1. Saramin After-Hours Trading: What Happened?

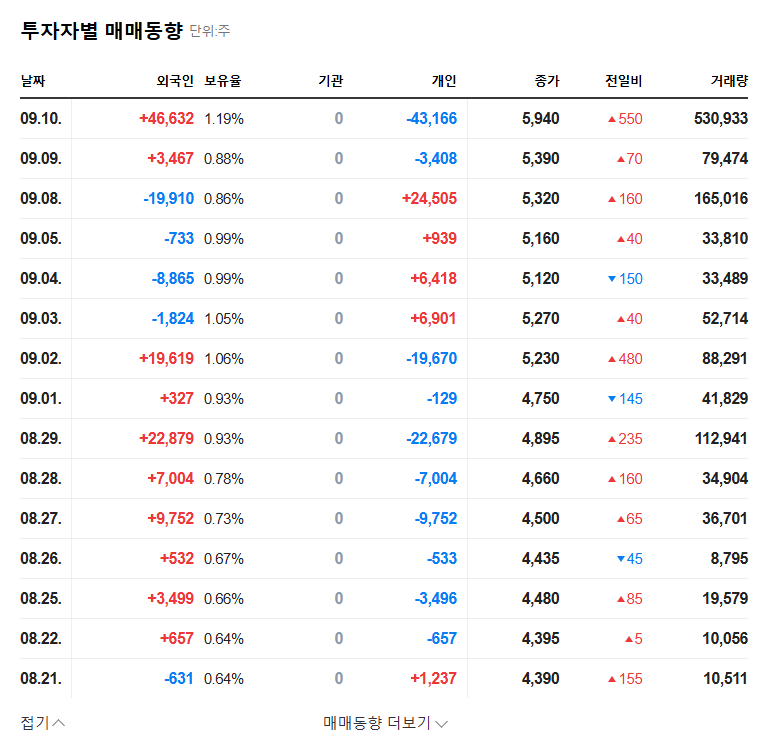

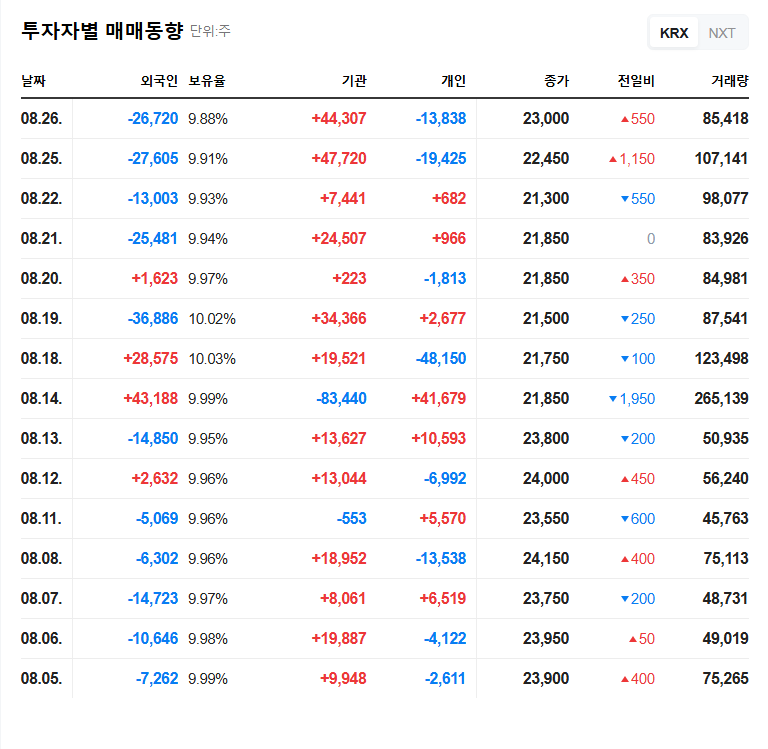

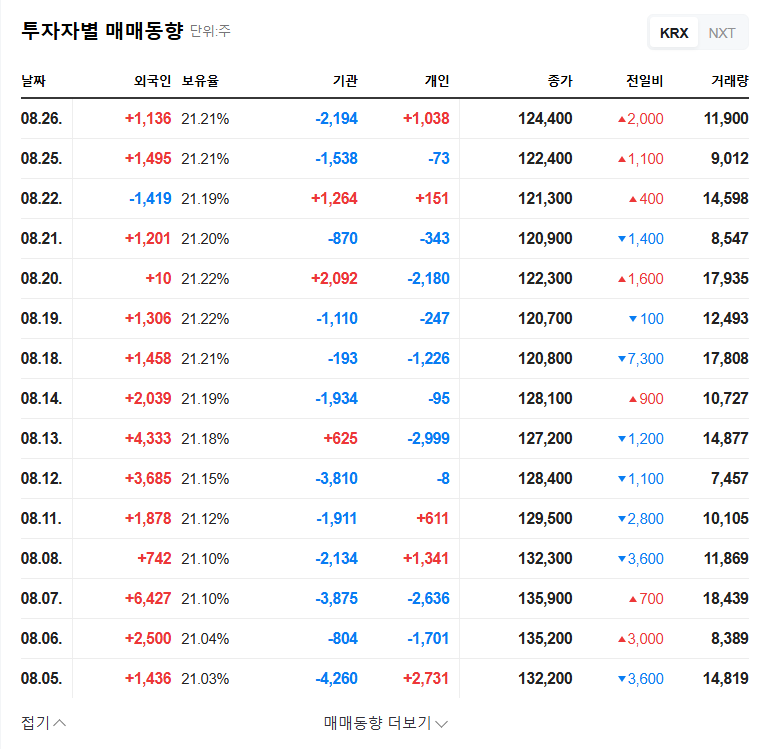

After the market closed on September 11, 2025, 58,765 shares of Saramin were traded for approximately ₩850 million in an after-hours block trade. Foreign investors participated in both buying and selling.

2. Why Did This Happen?: Background and Analysis

This large trade can be interpreted in connection with Saramin’s recent poor performance. In the first half of 2025, Saramin experienced a significant decline in both sales and operating profit. A slowdown in the job market, increased competition, and an overall economic downturn are cited as the primary causes. However, the active participation of foreign investors could suggest various interpretations, such as expectations for future performance improvement or short-term profit-taking.

3. What’s Next?: Future Outlook and Investment Strategies

After-hours trading can cause short-term stock price volatility. Investors should pay attention to the opening price on the next trading day and consider the possibility of support or resistance levels forming at specific price points. In the medium to long term, the performance of Saramin’s new businesses and the recovery of the job market will determine the stock’s direction.

