What Happened?

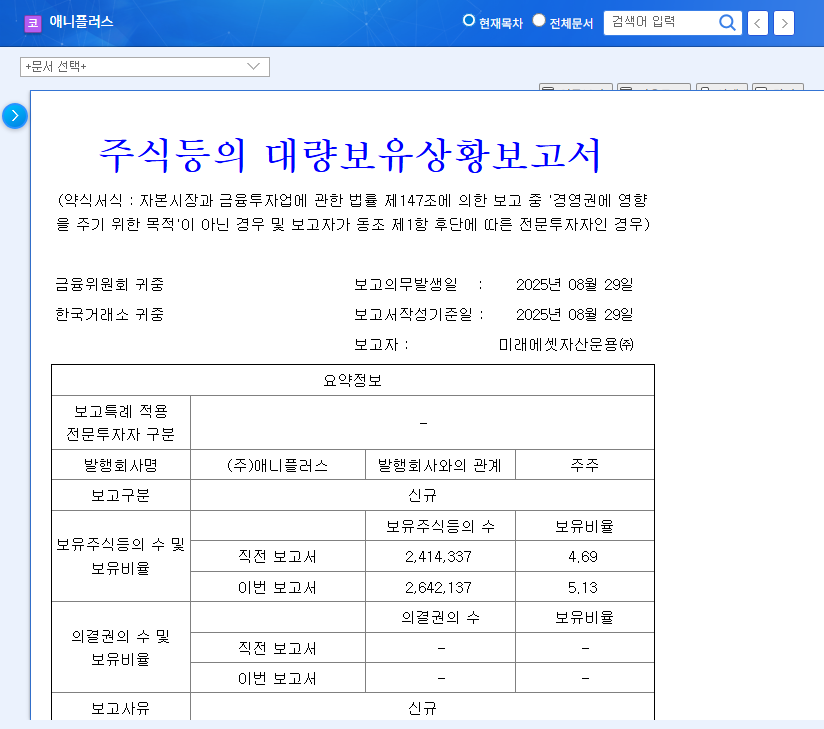

ESANG Networks’ CEO, Sung-Il Ha, and related party, Geosani&G, increased their stake through open market purchases. The stake increased slightly from 11.21% before the report to 11.45% after. While the change is not substantial, the increase in stake by major shareholders can send a positive signal to the market.

Why the Increased Stake?

According to the disclosure, the purpose of this stake increase is ‘simple investment.’ It is not a move for management participation or changes in corporate governance.

Is ESANG Networks a Good Investment Now?

ESANG Networks continues its growth based on solid fundamentals. The strong performance of the exhibition business and the expansion of production capacity in the steel business are positive factors. Financial soundness is also steadily improving, and the treasury stock policy raises expectations for shareholder value enhancement. However, risks such as global economic uncertainty, raw material price volatility, and past stock price volatility should also be considered. Investors should note that interest rate and exchange rate fluctuations can directly impact the profitability of the steel business.

What Should Investors Do?

- Consider both positive and negative factors: While ESANG Networks’ growth potential and solid fundamentals are attractive, caution regarding external variables is also necessary.

- Monitor macroeconomic indicators: Continuously review global economic conditions, raw material prices, and interest rate and exchange rate trends.

- Diversify investments: It’s crucial to manage risk through diversification rather than concentrating investments in a specific stock.

- Check additional information: Before making investment decisions, refer to additional information such as securities company reports and analyze from various perspectives.

Frequently Asked Questions

What are ESANG Networks’ main businesses?

ESANG Networks’ main businesses are exhibition, convention, and event planning and operation, a B2B e-commerce platform business (Corporate PG), and steel product manufacturing and sales.

How will this stake change affect the stock price?

The short-term impact may be limited, but it can be interpreted as a positive signal in the long term. However, fundamental analysis and market conditions should be comprehensively considered when making investment decisions.

What are the precautions for investing in ESANG Networks?

Be aware of factors such as global economic uncertainty, raw material price fluctuations, and increased competition. It’s also important to make prudent investment decisions by referring to past stock price volatility.