1. Jeil Technos Disposes of ₩3 Billion in Treasury Stock: What’s Happening?

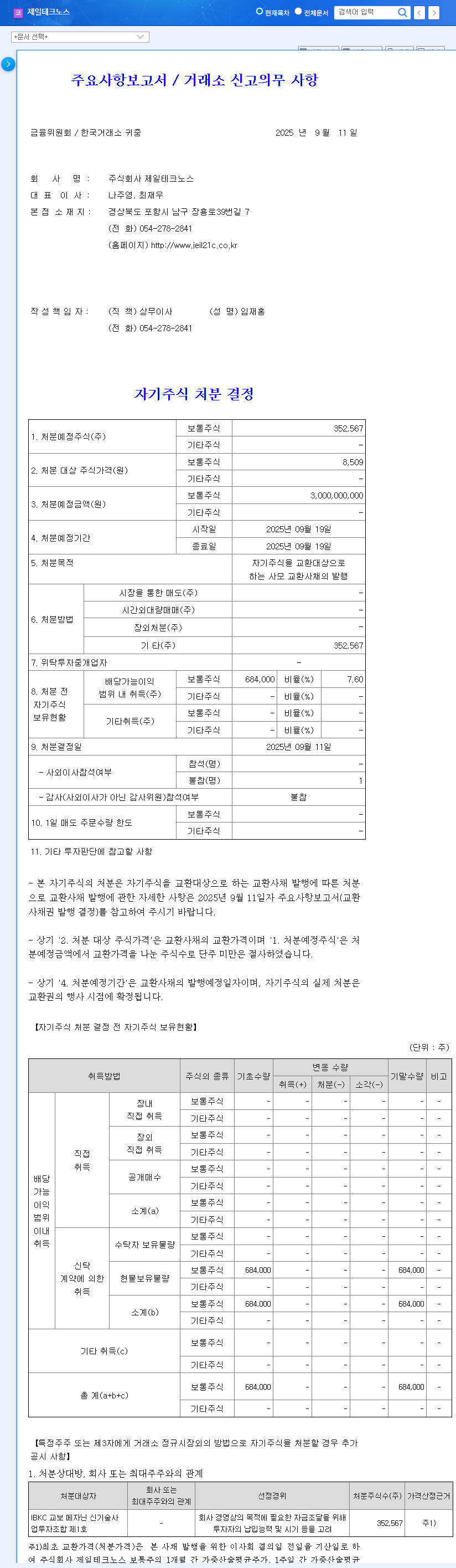

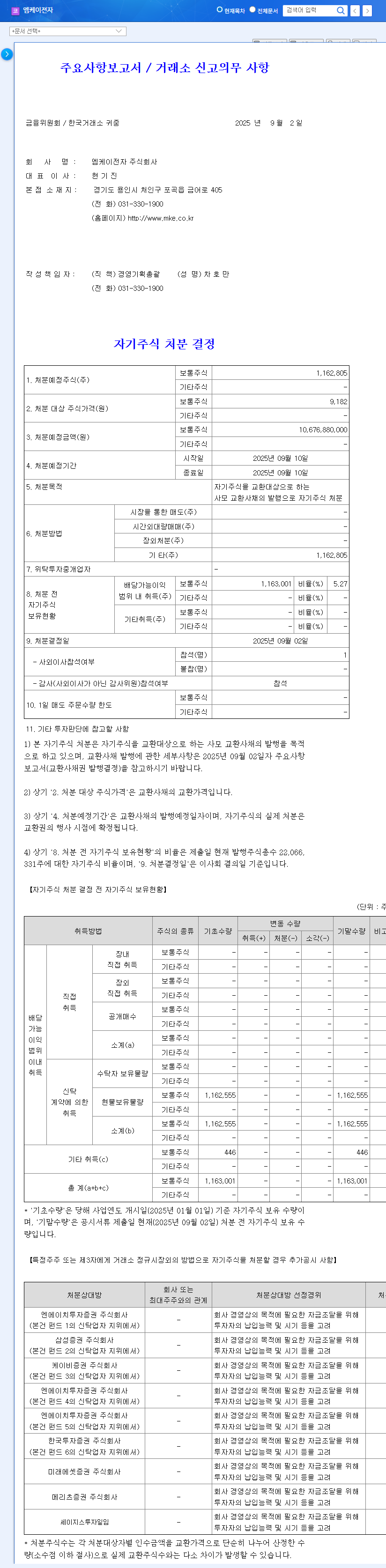

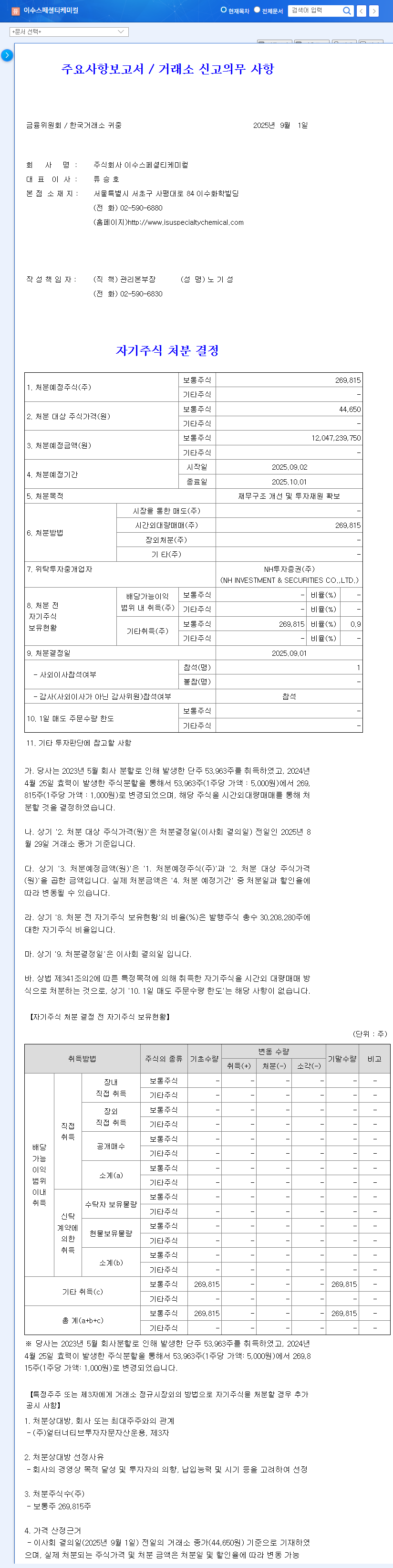

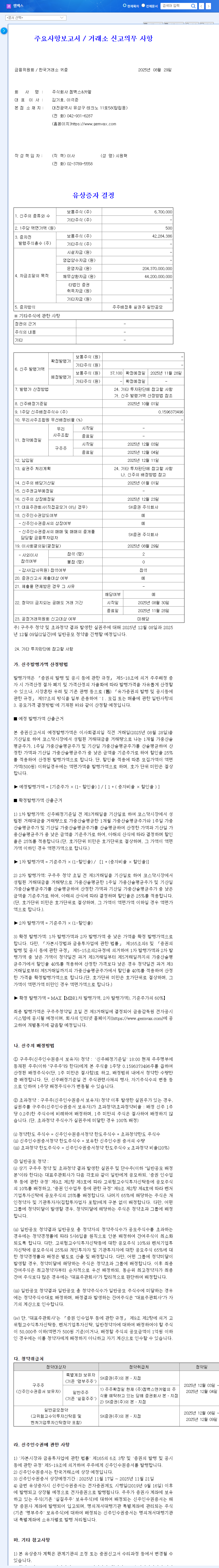

On September 11, 2025, Jeil Technos announced the disposal of 352,567 common shares, equivalent to approximately ₩3 billion. These treasury shares will be used for the issuance of private convertible bonds.

