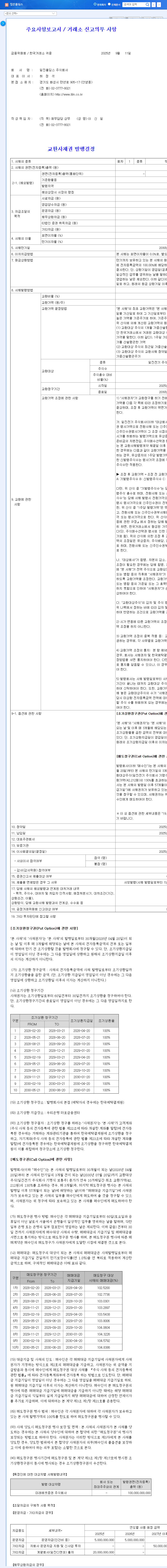

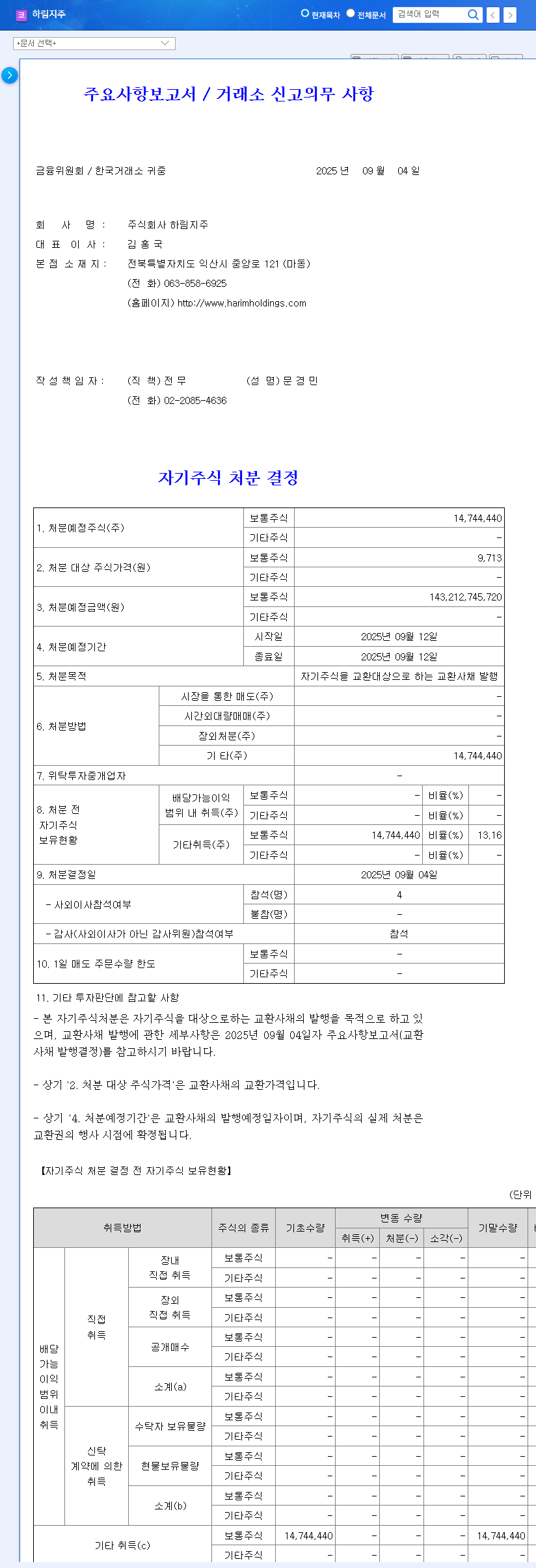

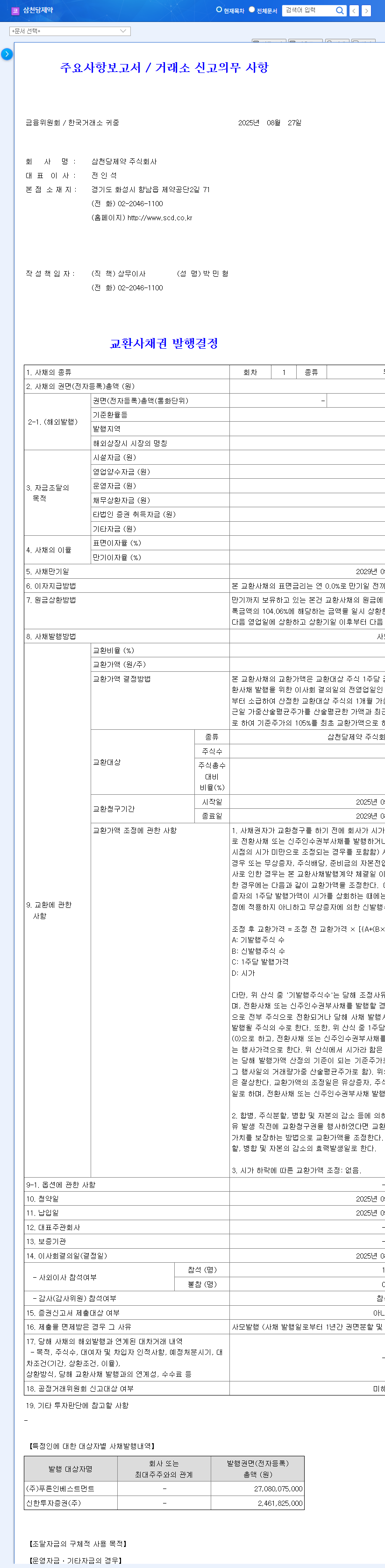

1. What Happened?: Iljin Holdings Announces ₩100 Billion Exchangeable Bond Issuance

Iljin Holdings announced on September 11, 2025, its decision to issue ₩100 billion in exchangeable bonds. The bonds are exchangeable for shares of its subsidiary, Iljin Hysolus, with a conversion price of ₩42,212, which is 7.4 times higher than the current stock price of ₩5,710.

2. Why?: Purpose and Background of the Bond Issuance

The funds raised through this bond issuance will be used to secure new growth engines, such as investments in Iljin Hysolus’ hydrogen business and strengthening Iljin Electric’s business, as well as improving the company’s financial structure. Amidst the growing interest in the hydrogen business, Iljin Holdings is interpreting this as a growth opportunity and plans to make active investments.

