Woori Financial Group Inc. (KRX: 316140) has released its preliminary financial results, and the initial numbers from the Woori Financial Group Q3 2025 earnings report present a complex puzzle for investors. While the group’s operating profit fell short of market consensus, its net profit surprisingly surpassed expectations. This mixed signal raises critical questions about the company’s underlying financial health and future trajectory.

This comprehensive analysis dissects the official earnings data, explores the fundamental drivers behind the numbers, and evaluates the broader macroeconomic headwinds impacting the Korean financial sector. We provide a forward-looking perspective on what this performance means for Woori Financial Group stock and offer strategic insights for current and prospective investors.

Q3 2025 Earnings at a Glance

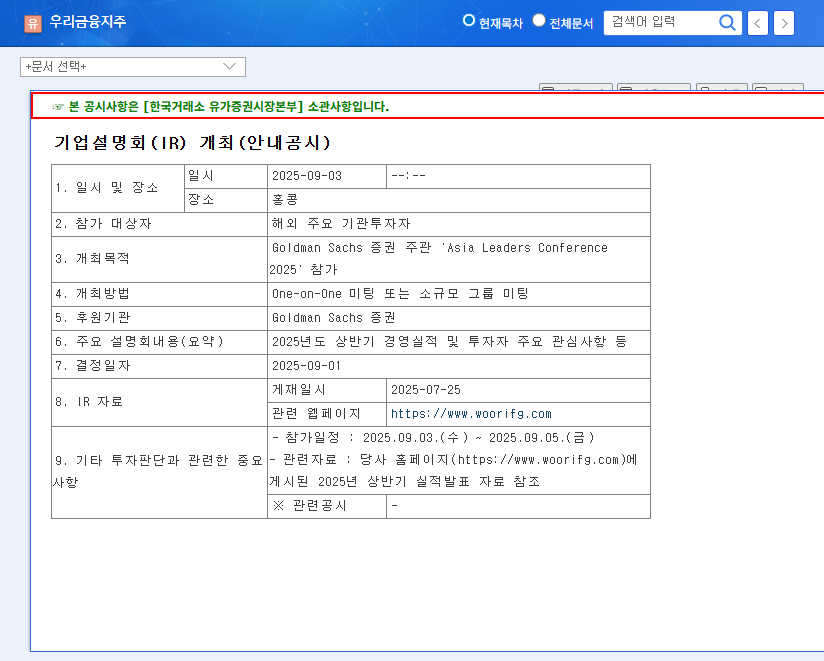

According to the company’s preliminary consolidated results for the third quarter of 2025, Woori Financial Group reported a revenue of KRW 8,000.9 billion, an operating profit of KRW 987.7 billion, and a controlling net profit of KRW 1,244.4 billion. The full details can be reviewed in the Official Disclosure (DART).

- •Operating Profit Miss: The operating profit of KRW 987.7 billion was a significant 17% below the market’s expectation of KRW 1,194.9 billion. This decline, both quarter-over-quarter and year-over-year, points to escalating competition and potential pressures on core profitability.

- •Net Profit Beat: Conversely, the net profit of KRW 1,244.4 billion impressively exceeded consensus estimates (KRW 1,047.4 billion) by 19%. However, this outperformance appears to be driven by non-operating factors, such as one-off gains from asset sales or favorable tax adjustments, rather than a fundamental improvement in core business operations.

Behind the Numbers: Fundamentals vs. Macro Environment

To truly understand the Woori Financial Group Q3 2025 earnings, we must look beyond the headline figures and analyze the two primary forces at play: the company’s internal strategic initiatives and the external economic climate.

Strengthening the Integrated Financial Powerhouse

Despite short-term profit fluctuations, Woori Financial Group is making strategic moves to solidify its long-term market position.

The group’s focus on diversifying revenue streams beyond traditional banking is a key pillar of its future growth strategy, aiming to build resilience against interest rate volatility.

- •Non-Banking Expansion: The full-scale operation of Woori Investment & Securities and the integration of a life insurance subsidiary are critical steps. These ventures are designed to increase stable, non-interest income from fees and commissions, reducing dependency on net interest margins.

- •Robust Financial Health: The group maintains a strong capital position with a CET1 ratio above 12.8% and a managed Non-Performing Loan (NPL) ratio of 0.71%. This demonstrates a solid foundation to weather economic uncertainties.

- •ESG Leadership: Achieving top-tier ESG ratings (MSCI ‘AAA’, DJSI inclusion) is no longer just a reputational benefit. It attracts a growing class of global investors and can lead to a lower cost of capital, enhancing long-term corporate value.

Navigating Macroeconomic Headwinds

The global economic landscape remains a significant challenge. According to global economic reports from outlets like Bloomberg, several factors are creating a difficult operating environment for financial institutions.

- •Persistent Interest Rates: While the Bank of Korea’s stable policy rate provides some predictability, rising funding costs across the board are squeezing net interest margins (NIM), a core profitability metric for banks.

- •Economic Uncertainty: Downside risks, including geopolitical tensions, a slowdown in domestic growth, and concerns over the real estate market (particularly Project Financing loans), continue to create volatility and require prudent risk management.

- •Market Volatility: Fluctuations in the KRW/USD exchange rate and commodity prices add another layer of complexity, affecting overseas operations and the value of foreign currency-denominated assets.

Investor Outlook & Strategic Action Plan

The market’s reaction to the Woori Financial Group analysis will likely be mixed. The operating profit miss could trigger short-term negative sentiment, as investors question the quality of the net profit beat. However, a long-term view reveals a more optimistic picture centered on the group’s strategic transformation.

The key determinant of future stock performance will be the tangible results from the non-banking segments. Investors should monitor for clear evidence of synergy and profit growth from the securities and insurance arms. For those looking to broaden their portfolio, our guide on investing in leading Korean financial stocks provides valuable context.

In conclusion, while the Q3 2025 results were clouded by one-off factors and macroeconomic pressures, Woori Financial Group’s foundational strengthening and diversification strategy remain intact. Prudent investors will look past the short-term noise, focusing on the execution of its long-term vision for sustainable, diversified growth.

Frequently Asked Questions (FAQ)

Q1: What were the key takeaways from Woori Financial Group’s Q3 2025 earnings?

A1: The main story was a mixed result. Operating profit fell 17% below market expectations, indicating pressure on core banking operations. However, net profit beat expectations by 19%, largely due to non-recurring gains rather than fundamental business improvement.

Q2: Why is the distinction between operating and net profit important here?

A2: Operating profit reflects the health of a company’s primary business activities. Net profit includes all income and expenses, including one-off events like asset sales. A miss in operating profit suggests the core business is facing challenges, even if the final net profit looks strong.

Q3: What are the long-term growth drivers for Woori Financial Group?

A3: The key long-term drivers are the expansion of its non-banking divisions (securities, insurance, wealth management), which will create more diverse and stable revenue streams. Its strong financial health and leadership in ESG are also major long-term attractions for investors.

Q4: What should investors watch for in the coming quarters?

A4: Investors should monitor the growth of non-interest income, the profitability of the new securities and insurance subsidiaries, and the company’s ability to manage costs and credit risks, especially concerning real estate loans. Progress in digital transformation will also be a key indicator of future competitiveness.

Disclaimer: This analysis is based on preliminary data and publicly available information. It does not constitute investment advice. Investors should conduct their own due diligence before making any investment decisions.