1. Ecoeye Signs $1.8M Contract with UK Company

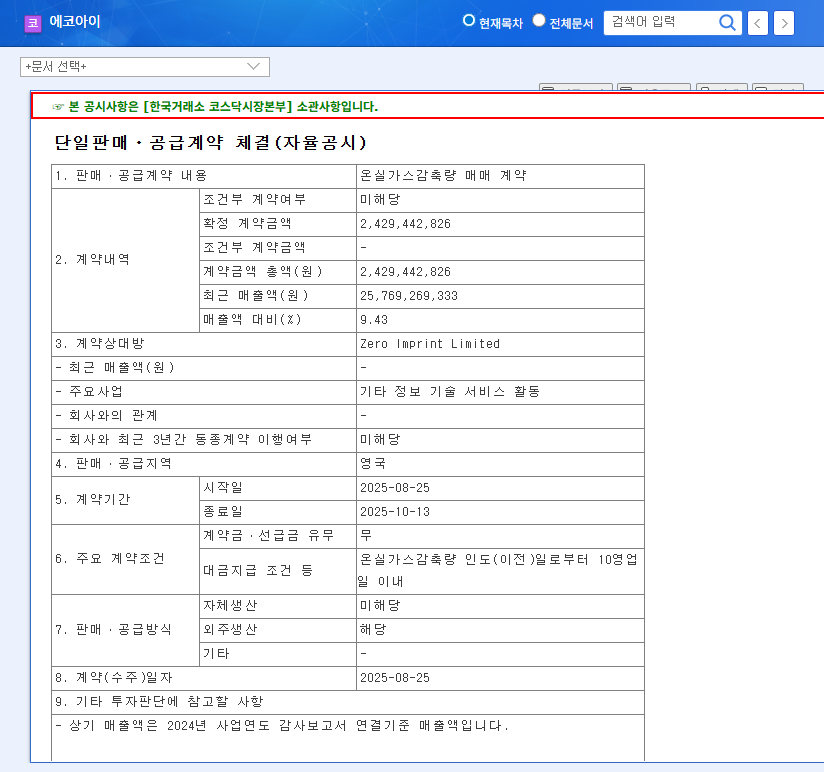

Ecoeye has secured a $1.8 million greenhouse gas reduction sales contract with Zero Imprint Limited. This represents approximately 9.43% of Ecoeye’s recent sales and will run for about one month, from August 25th to October 13th, 2025.

2. Positive Factors: Increased Sales and Overseas Expansion

This contract is expected to directly contribute to Ecoeye’s short-term sales growth. Furthermore, the contract with a British company holds significant meaning as it demonstrates Ecoeye’s overseas business capabilities and establishes a foothold for entering the global carbon market. This will act as a factor strengthening Ecoeye’s competitiveness, especially amid the trend of strengthening environmental regulations.

3. Considerations: Short Contract Period and Profitability Uncertainty

Despite the positive aspects, the short contract period of one month may limit sustainable revenue generation. Also, the specific profit margin of the contract has not been disclosed, leading to uncertainty regarding profitability. Considering the past stock price trends, the impact of this contract on the stock price remains to be seen.

4. Action Plan for Investors

While this contract is positive for short-term sales growth, whether it will lead to long-term growth momentum depends on securing additional contracts. Investors should closely monitor Ecoeye’s efforts to secure overseas contracts and the growth trend of its core business. It’s also crucial to check the profit margin information that will be disclosed and the resulting changes in profitability.

What is Ecoeye’s main business?

Ecoeye’s primary business is greenhouse gas reduction and emissions trading.

Will this contract positively affect Ecoeye’s stock price?

While it is expected to contribute to short-term sales growth, the short contract period and profitability uncertainty should be considered. The long-term stock price outlook will depend on securing additional contracts and the growth trend of the core business.

What should investors be cautious about?

Investors should closely monitor Ecoeye’s efforts to secure overseas contracts, the growth trend of its core business, the contract’s profit margin, and changes in profitability.