3. What’s the Impact?: Short-Term and Long-Term Stock Price Analysis

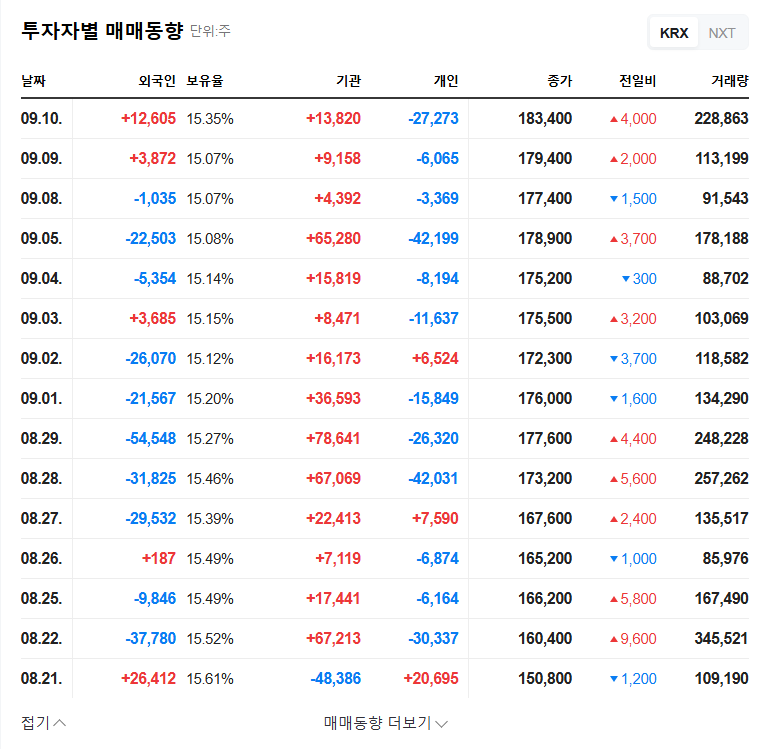

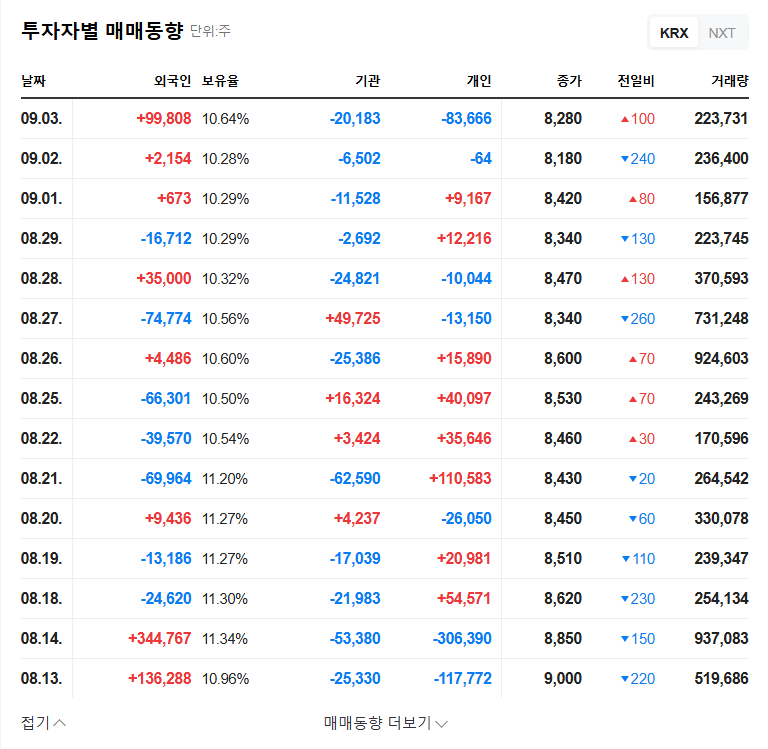

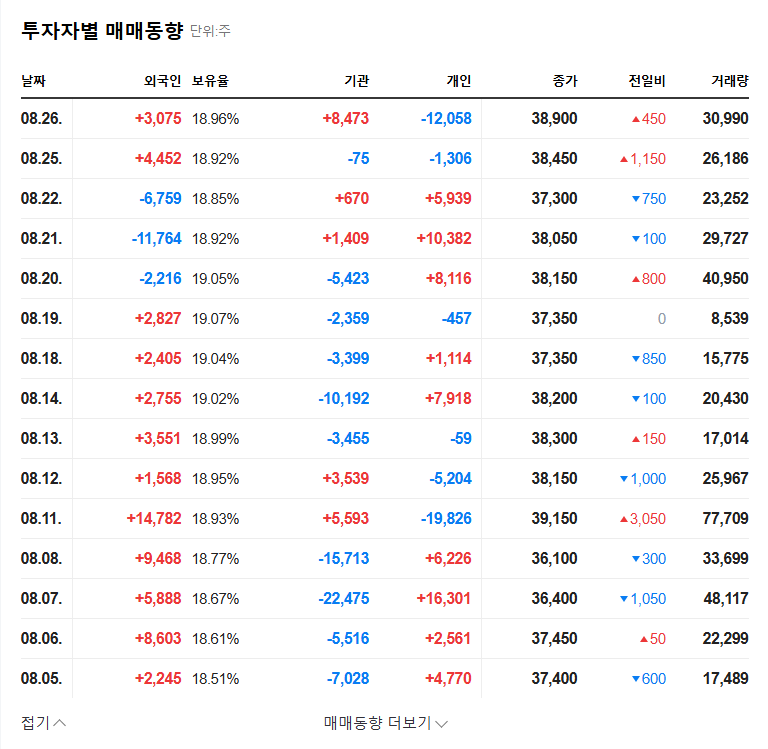

3.1. Short-Term Impact: Potential Stock Price Decline

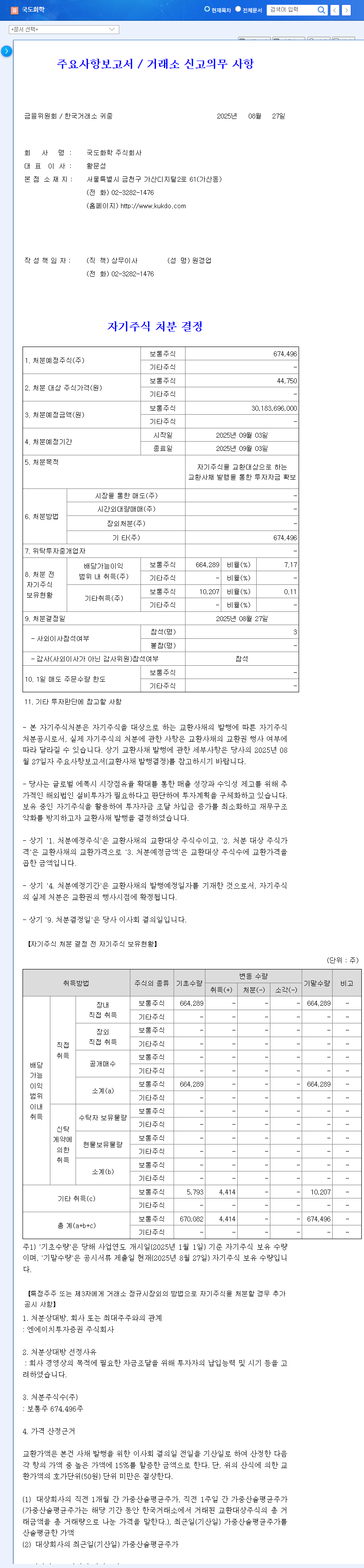

The high conversion price compared to the current stock price may raise concerns about stock dilution in the short term, negatively impacting investor sentiment. The possibility of an increase in debt-to-equity ratio can also put downward pressure on the stock price in the short term.

3.2. Long-Term Impact: Positive or Neutral Outlook

If the procured funds lead to successful investments in new businesses and strengthen growth drivers, it can drive an increase in corporate value in the long term, positively affecting the stock price. The growth potential of the hydrogen business is expected to be a key factor influencing the stock price’s direction. If the stock price rises and the exchangeable bonds are converted into shares, it can also lead to an improvement in the financial structure by converting debt into equity.

4. What Should Investors Do?: Investment Strategy and Monitoring Points

Investors should be aware of increased stock price volatility in the short term. In the medium to long term, it is essential to closely monitor the growth potential of the hydrogen business, order performance, and the company’s ability to respond to fluctuations in exchange rates and raw material prices. It is particularly important to keep an eye on whether the terms and conditions of the bond issuance are met and how the funds are being utilized, while continuously checking the company’s earnings announcements and public disclosures.

FAQ

What are exchangeable bonds?

Exchangeable bonds are bonds that can be redeemed for principal and interest at maturity or exchanged for shares of the issuing company’s stock.

Will this bond issuance positively impact the stock price?

In the short term, there is a possibility of a stock price decline due to concerns about stock dilution. However, in the long term, the impact can be positive depending on the success of the investments in new businesses.

What are the key points to consider when investing?

Closely monitor the growth potential of the hydrogen business, order performance, and the company’s response to fluctuations in exchange rates and raw material prices, and continuously check the company’s public disclosures.