1. What Happened?: Major Shareholder Stake Sale

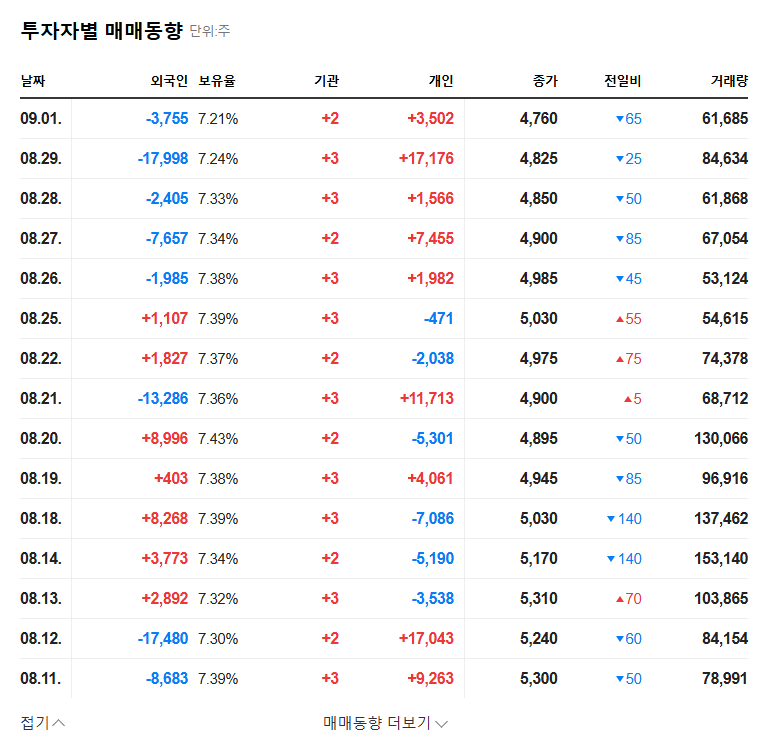

Major shareholders of ABKO, including Taehwa Lee and 2 others, announced a change in their stake through a public disclosure on September 2, 2025. They sold a total of 1,337,000 shares, reducing their stake from 7.50% to 3.15%.

2. Why the Sale?: Analyzing the Background

- Profit-Taking: The sale likely stems from profit-taking following the recent rise in stock price.

- Securing Liquidity: The purpose could be to secure liquidity for personal financial needs or new investments.

- Change in Investment Objectives: The possibility of a sale for stake management purposes cannot be ruled out.

3. About ABKO: Fundamental Analysis

As of the first half of 2025, ABKO recorded sales growth (9.9% increase) but a decrease in operating profit (6.3% decrease). The gaming gear sector showed solid growth (19.6% increase), and the company is pursuing business diversification by adding ‘import of non-ferrous metals and other raw materials’ as a new business. Financially, assets increased due to the completion and lease decision of the Gimpo logistics center, but liabilities also increased.

4. Future Stock Price Outlook: Forecast and Investment Strategy

The sale of shares by major shareholders could negatively impact the stock price in the short term. However, depending on ABKO’s fundamentals, growth potential, and the performance of its new business, the stock price could recover. Investors should analyze ABKO’s business competitiveness and growth potential from a long-term perspective, rather than focusing on short-term stock price fluctuations.

5. What Should Investors Do?: Action Plan

- Short-Term Investors: A conservative approach is necessary considering the downward pressure on the stock price. Closely monitor the process of absorbing the sold shares and market reactions.

- Mid-to-Long-Term Investors: Continuously monitor ABKO’s fundamental improvements and the performance of its new business.

Why did the major shareholders sell their stake?

There could be various reasons, such as profit-taking, securing liquidity, or changes in investment objectives, but the exact background is unknown. It’s crucial to focus on the company’s fundamentals rather than short-term price fluctuations.

What is the outlook for ABKO’s stock price?

There may be downward pressure on the stock price in the short term, but the price could recover depending on ABKO’s growth potential and the performance of its new business.

How should investors react?

Short-term investors should take a conservative approach, while mid-to-long-term investors should continuously monitor the company’s fundamentals and new business performance.