2. Why the Disposal? Understanding the Background and Objectives

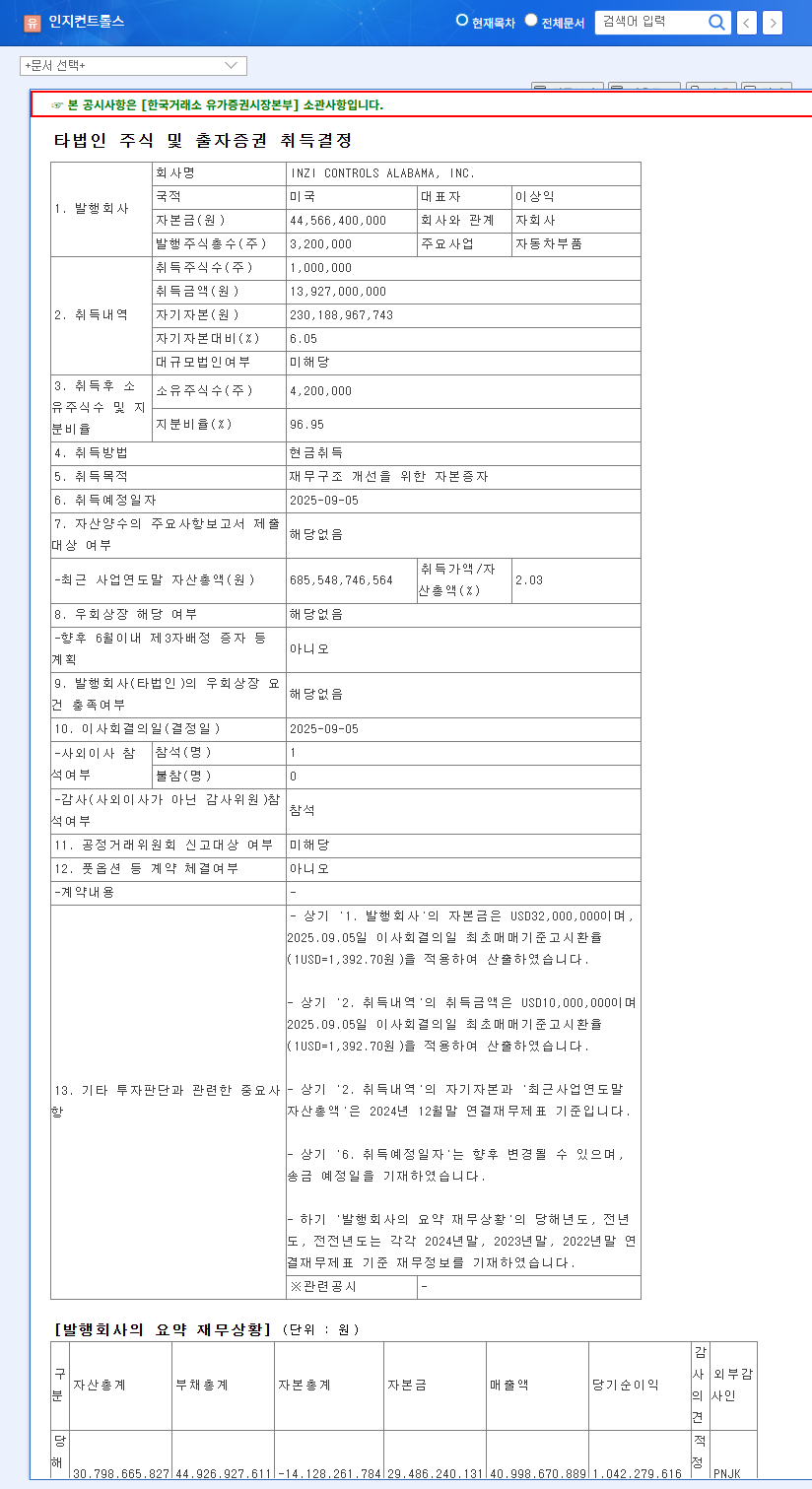

The company plans to utilize the funds acquired through the treasury stock disposal for new business investments and operating funds. Specifically, they aim to invest in the promising graphene business, strengthening their financial soundness and creating a springboard for business expansion. This move is interpreted as a crucial step to overcome recent sluggish performance and secure future growth engines. According to the 2025 semi-annual report, both the shipbuilding and construction sectors experienced significant declines in sales and profitability, creating an urgent need for securing funds.

3. Impact on Investors: Analyzing Opportunities and Risks

- Positive Impacts:

- Improved financial structure and increased growth potential through new business investments.

- Potential interpretation as an effort to enhance shareholder value.

- Negative Impacts and Risk Factors:

- Potential for further deterioration in profitability.

- Increased stock price volatility and potential stock dilution due to the issuance of private convertible bonds.

- Uncertainty in the business environment, including sluggish shipbuilding and construction sectors.

