The recent performance of GABIA, Inc. stock (KOSDAQ: 079940) has sent ripples through the investment community, raising a critical question: Is the recent large-scale sell-off by a major foreign investor a warning sign or a golden buying opportunity? A disclosure revealed that Fidelity Management & Research Company LLC significantly cut its stake, sparking concern among shareholders. This development, paired with a mixed financial report showing strong revenue growth but declining profits, requires a careful and nuanced approach.

In this comprehensive GABIA stock analysis, we will dissect the Fidelity sell-off, explore the company’s underlying fundamentals, and provide a strategic outlook for potential investors. Our goal is to equip you with the insights needed to navigate the short-term volatility and evaluate the long-term potential of this prominent cloud and IT services provider.

The Catalyst: A Major Foreign Investor Hits ‘Sell’

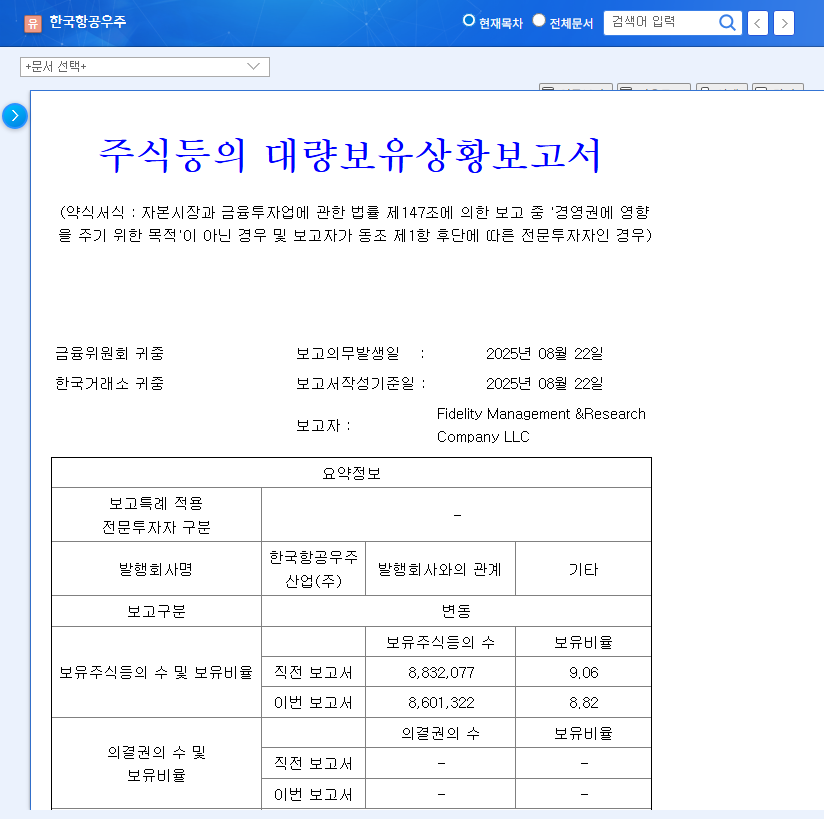

On October 30, 2025, the market was alerted to a significant shift in ownership for GABIA, Inc. Fidelity, a global asset management giant, disclosed a drastic reduction in its holdings, slashing its position from a substantial 9.99% down to just 2.62%. According to the report, the stated reason was a simple disposal of shares connected to the dissolution of an operating fund. You can view the complete filing in the Official Disclosure (Source: DART).

While any large institutional sell-off can trigger alarm bells, the context provided—a fund dissolution—suggests this may be a portfolio rebalancing act rather than a verdict on GABIA’s future performance. However, the market rarely waits for full context, and the immediate impact on the GABIA, Inc. stock price is undeniable.

GABIA Stock Analysis: A Deep Dive into Company Fundamentals

To understand if this is a crisis or an opportunity, we must look beyond the headlines and into the health of the business itself. GABIA’s recent financial reports paint a picture of a company in a high-growth, high-investment phase.

Robust Revenue Growth Meets Profitability Headwinds

In the first half of 2025, GABIA reported an impressive 25% year-over-year increase in consolidated revenue, reaching 157.6 billion KRW. This growth was largely driven by its subsidiary SPSoft. However, this top-line success was overshadowed by a 51.7% decrease in operating profit and a 43.9% drop in net profit. This squeeze on profitability is attributed to necessary investments, including higher administrative expenses, R&D costs, and financial costs in a high-interest-rate environment.

Unpacking GABIA’s Core Growth Engines

GABIA’s long-term value is rooted in its strong position across several key tech sectors. These core segments provide a stable foundation and significant growth potential.

- •Cloud & IT Services: Accounting for 56% of revenue, this is GABIA’s powerhouse. Services like ‘g-Cloud,’ ‘Hihoworks,’ and ‘GABIA DaaS’ are not just growing; they are strategically expanding into the lucrative public sector, bolstered by key CSAP certifications.

- •IX & IDC Business: This segment (30% of revenue) is a bastion of stability. As Korea’s only neutral Internet Exchange (IX) operator, GABIA is uniquely positioned to benefit from the ever-increasing flow of internet traffic, further enhanced by the new Gwacheon Data Center.

- •Security Business: While smaller (11% of revenue), this division holds significant growth potential through synergies with its subsidiary XGate, combining security solutions with managed services.

Evaluating the Impact: Short-Term Pain vs. Long-Term Gain?

The Fidelity GABIA sell-off has two distinct timelines of impact that investors must consider.

Immediate Market Reaction: Expect Volatility

In the short term, such a large volume of shares hitting the market creates a supply-demand imbalance, inevitably putting downward pressure on the stock price. This can negatively impact investor sentiment and lead to follow-on selling. Understanding the dynamics of how institutional selling affects stock prices is crucial for navigating this period of heightened volatility.

Mid-to-Long-Term Outlook: Fundamentals Poised for a Rebound

Looking beyond the immediate noise, the long-term case for the GABIA, Inc. stock remains compelling. The sell-off appears procedural rather than a critique of GABIA’s business model. As the company’s strategic investments in infrastructure and R&D begin to pay off and profitability improves, the stock has strong potential to rebound. For investors who believe in the growth of Korea’s digital infrastructure, any significant price dip could represent an attractive entry point. This aligns with strategies discussed in our guide to investing in cloud computing stocks.

Investor Action Plan: A Prudent Strategy for GABIA

Given the circumstances, a measured and strategic approach is recommended for investors considering the GABIA 079940 stock.

- •Brace for Volatility: Acknowledge that the stock will likely experience price swings in the near term. Avoid emotional, knee-jerk reactions to daily price movements.

- •Monitor Profitability Metrics: Keep a close eye on GABIA’s next quarterly reports. Look for signs that their investments are leading to improved operating margins and net profit.

- •Analyze Market Sentiment: Track trading volumes and look for signs of accumulation by other institutional investors, which could signal that the selling pressure is subsiding.

- •Maintain a Long-Term View: Focus on the company’s intrinsic value and its position in the growing cloud and data center markets. Short-term price drops unrelated to fundamentals can be opportunities for long-term investors.