4. Investor Action Plan

- Earnings Reports: Carefully review quarterly earnings reports to assess the company’s growth trajectory.

- New Business Monitoring: Continuously monitor the performance of new services.

- Macroeconomic Indicators: Understand the job market and economic trends to inform investment decisions.

- Risk Management: Investing always involves risk. Manage risk through diversification and other strategies.

FAQ

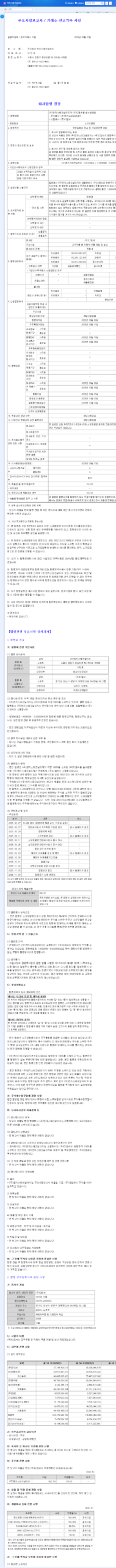

What are Saramin’s main businesses?

Saramin operates career platform (54.6%), recruitment consulting (14.8%), and outsourcing (30.6%) businesses.

What does after-hours trading mean?

After-hours trading refers to the trading of large volumes of stock outside of regular trading hours, which can impact investor sentiment and stock price volatility.

Should I invest in Saramin?

Saramin is currently underperforming, but there is potential for growth in its new businesses. Thorough analysis and careful consideration are necessary before making any investment decisions.