1. What Happened at Shinhan’s IR?

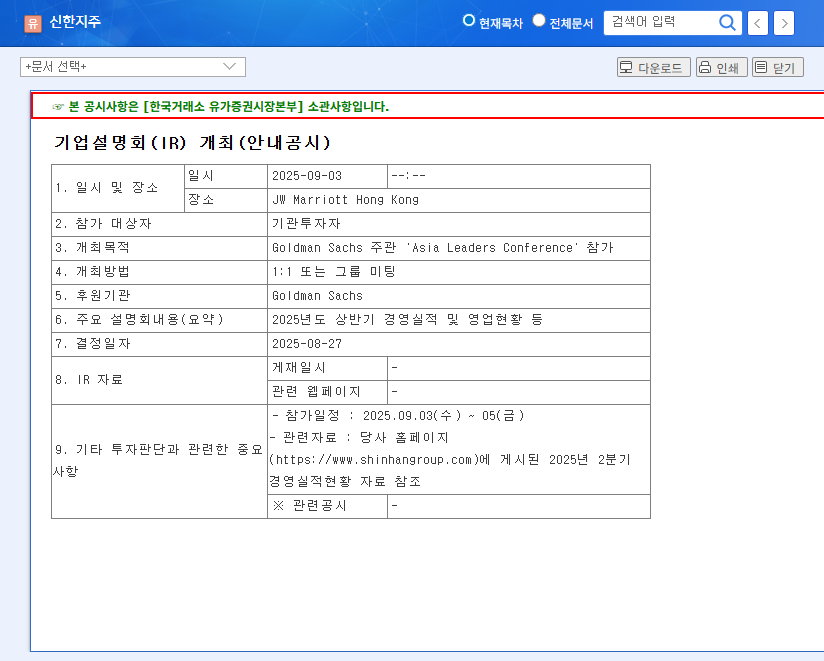

Shinhan Financial Group presented its H1 2025 earnings and business performance at the Goldman Sachs Asia Leaders Conference on September 3, 2025. The goal was to showcase the company’s value and attract both domestic and international investors.

2. Why Does It Matter?

Shinhan boasts a diversified portfolio across banking, credit cards, investment banking, and insurance, and delivered solid H1 results. However, slowing profitability in the credit card segment and increased burdens on Shinhan Capital’s PF loans have raised concerns. This IR is a crucial opportunity to address these concerns and outline the company’s future growth strategy.

3. What’s the Market Saying?

The market is focused on Shinhan’s plans to improve credit card profitability, strategies to navigate interest rate volatility, and its response to increased competition from Big Tech companies. A positive outlook could drive stock prices higher, while a disappointing presentation could trigger a decline.

4. What Should Investors Do?

- Carefully analyze the IR information and market reactions to adjust investment strategies.

- Assess the company’s plans to address slowing growth and secure future growth drivers before making investment decisions.

- Evaluate Shinhan’s long-term fundamentals and growth potential when making investment choices.

Frequently Asked Questions (FAQ)

What were the key takeaways from Shinhan’s IR?

The presentation focused on H1 2025 financial results, business performance, and future growth strategies.

What should investors pay attention to?

Key areas of focus include plans to improve credit card profitability, strategies for managing interest rate volatility, and the company’s response to Big Tech competition.

How might the IR results impact Shinhan’s stock price?

A positive outlook could boost the stock price, while a disappointing presentation could lead to a decline.