In a significant development for investors, SKNetworks (KRX: 001740) has released its SKNetworks Q3 2025 earnings, which have surpassed market consensus. This isn’t just a story about numbers; it’s a critical signal that the company’s ambitious transformation into a leading SKNetworks AI company is gaining tangible momentum. For those following the SKNetworks stock analysis, this report provides crucial insights into the effectiveness of its strategic pivot and portfolio restructuring.

This comprehensive analysis will dissect the latest financial report, evaluate the company’s fundamental health, and explore the potential trajectory for its stock price. We aim to provide a clear, data-driven perspective to help you make informed investment decisions.

SKNetworks Q3 2025 Earnings: The Official Numbers

On November 11, 2025, SKNetworks announced its preliminary operating results, sending a wave of optimism through the market. The key figures, as detailed in the Official Disclosure (DART), reveal a solid performance:

- •Revenue: KRW 1,972.6 billion (Exceeding estimate of KRW 1,891.0 billion)

- •Operating Profit: KRW 22.4 billion (Exceeding estimate of KRW 21.5 billion)

- •Net Profit: KRW 19.2 billion (Swung to profit from the previous quarter)

While both revenue and operating profit modestly beat expectations, the most significant highlight is the robust 30% quarter-over-quarter (QoQ) revenue increase and the return to net profitability. This signals a strong recovery and potentially validates the company’s recent strategic shifts.

Deep Dive: Why These Results Matter

The Pivot to an AI-Powered Future

SKNetworks is aggressively restructuring its portfolio to establish itself as a formidable SKNetworks AI company. The growth engine appears to be the Information and Communication segment, which saw a 16.4% year-over-year (YoY) increase. This division is no longer just about mobile device distribution; it’s about integrating AI into logistics, customer service, and supply chain management to create a smarter, more efficient ecosystem. Meanwhile, other segments like Trading and SK Intellix are undergoing profitability-focused restructuring, trimming inefficiencies to contribute more effectively to the bottom line.

Financial Health and Segment Performance

A closer look at the key business units reveals a mixed but promising picture:

- •Information & Communication: The clear star performer, driving growth and showing strong potential for AI integration.

- •Walkerhill Hotel & Resort: Demonstrating a gradual but steady post-pandemic recovery, contributing positively to revenue.

- •SK Intellix (formerly SK magic): Undergoing a strategic shift to focus on profitable segments within the home appliance rental market.

- •Financial Stability: The company’s debt-to-equity ratio remains stable at 153.3%, indicating a solid financial foundation to support its strategic investments and transformation.

The Q3 earnings beat is more than a short-term win; it’s the first major data point suggesting that SKNetworks’ strategic bet on AI and portfolio optimization is beginning to pay off, potentially unlocking significant long-term value.

Analyzing the Broader Market Context

No company operates in a vacuum. Several macroeconomic factors could influence SKNetworks’ path forward. The ongoing weakness of the Korean Won (KRW) against the USD and EUR presents a double-edged sword: it can increase import costs for the trading business but also boost the value of foreign earnings. SKNetworks mitigates this through a robust hedging strategy. Furthermore, global interest rate stability and declining shipping costs could provide a more predictable environment for its trading and logistics operations. Investors should continue to monitor these trends, as discussed in broader reports about global macroeconomic conditions on sites like Bloomberg.

Impact Analysis & Investor Outlook

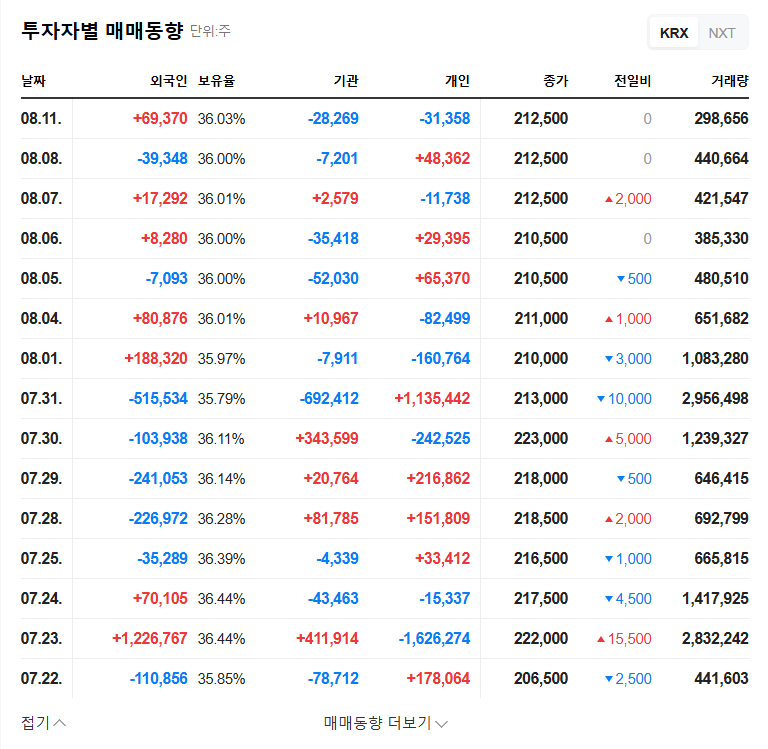

Short-Term Stock Price Momentum

In the short term, this positive SKNetworks Q3 2025 earnings report is likely to boost investor sentiment and drive the stock price upward. Beating expectations is a powerful catalyst that attracts market attention and builds confidence.

Mid- to Long-Term Value Creation

The long-term value of the 001740 stock hinges on sustained execution. The market will be watching for several key indicators:

- •Consistent Profitability: Can the company improve its operating profit margin, which has seen some pressure?

- •Tangible AI Results: Will the AI investments translate into concrete efficiency gains and new revenue streams?

- •Successful Restructuring: Will the turnaround at SK Intellix and other divisions be completed successfully?

For those looking to deepen their understanding, our comprehensive guide to investing in AI-driven companies provides a valuable framework for evaluating businesses like SKNetworks.

In conclusion, SKNetworks has delivered a reassuring quarter that adds credibility to its transformation story. While macroeconomic risks and the challenge of execution remain, the positive momentum is undeniable. Investors should view this as a promising sign, but maintain a watchful eye on the company’s ability to turn its AI vision into sustained financial performance.

Disclaimer: This article is for informational purposes only and is based on publicly available data. It does not constitute investment advice. All investment decisions should be made at the investor’s own discretion and risk.