What Happened at Osang Healthcare?

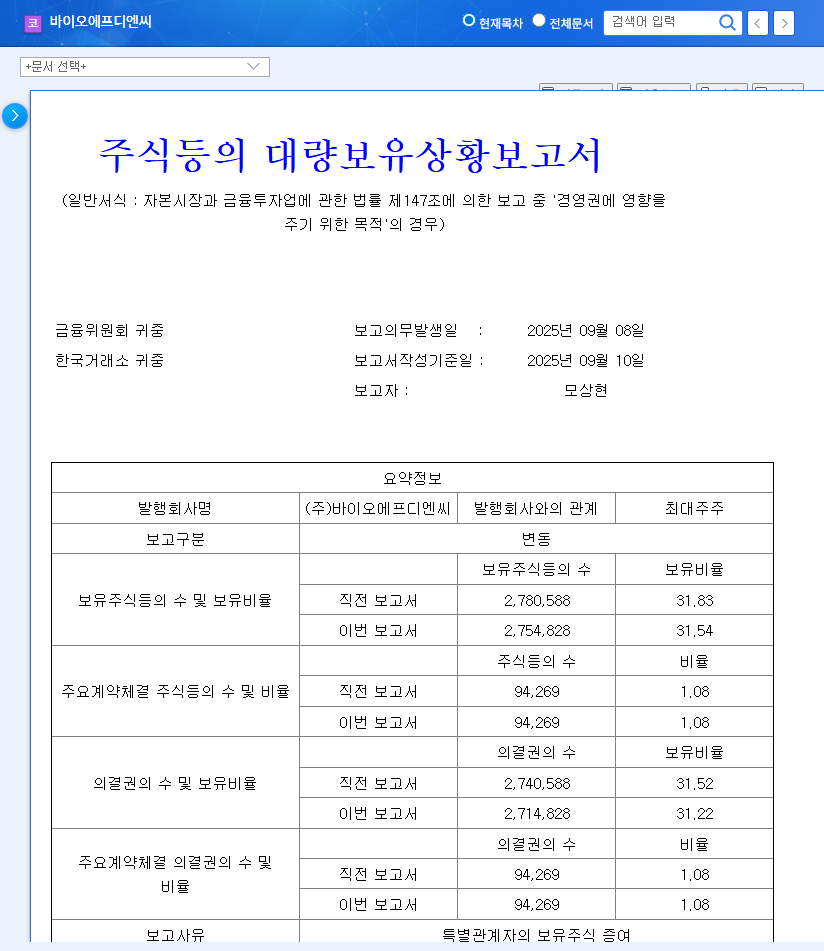

On September 11, 2025, Hong Seung-eok, an insider at Osang Healthcare, sold 4,000 shares. This resulted in a slight decrease in his stake from 56.60% to 56.52%.

Analyzing the Sale and its Investment Impact

The 4,000 shares represent a very small portion of the total outstanding shares, and the change in ownership is minimal. Therefore, the short-term impact of this sale on the company’s management or stock price is expected to be insignificant. However, the unclear reason for the insider’s sale could potentially dampen investor sentiment.

What’s Next for Osang Healthcare?

According to the 2025 semi-annual report, Osang Healthcare achieved a turnaround in both operating profit and net income despite a decline in sales. The stable sales in the biochemical diagnostics division and the global expansion of its new health functional food product, ‘Dangkyurak,’ are positive signs. However, the continued decline in sales in the immune diagnostics division and the increase in debt ratio warrant careful attention.

Action Plan for Investors

- Short-term Investment: Focus on fundamental changes, such as recovery in the immune diagnostics division and the performance of the new business, rather than the share sale event itself.

- Mid- to Long-term Investment: An investment strategy that considers the growth potential of the health functional food business and the sustained competitiveness of the biochemical diagnostics division is essential.

FAQ

Who is Hong Seung-eok?

He was an insider at Osang Healthcare.

Will this share sale affect the stock price?

Due to the small scale of the sale, a significant impact is unlikely, but it could negatively affect investor sentiment.

What is the outlook for Osang Healthcare?

Expansion into new businesses and stable growth in the biochemical diagnostics division are expected. However, sluggish performance in the immune diagnostics division and increasing debt ratio are risk factors.