1. What is the Share Buyback?

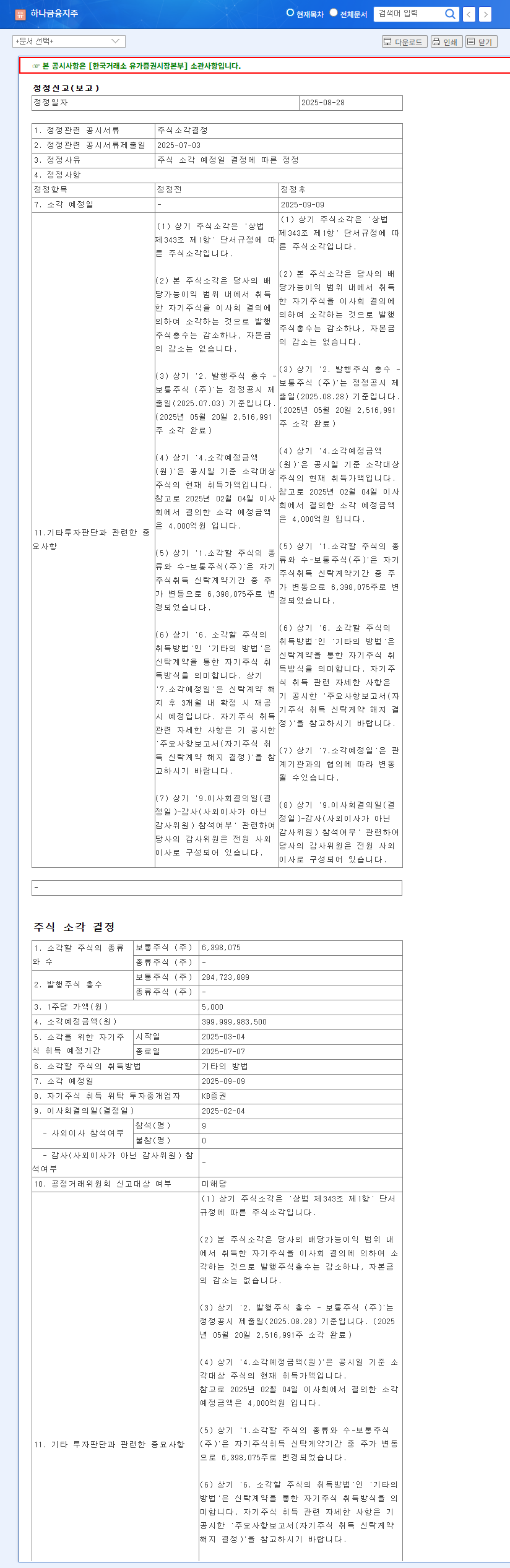

On August 28, 2025, Hana Financial Group announced its decision to repurchase and cancel KRW 400 billion worth of common stock, equivalent to 6,398,075 shares. The cancellation is scheduled for September 9, 2025. A share buyback reduces the number of outstanding shares, effectively increasing the value per share.

2. Why the Buyback?

The share buyback is part of Hana Financial Group’s shareholder return policy. Reducing the number of shares increases both Book Value Per Share (BPS) and Earnings Per Share (EPS), improving capital efficiency. This directly translates to enhanced shareholder value. The buyback also signals confidence in the company’s financial health and future growth prospects.

3. How Will the Buyback Affect the Stock Price?

- Positive Impacts: Increased BPS and EPS, enhanced capital efficiency, strengthened shareholder return policy, positive market signal

- Negative Impacts: Potential decrease in short-term liquidity, possible reduction in growth investment capacity (though not a major concern considering the company’s financial strength)

- Neutral Impacts: Limited direct impact on fundamental business model or revenue generation, low correlation with macroeconomic variables

In the short term, the buyback is likely to have a positive impact on the stock price. However, the overall market conditions and the company’s future plans will also play a role.

4. What Should Investors Do?

This share buyback is a positive sign for shareholder value. However, before making any investment decisions, investors should carefully consider the company’s financial health, business outlook, and the overall macroeconomic environment.

Frequently Asked Questions

When will the share buyback take place?

It is scheduled for September 9, 2025.

Will the stock price definitely go up after the buyback?

While share buybacks generally have a positive effect on stock prices, various factors, including market conditions, can influence the outcome.

Why is the company doing a share buyback?

It’s a part of their shareholder return policy, aiming to enhance shareholder value by reducing the number of outstanding shares and increasing the value per share.