In a significant development for the pharmaceutical industry, Daewoong Pharmaceutical, a key subsidiary of DAEWOONG CO.,LTD, has announced a major milestone for its flagship drug. The company is seeking a new indication for Fexuclue 40mg, targeting H. pylori eradication. This strategic move is not just a clinical update; it’s a potential game-changer that could redefine the company’s growth trajectory and solidify its position in the competitive gastrointestinal treatment market.

This comprehensive analysis will unpack the implications of this development, exploring the science behind Fexuclue, the significance of the clinical trial results, and the profound potential impact on DAEWOONG CO.,LTD‘s financial health and investor outlook.

The Breakthrough: Fexuclue’s New Frontier in H. pylori Treatment

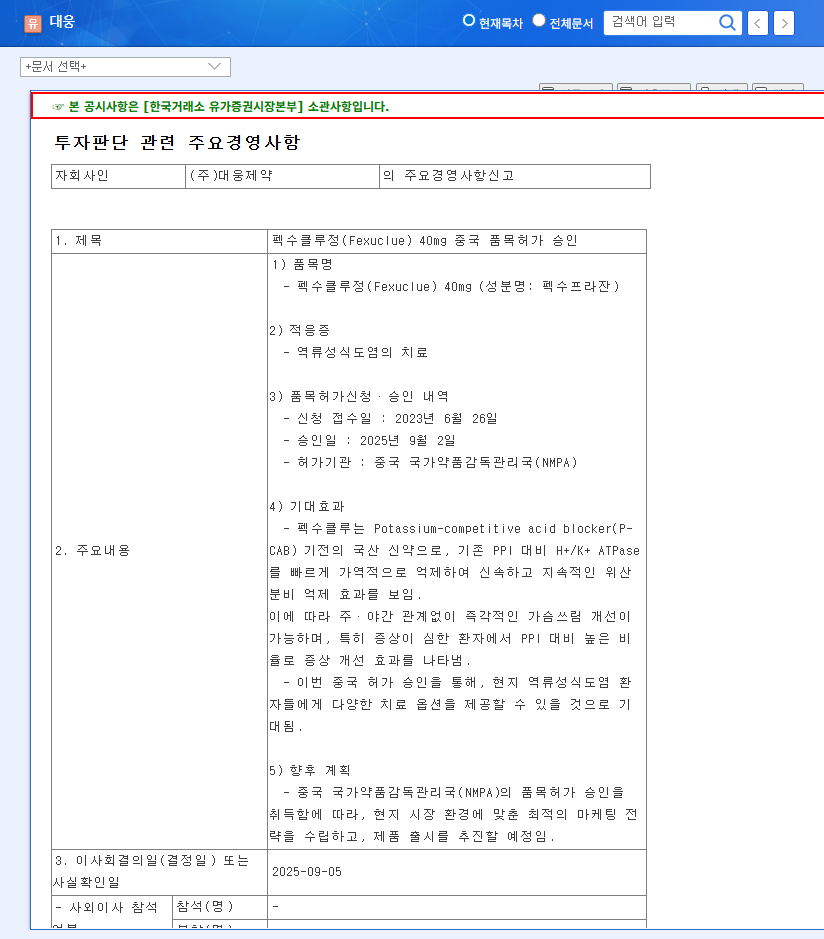

On October 27, 2025, Daewoong Pharmaceutical submitted a New Drug Application (NDA) to the Ministry of Food and Drug Safety (MFDS) for a new indication: ‘Helicobacter pylori eradication combined with antibiotics therapy.’ This is a pivotal step to expand the use of Fexuclue, a Potassium-Competitive Acid Blocker (P-CAB), beyond its current approval for GERD.

Helicobacter pylori is a type of bacteria that infects the stomach and is a primary cause of peptic ulcers and even stomach cancer, affecting a significant portion of the global population. According to the World Health Organization, effective eradication is crucial for public health. The market for H. pylori eradication therapies is therefore substantial and has consistent demand, making this a lucrative new arena for DAEWOONG CO.,LTD.

Decoding the Clinical Trial Success

The foundation of this application lies in robust domestic Phase 3 clinical trials. The results were highly encouraging:

- •Non-Inferior Eradication Rate: The Fexuclue-based triple therapy achieved an impressive eradication rate of 83.64%, proving it to be non-inferior to existing standard-of-care treatments.

- •Safety Profile: The trials confirmed a safety profile similar to that of conventional therapies, a critical factor for physician adoption and patient trust.

This successful trial data, submitted to regulators, can be reviewed in the company’s Official Disclosure. This evidence strongly supports the potential approval and subsequent market launch.

Expanding Fexuclue’s indication into H. pylori eradication isn’t just an addition to the product line; it’s a strategic move that enhances Daewoong’s portfolio, strengthens its market competitiveness, and unlocks a significant new revenue stream.

Analyzing the Financial and Market Impact for DAEWOONG CO.,LTD

The approval of the Fexuclue H. pylori indication is expected to be a powerful growth engine, strengthening the company’s fundamentals in several key areas. While the competitive landscape is robust, Daewoong Pharmaceutical’s track record with successful drugs like Nabota and Envlo builds confidence in its ability to execute a powerful market entry strategy.

Key Factors Strengthening Corporate Fundamentals

- •Revenue Diversification: A new, high-demand indication diversifies revenue streams, reducing reliance on existing products and creating a more resilient business model.

- •Profitability Boost: Entering the high-margin H. pylori market is projected to directly enhance operating profit and net income, thereby improving key metrics like Return on Equity (ROE).

- •Strengthened Portfolio: This expansion strengthens Daewoong’s gastroenterology portfolio, creating synergistic marketing opportunities and reinforcing its market leadership.

- •Increased Pipeline Value: Each successful commercialization raises the perceived value of the company’s entire drug pipeline, signaling strong R&D capabilities to investors. For more on their pipeline, see our overview of Daewoong’s R&D strategy.

Investor Outlook and Strategic Considerations

For investors, this development presents a compelling growth story. However, a prudent approach requires monitoring several key milestones and potential risks. The path from application to market dominance involves regulatory hurdles, competitive pressures, and successful marketing execution.

Key Monitorables for Investors:

- •MFDS Approval Timeline: The most critical upcoming event is the final approval from the Ministry of Food and Drug Safety.

- •Post-Launch Market Penetration: After approval, tracking initial sales figures and market share capture will be vital to assess the real-world success of Fexuclue H. pylori therapy.

- •Macroeconomic Factors: While strong sales can offset some pressures, factors like interest rates and currency exchange rates can still impact overall profitability, especially in international markets.

In conclusion, the pursuit of an H. pylori indication for Fexuclue represents a calculated and potent strategic move by DAEWOONG CO.,LTD. It leverages a proven asset to tap into a stable, high-value market, promising significant upside for the company’s financial performance and long-term enterprise value.