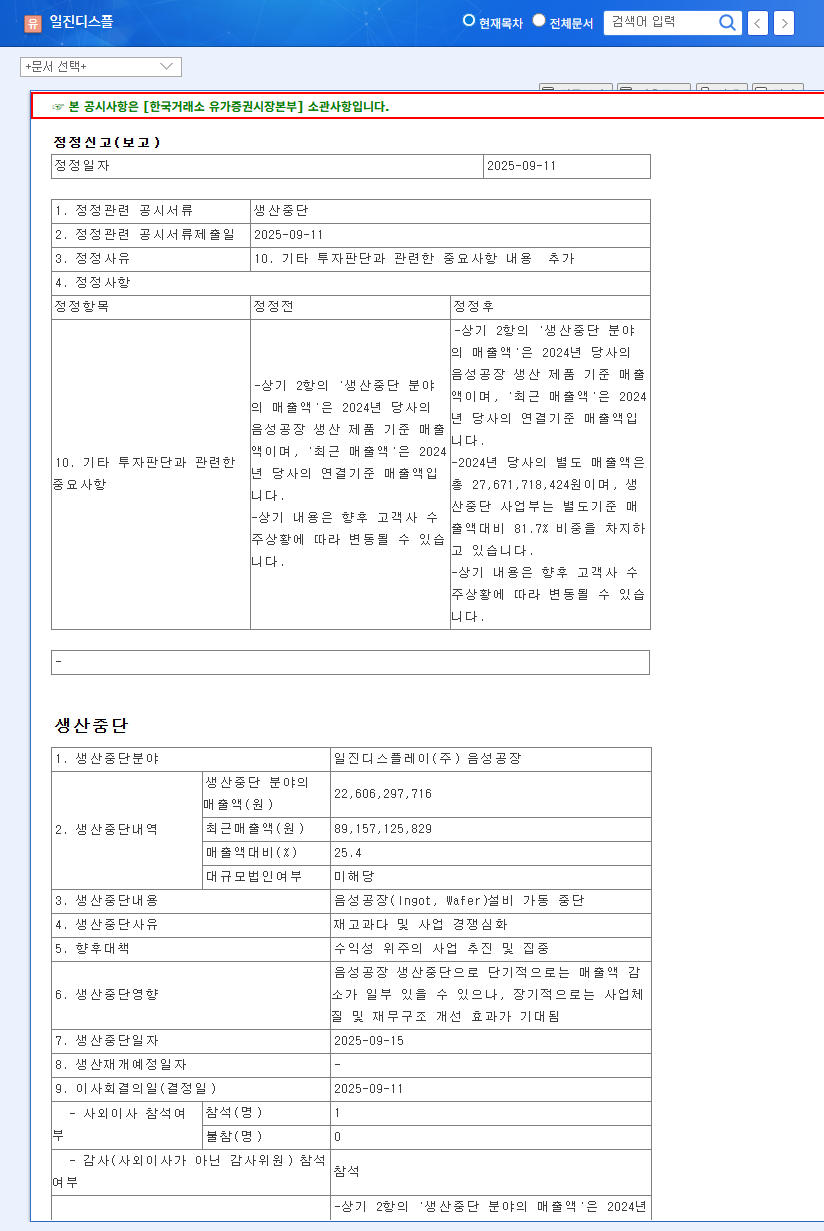

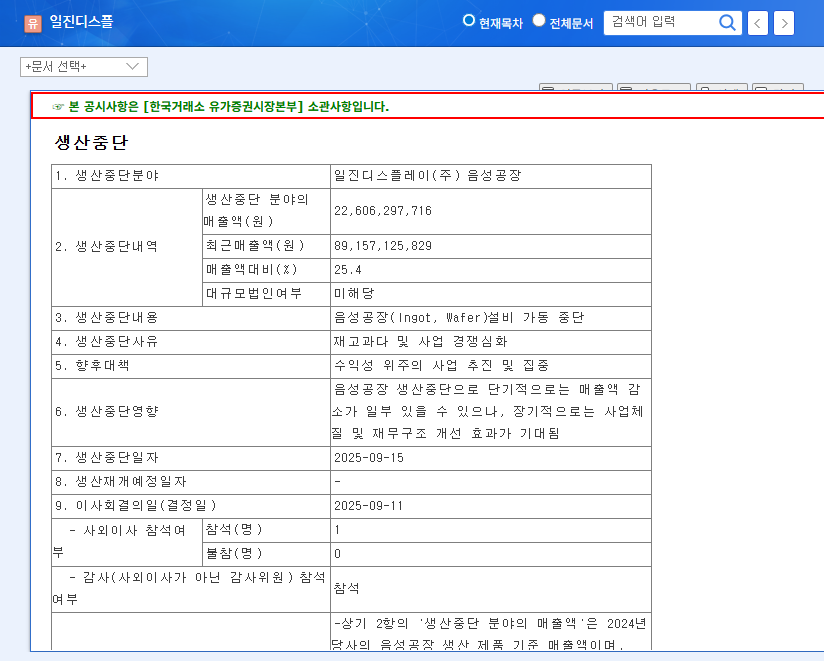

What Happened? – Iljin Display Halts Main Operations

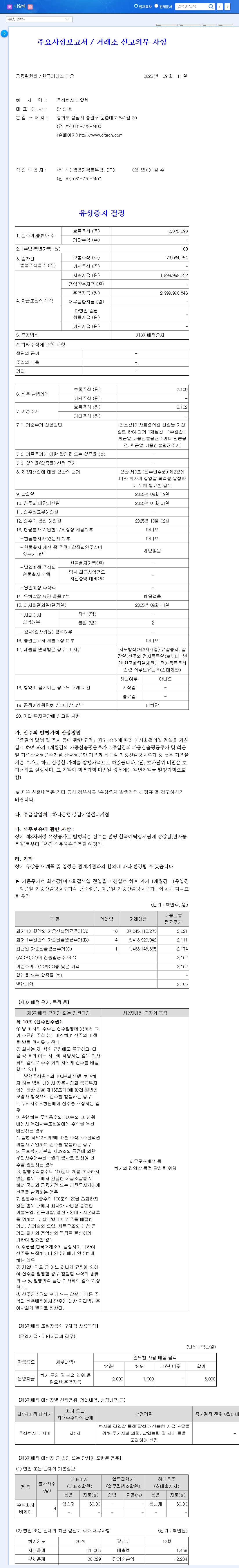

On September 11, 2025, Iljin Display announced a production halt at its Eumseong plant. This constitutes a “major suspension of operations,” triggering a delisting review by the Korea Exchange.

