1. Next Biomedical IR: What was discussed?

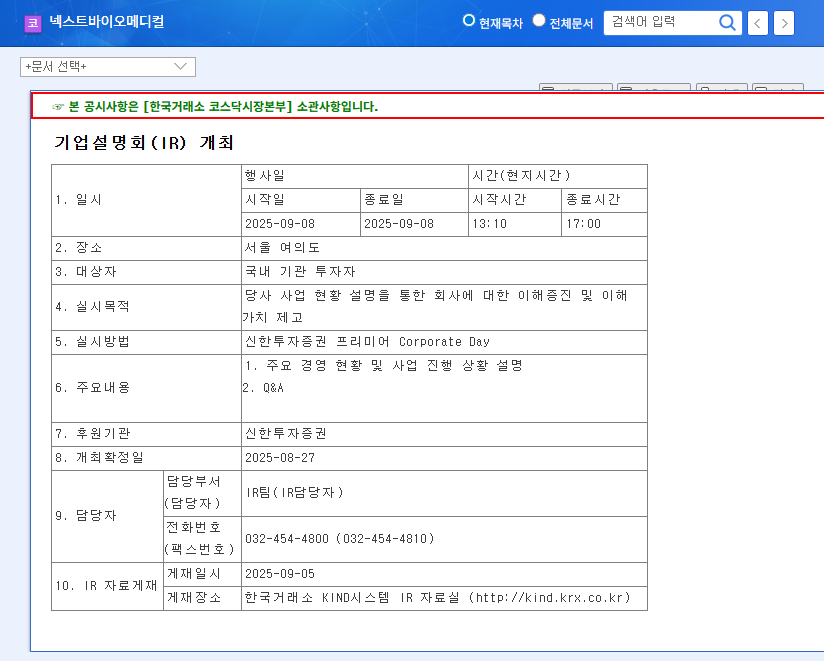

Next Biomedical presented its key management status and business progress, followed by a Q&A session with investors on September 8, 2025. The core focus of this IR was Nexpowder™’s global market expansion strategy, Nexsphere™-F’s US FDA approval and market entry roadmap, and plans for profitability improvement.

2. Key Analysis: Why is it important?

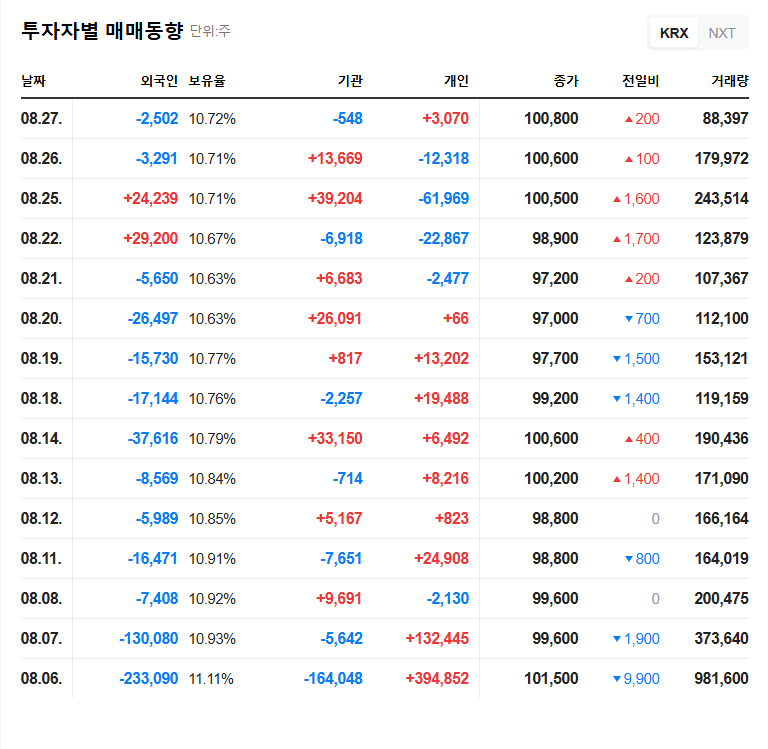

- Continued Nexpowder™ Growth: Sales reached 6.544 billion KRW in the first half of 2025, a 20.98% increase year-over-year, with plans to accelerate global expansion through US FDA approval and the Medtronic partnership.

- Nexsphere™-F FDA Approval Expectations: Expectations for US market entry are rising with the US FDA Breakthrough Device Designation and Medicare approval.

- Profitability Improvement Challenges: Improving the deficit structure due to high R&D and SG&A expenses is urgent.

3. Future Outlook and Investment Strategy: What should investors do?

Next Biomedical possesses an innovative product portfolio, but securing profitability is a critical challenge. Investors should carefully review the feasibility of the profitability improvement strategies presented at the IR, the speed of Nexpowder™’s global market expansion, and the roadmap for Nexsphere™-F’s FDA approval and market entry.

4. Action Plan for Investors

- Analyze IR materials and management responses

- Refer to securities firm reports (to be published)

- Evaluate company value and make investment decisions

Frequently Asked Questions

What is Next Biomedical’s main product?

Next Biomedical’s main product is Nexpowder™, an endoscopic hemostatic agent.

What is Next Biomedical’s Nexsphere™-F?

Nexsphere™-F is a vascular embolization microsphere and a fast-degradable pain embolization therapeutic agent. It has received the US FDA Breakthrough Device Designation and Medicare approval.

What were Next Biomedical’s sales in the first half of 2025?

Next Biomedical’s sales in the first half of 2025 were 7.745 billion KRW, a 50.93% increase year-over-year.

What are the main risks for Next Biomedical?

The main risks for Next Biomedical are the continuous deficit structure due to high R&D and SG&A expenses, and the history of unmet 2024 forecasts.