VIP Asset Management Sells 2.5% Stake in Global Tax Free: What Happened?

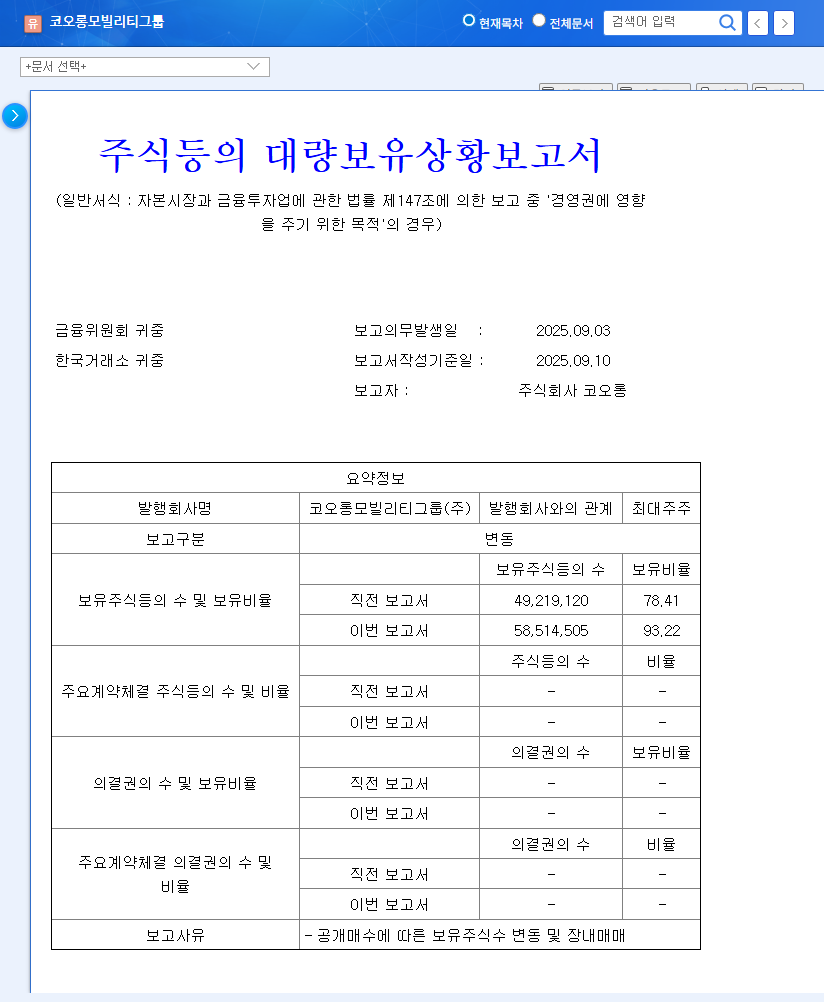

VIP Asset Management sold 2.5% of its Global Tax Free shares between September 3rd and 9th, 2025, reducing its stake from 8.86% to 6.36%. The stated reason for the sale is a change in investment strategy, suggesting profit-taking.

Why the Sale, and What’s Next?

Global Tax Free delivered solid results in the first half of 2025, driven by its thriving tax refund business, fueled by increasing foreign tourists and the expansion of the immediate refund system. However, the underperformance of subsidiaries Swanicoco (cosmetics) and Fingerstory (online content) remains a risk.

What Should Investors Do?

While the stake sale might exert short-term downward pressure on the stock price, the direct impact on the company’s fundamentals is expected to be limited. Investors should focus on the long-term intrinsic value of the company rather than short-term price fluctuations. Closely monitoring the performance of the subsidiaries and future stake changes by VIP Asset Management is crucial.

Key Investment Takeaways

- Positive Factors: Growth in tax refund business, strong financial performance, improved financial health.

- Negative Factors: Underperforming subsidiaries, investment portfolio volatility, increased market competition.

- Points to Watch: Subsidiary performance improvements, investment portfolio stabilization, foreign tourist trends, and VIP Asset Management’s future stake changes.

Frequently Asked Questions (FAQ)

Is VIP Asset Management’s stake sale a negative signal for Global Tax Free’s future?

Not necessarily. The sale is likely driven by a change in VIP Asset Management’s investment strategy and doesn’t necessarily reflect a change in Global Tax Free’s fundamentals. The strong growth of the tax refund business remains a positive factor.

Should I invest in Global Tax Free?

Investment decisions depend on individual investment goals and risk tolerance. Carefully consider the growth potential of the tax refund business and the risks associated with the underperforming subsidiaries before making any investment decisions. Consulting with a financial advisor is recommended.

What is the outlook for Global Tax Free’s stock price?

In the short term, the stock price may experience volatility due to the stake sale. However, the long-term outlook remains positive, driven by the growth of the tax refund business and the increasing trend of foreign tourists.