What Happened? HPO Announces Share Buyback

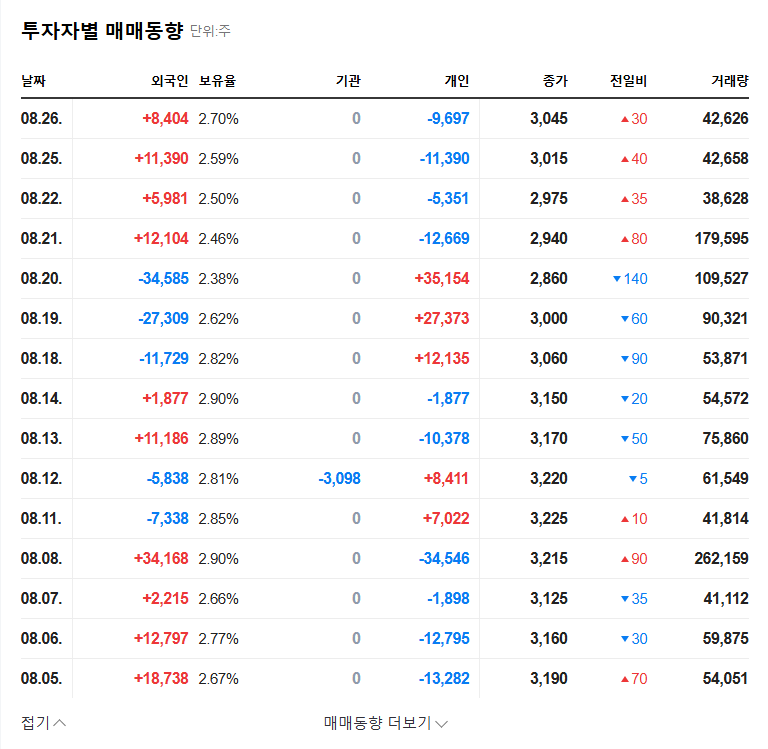

HPO is planning to buy back KRW 9 billion worth of its own shares, equivalent to 796,011 common shares, on September 12, 2025. This represents 8.32% of the company’s market capitalization and can be interpreted as a positive signal for shareholders.

Why the Buyback? Background and Objectives

Share buybacks are generally part of a company’s shareholder return policy aimed at increasing shareholder value. Reducing the number of outstanding shares increases earnings per share (EPS), which can lead to a rise in stock price. HPO’s share buyback can be seen as a way to demonstrate its growth potential and commitment to returning value to shareholders.

So, What About the Stock Price? Short-Term and Long-Term Impact Analysis

In the short term, the share buyback is likely to have a positive impact on the stock price. However, the extent of the increase might be limited due to concerns about the company’s underperformance in 2024. In the long term, the company’s recovery from the 2024 earnings slump and the success of its new business ventures will have a greater impact on the stock price than the buyback itself. Potential financial risks, such as the call option related to BioPharm Co., Ltd., should also be carefully considered.

What Should Investors Do? Action Plan

- Check for continued shareholder return policies in the future.

- Monitor the recovery from the 2024 earnings decline and the performance of new investments.

- Keep an eye on the management of financial risks, such as the call option related to BioPharm Co., Ltd.

- Analyze the impact of macroeconomic variables such as exchange rates, interest rates, and oil prices.

FAQ

What is the size of HPO’s share buyback?

KRW 9 billion, equivalent to 796,011 common shares or 8.32% of the company’s market cap.

When is the share buyback scheduled?

September 12, 2025.

Will the share buyback positively affect the stock price?

It’s likely to be positive in the short term, but the extent of the increase may be limited by factors like the 2024 earnings slump.

What should investors be cautious about?

Consider factors like earnings recovery, new business performance, and potential financial risks.