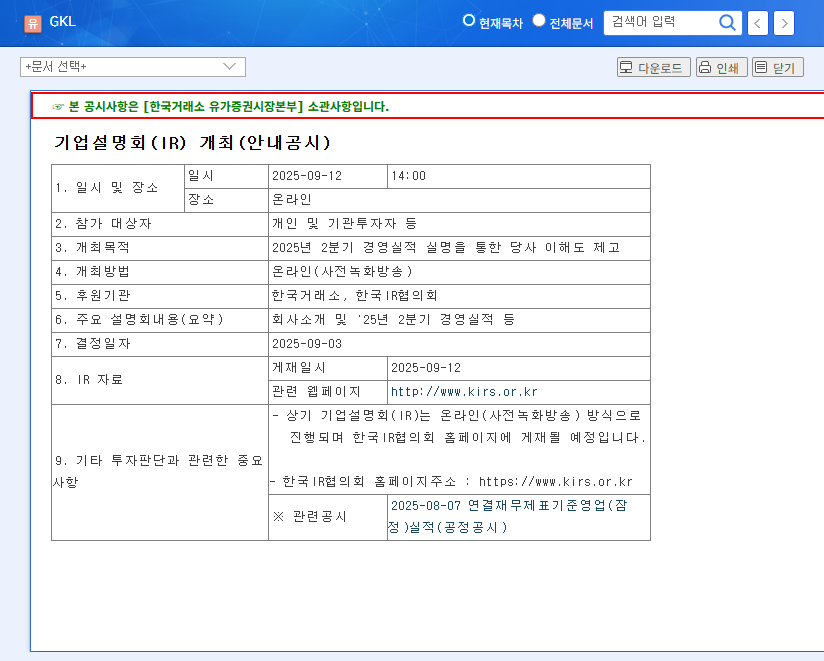

Key Takeaways from the IR Presentation and Investor Impact

The IR presentation is expected to enhance GKL’s transparency and improve investor understanding. However, if the announced results fall short of market expectations, it could negatively impact the stock price. Risks associated with external environmental changes also persist.

Action Plan for Investors

- Gather Information: Carefully review the IR presentation and understand the company’s future strategies.

- Market Analysis: Continuously monitor the tourism industry’s recovery, competitive landscape changes, and macroeconomic indicators.

- Prudent Investment: Considering the casino industry’s sensitivity to external factors, make investment decisions carefully.

Disclaimer: This report is based on the information provided, and the final responsibility for investment decisions rests with the individual investor.

Frequently Asked Questions

How was GKL’s Q2 performance?

GKL’s Q2 2025 revenue increased by 7% YoY, operating profit by 34%, and net income by 54%.

What is the GKL stock forecast?

GKL’s stock has been recovering since H2 2023 and is expected to continue its upward trend based on positive earnings and market outlook. However, fluctuations are possible depending on external factors.

What should investors be aware of?

Investors should carefully analyze the IR presentation and market conditions, continuously monitor the tourism industry recovery, competitive landscape, and macroeconomic indicators, and make prudent investment decisions.