Why Did This Happen? – Deteriorating Fundamentals

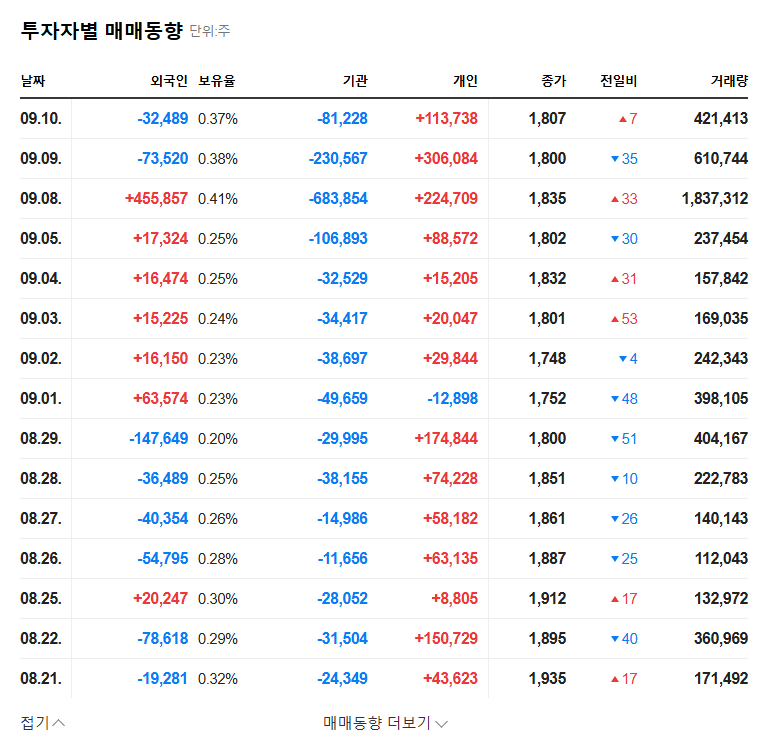

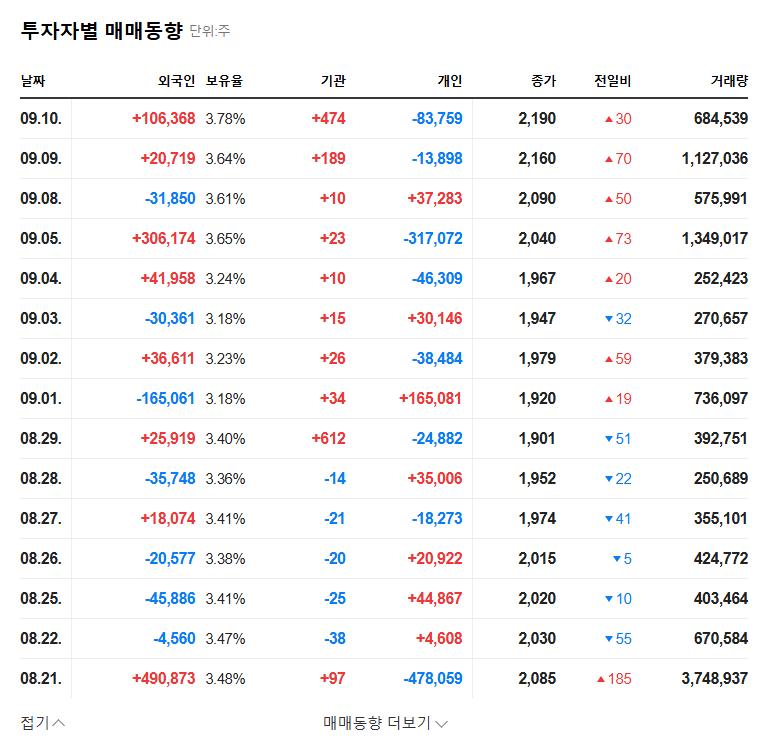

Iljin Display was already facing a severe financial crisis as of the first half of 2025. Both the AD division (sapphire wafer) and the DS division (touchscreen panel) experienced declining sales and profitability, coupled with increasing debt and lack of liquidity.

- Sharp decline in sales: Significant drop in AD division sales, decrease in DS division sales

