An investment analysis of KYUNGNONG CORPORATION (002100) reveals a compelling story, highlighted by recent insider share acquisitions that signal strong management confidence. When executives like CEO Yong-jin Lee increase their personal stake, it often speaks louder than any press release. But is this confidence justified by the company’s fundamentals? This comprehensive analysis will explore the significance of this move, dissect the performance of Kyungnong’s core business segments, evaluate its financial health, and outline a strategic outlook for potential investors.

This isn’t just a minor stock purchase; it’s a powerful declaration from the management team about their belief in KYUNGNONG CORPORATION’s long-term value and commitment to stable, responsible governance.

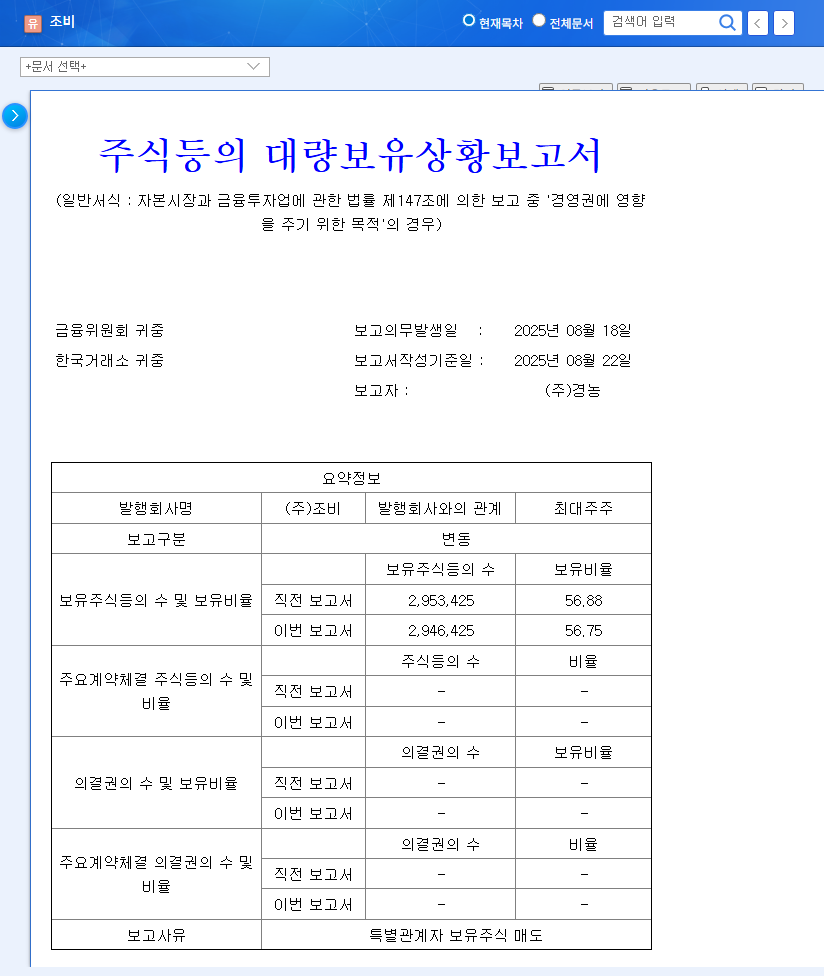

Insider Buying: A Closer Look at the Numbers

On November 12, 2025, a significant event unfolded for those following the Kyungnong stock. According to the official disclosure filed with DART, key insiders, including CEO Yong-jin Lee and other special affiliates, increased their collective holdings. While the percentage increase was a modest 0.08 points—from 67.53% to 67.61%—the strategic implication is substantial. You can view the Official Disclosure here.

This action, explicitly stated to be for the purpose of influencing management rights, reinforces the leadership’s commitment to steering the company towards long-term growth. It serves as a bulwark against potential hostile takeovers and allows the executive team to focus on strategic execution rather than short-term market pressures. For investors, this is often interpreted as a bullish signal, suggesting that those with the most intimate knowledge of the company foresee a bright future.

Core Business and Growth Engine Analysis

A complete Kyungnong analysis must go beyond shareholder movements and delve into the operational heart of the company. KYUNGNONG CORPORATION’s strength is built on a diversified foundation with a clear vision for the future.

Agrochemicals: The Stable Foundation

The agrochemical division remains the company’s primary revenue driver, accounting for the vast majority of sales. With robust year-over-year growth, this segment benefits from the global imperative of food security and agricultural efficiency. Stable raw material prices have helped ease cost burdens, and the demand for effective crop protection products is inelastic. The future here involves expanding into eco-friendly agricultural materials, a market segment experiencing rapid growth as sustainability becomes a key focus for farmers worldwide.

Fertilizers (Joby Subsidiary): Navigating Challenges

The fertilizer business, operated through its subsidiary Joby, faces a more challenging landscape. Decreasing domestic cultivated land and intense competition have put pressure on revenue. However, the company is not standing still. The strategic pivot towards developing high-value-added functional fertilizers and strengthening marketing efforts is a proactive measure to reclaim profitability and market share. This transformation is crucial for the segment’s long-term viability.

Smart Farms: The High-Growth Future

Perhaps the most exciting aspect of the Kyungnong investment thesis is its smart farm business. Though still in its early stages, this segment is showing explosive growth, perfectly aligning with government policies fostering agricultural technology. By leveraging proprietary technology under its ‘Signit’ brand, Kyungnong is positioning itself as a leader in a sector poised for rapid expansion. As detailed in reports on the global smart agriculture market, the integration of IoT, data analytics, and automation is revolutionizing farming. The key risk here is a reliance on imported materials, making the business sensitive to currency fluctuations.

Financial Health and Investor Action Plan

While the operational outlook has clear strengths, a review of the company’s financials reveals areas that require diligent monitoring. The increase in short-term borrowings could lead to higher interest expenses, and a decrease in operating cash flow highlights the need for more efficient working capital management. On the positive side, retained earnings are consistently accumulating, bolstering the company’s financial soundness and its capacity for future dividends.

For those considering an investment in KYUNGNONG CORPORATION, the recent insider buying is a clear vote of confidence. However, a prudent strategy should focus on the fundamentals. Investors should watch for the following:

- •Smart Farm Growth: Track revenue growth and market penetration of the ‘Signit’ brand as key indicators of successful execution.

- •Profitability Improvements: Monitor margins in the core agrochemical business and the turnaround progress in the fertilizer segment.

- •Working Capital Efficiency: Look for improvements in operating cash flow and management of accounts receivable. This is critical for financial stability.

- •Shareholder Returns: With enhanced dividend capacity, pay attention to announcements regarding shareholder-friendly policies. For further reading, you can learn more about investing in the agricultural tech sector.

In conclusion, the combination of stable management, a robust core business, and a promising new growth engine makes KYUNGNONG CORPORATION a compelling company to watch. The long-term performance of the Kyungnong stock will ultimately be determined not by this single act of insider buying, but by the company’s ability to execute its strategic vision and strengthen its financial footing.