1. What Happened to EID?

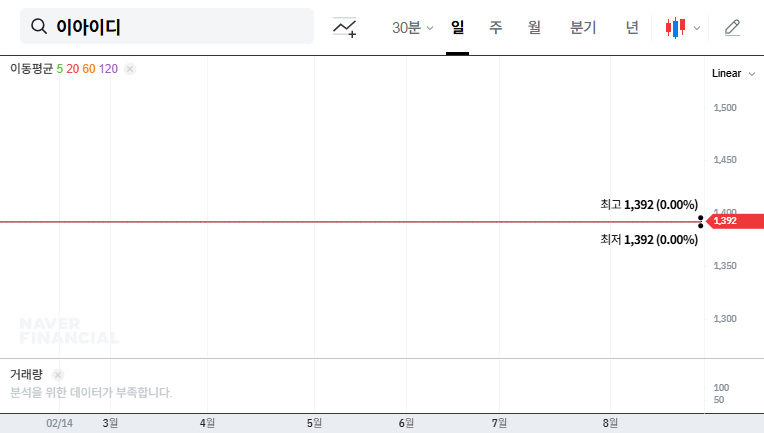

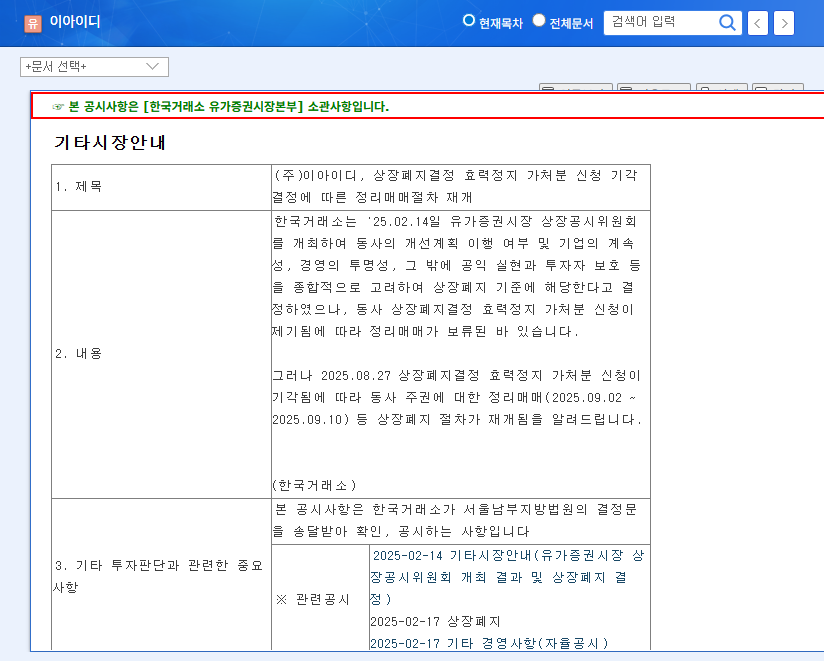

EID received a delisting decision on February 14, 2025, which was confirmed on August 27 after their injunction request was denied. The trading halt period is scheduled from September 2nd to 10th.

2. Why is EID Being Delisted?

EID has faced persistent operating losses, declining revenue, and auditor disagreements, indicating severe financial distress. Despite venturing into various businesses like oil, real estate, secondary batteries, and NFTs, the company failed to generate significant returns. Allegations of embezzlement and lawsuits further exacerbated the situation. The table below illustrates EID’s deteriorating financial performance.

| Indicator | Dec 2022 | Dec 2023 | Dec 2024 | Dec 2025 |

|---|---|---|---|---|

| Revenue | 6,994 | 4,167 | 4,005 | 3,304 |

| Operating Income | 629 | -133 | 0 | -97 |

| Net Income | 454 | -140 | 205 | -88 |

3. What Should Investors Do?

Stock prices can fluctuate drastically during the trading halt period. Investors should understand the situation and exercise extreme caution. Participating in trading during this period carries significant risk, and the chances of recovering investment capital are minimal. Considering EID’s deteriorating fundamentals, transparency issues, and ongoing lawsuits, further investment should be avoided.

4. Key Takeaways & Action Plan

- Understand the Situation: Fully grasp the reasons behind EID’s delisting.

- Assess the Risks: Carefully consider the price volatility and investment risks during the trading halt period.

- Invest Cautiously: All investment decisions should be made with extreme caution and at your own risk. Be prepared for potential losses.

- Stay Informed: Continuously monitor public disclosures and relevant news for the latest updates.

Frequently Asked Questions (FAQ)

What is a trading halt period?

A trading halt period is a designated time before a stock’s delisting when investors are given a final opportunity to sell their shares.

Can the stock price surge during the trading halt period?

Yes, it’s possible. However, given the confirmed delisting, such price movements are highly speculative and carry significant downside risk.

Should I sell my EID shares now?

With the delisting confirmed, selling your shares during the trading halt period is generally recommended. However, all investment decisions should be made at your own discretion.

What happens after delisting?

After delisting, the stock will no longer be traded on the exchange. It may be traded over-the-counter (OTC), but liquidity will likely be low, making trading difficult.

Leave a Reply