- Operating loss: Both divisions recorded operating losses

- Worsening financial health: Increasing debt ratio, declining current ratio

What Happens Next? – Delisting Possibility and Investment Strategy

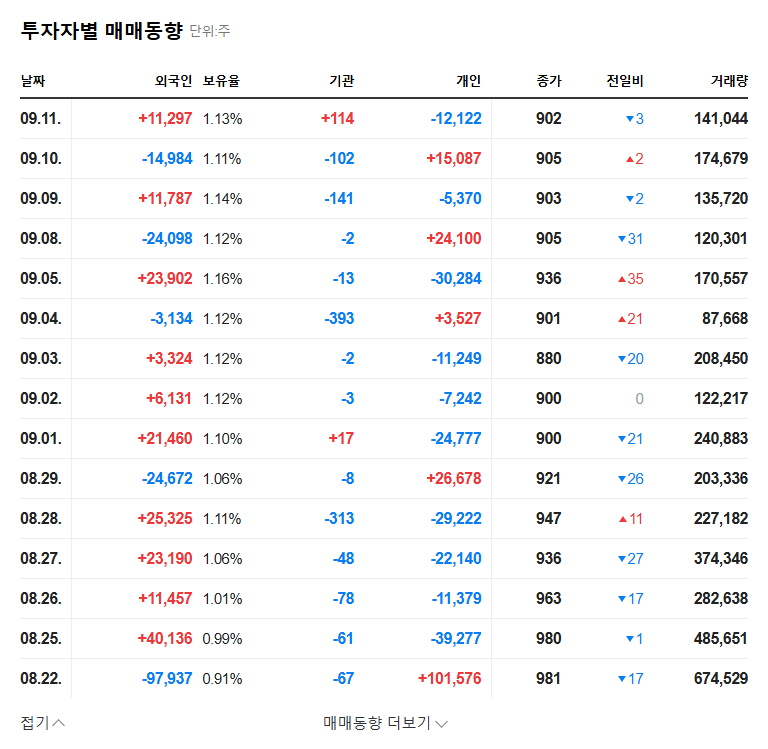

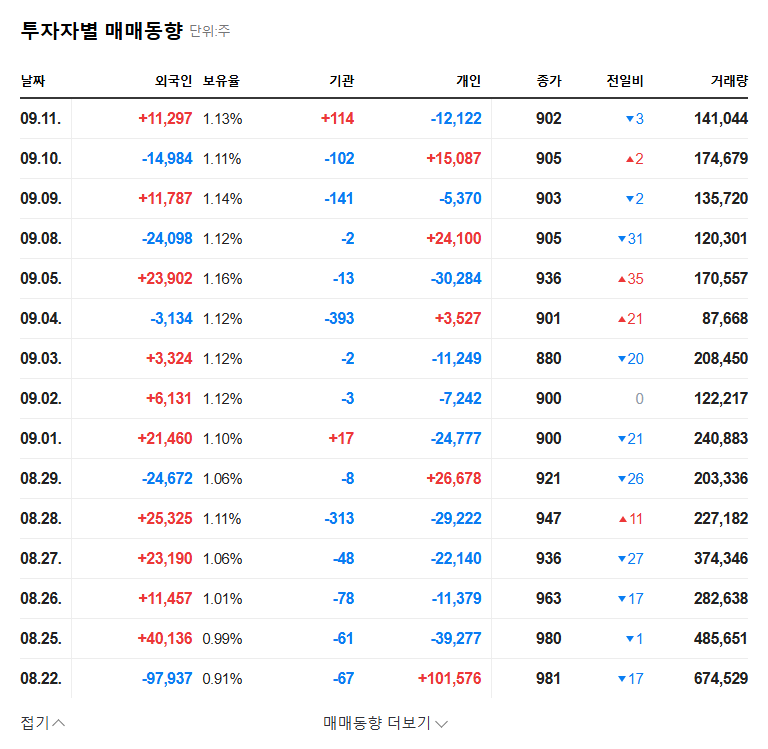

The decision of the Corporate Review Committee will determine Iljin Display’s fate. If designated for review, the likelihood of delisting increases significantly. Even if exempted, share price recovery will be challenging without addressing fundamental issues. Short-term price volatility is inevitable, demanding cautious investor approach.

What Should Investors Do? – Proceed with Caution, Monitor Closely

Given the current circumstances, extreme caution is advised for investments in Iljin Display. Monitor the delisting review outcome, the company’s self-rescue plans and management improvement efforts, and macroeconomic changes closely.

Recommendation: Sell or Hold (Investment decisions should be made carefully at your own discretion and responsibility.)

Frequently Asked Questions

Why is Iljin Display facing delisting?

The production halt at Iljin Display’s Eumseong plant is considered a “major suspension of operations,” which is grounds for a delisting review. The company may be delisted depending on the review’s outcome.

Should I sell my Iljin Display shares now?

Iljin Display’s current situation is critical, requiring extreme caution. Experts recommend selling or holding. However, investment decisions should be made carefully at your own discretion and responsibility.

What is the outlook for Iljin Display?

The future outlook hinges on the Corporate Review Committee’s decision and the company’s self-rescue efforts. Even if exempted from review, share price recovery may be difficult without resolving fundamental issues. Conversely, inclusion in the review increases the likelihood of delisting.

What should investors watch out for?

Investors should closely monitor the Corporate Review Committee’s decision, the resumption of production at the Eumseong plant, the company’s self-rescue plans, and fluctuations in exchange rates and interest rates.