1. CJ CheilJedang’s IR Presentation: What Was Discussed?

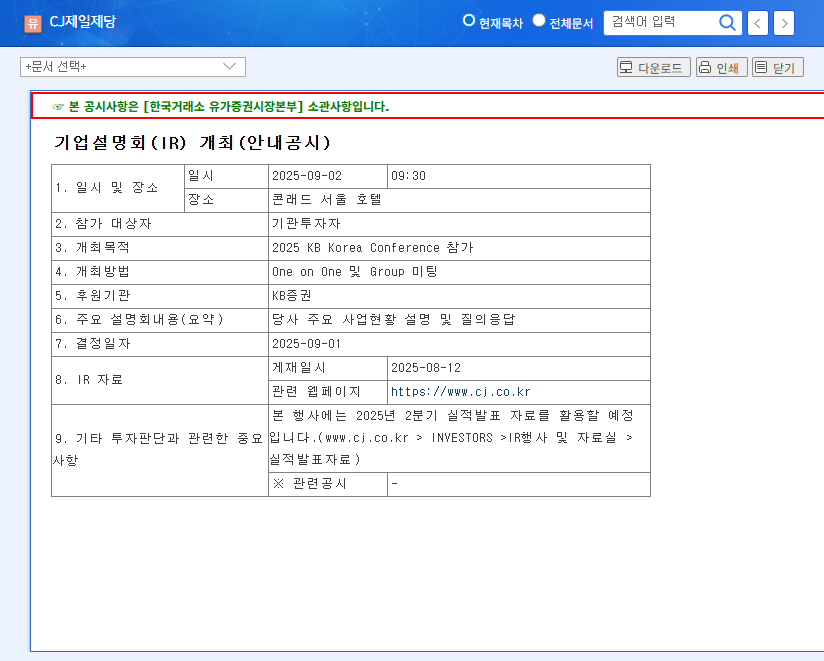

CJ CheilJedang presented its current business performance and future growth strategies at the KB Korea Conference on September 2, 2025. Key topics included the positive performance of the food and bio divisions, efforts to improve profitability in the F&C business, and strategies to navigate macroeconomic volatility.

2. Core Business Analysis: Growth Drivers and Risks

- Food & Bio: Continued growth driven by global expansion of the ‘Bibigo’ brand and strong fermentation/refining technology (Positive)

- F&C: Declining profitability requires improvement strategies (Risk)

- Logistics: Expansion of differentiated services in response to e-commerce growth (Positive)

3. Macroeconomic Impact: How Will It Affect CJ?

Macroeconomic uncertainties, including high interest rates, exchange rate fluctuations, and volatile raw material prices, can impact CJ CheilJedang’s business. Rising costs and interest rates pose a particular challenge to profitability.

4. Investor Action Plan: What to Watch For

- Analyze IR Presentation: Focus on F&C improvement strategies and R&D investment plans.

- Monitor Macroeconomic Factors: Track changes in exchange rates, interest rates, and raw material prices.

- Identify Positive Momentum: Look for new business successes and accelerated global growth.

Frequently Asked Questions

What are CJ CheilJedang’s main businesses?

CJ CheilJedang operates in the food, bio, F&C (feed and care), and logistics sectors.

What were the key takeaways from the KB Korea Conference presentation?

Key takeaways included continued growth in the food and bio sectors, efforts to improve F&C profitability, and strategies to address macroeconomic volatility.

What are the key considerations for investing in CJ CheilJedang?

Investors should consider F&C profitability, macroeconomic conditions, and the effectiveness of R&D investments.