4. Investor Action Plan: Short-term vs. Long-term Investment Strategies

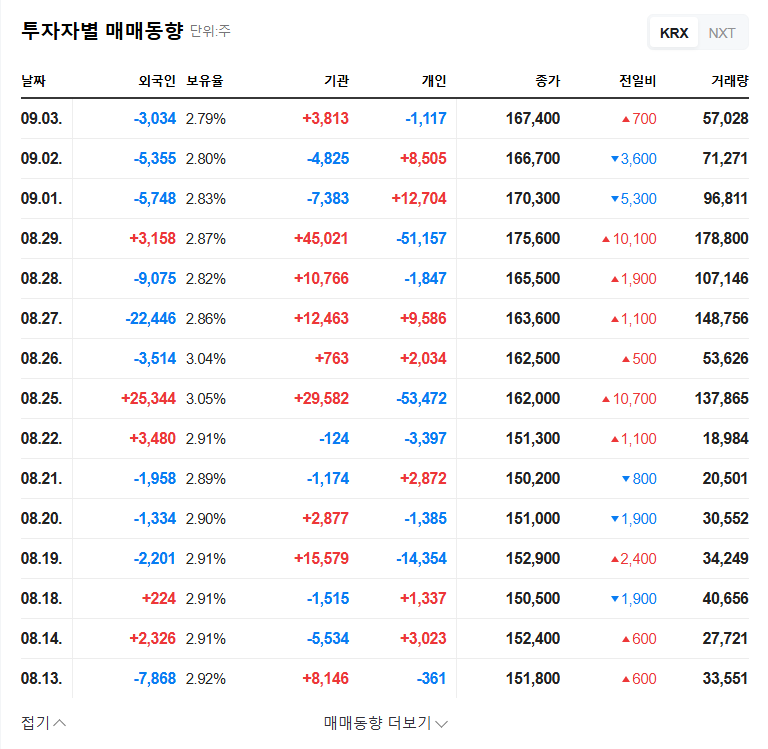

Short-term investors: Should be mindful of short-term stock price volatility caused by the disposal and closely monitor the company’s performance improvement trend and risks related to the suspension of business operations.

Long-term investors: Can consider investing from a long-term perspective, paying attention to the realization of results from the graphene business and the recovery of competitiveness in core business sectors.

FAQ

What is treasury stock disposal?

It refers to a company selling its own shares that it holds.

What is the purpose of the treasury stock disposal?

Jeil Technos plans to use the funds raised from the treasury stock disposal for the issuance of private convertible bonds and ultimately for new business investments and operating funds.

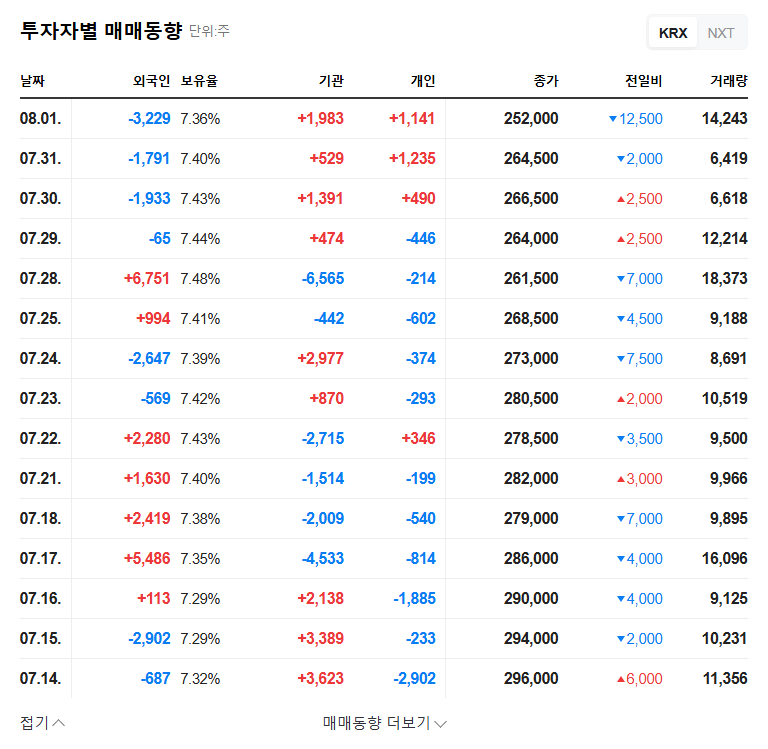

How will this treasury stock disposal affect the stock price?

In the short term, stock price volatility may increase, and the long-term impact will depend on the company’s earnings improvement.

What should investors pay attention to?

Short-term investors should be aware of stock price volatility and risks related to the suspension of business operations. Long-term investors should focus on the visibility of results from the graphene business and the recovery of competitiveness in core businesses.