1. The IR Event: What to Expect

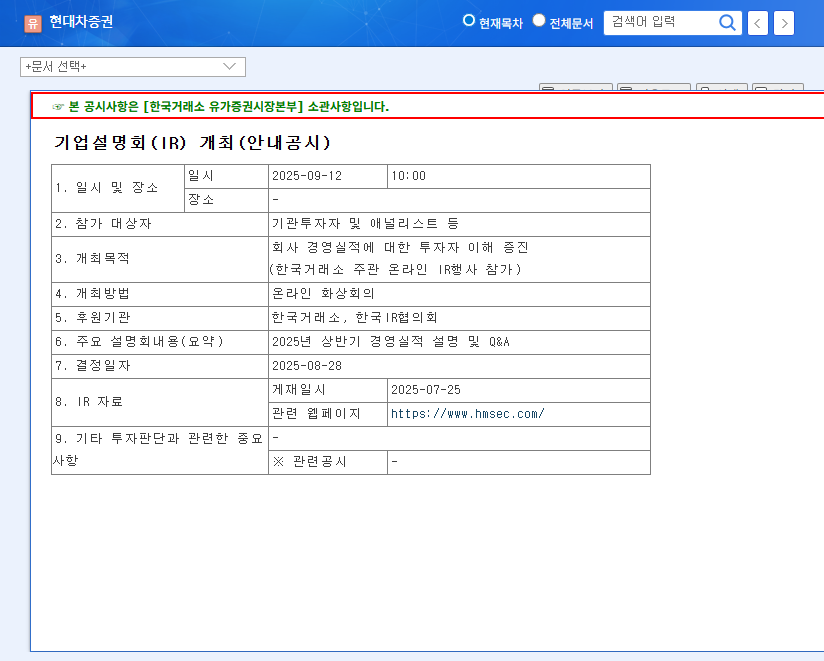

Hyundai Motor Securities will host an online IR presentation on September 12, 2025, at 10:00 AM KST. The event will cover the company’s H1 2025 financial performance, followed by a Q&A session with investors.

2. Key Investment Insights: Why This Matters

This IR is particularly significant as it provides insights into the company’s continued growth trajectory following its return to profitability in 2024. Investors should pay close attention to the company’s strategy for navigating the current volatile market conditions.

3. Hyundai Motor Securities Analysis: Key Factors to Consider

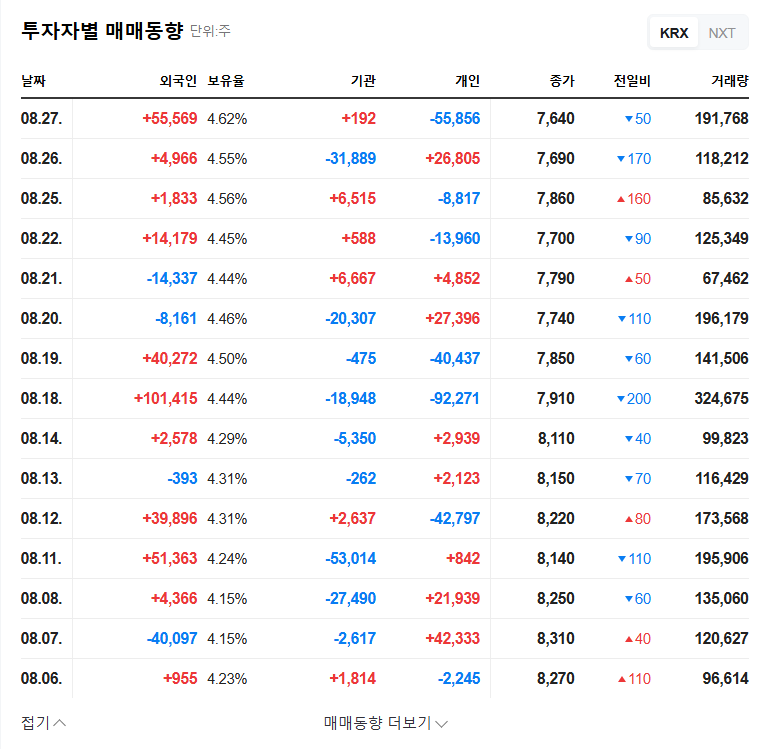

- Financial Performance: While the return to profitability in 2024 is positive, investors should carefully examine the sustainability of this performance in H1 2025. Key metrics such as ROE, debt-to-equity ratio, and PBR should be analyzed.

- Past Stock Performance: Considering the sideways to slightly downward trend in stock price since 2020, investors should assess potential future price movements.

- Macroeconomic Influences: Understanding the impact of macroeconomic factors, such as exchange rates, interest rates, and international oil prices, on Hyundai Motor Securities is crucial.

4. Investor Action Plan: What to Do

Investors should thoroughly analyze the information presented during the IR and pay close attention to management’s outlook for the future. Utilizing the Q&A session to address any concerns and reassessing investment strategies based on the new information is highly recommended.

Frequently Asked Questions

When is the Hyundai Motor Securities IR event?

The IR event will be held online on September 12, 2025, at 10:00 AM KST.

What will be covered during the IR presentation?

The presentation will cover the company’s H1 2025 financial results, followed by a Q&A session.

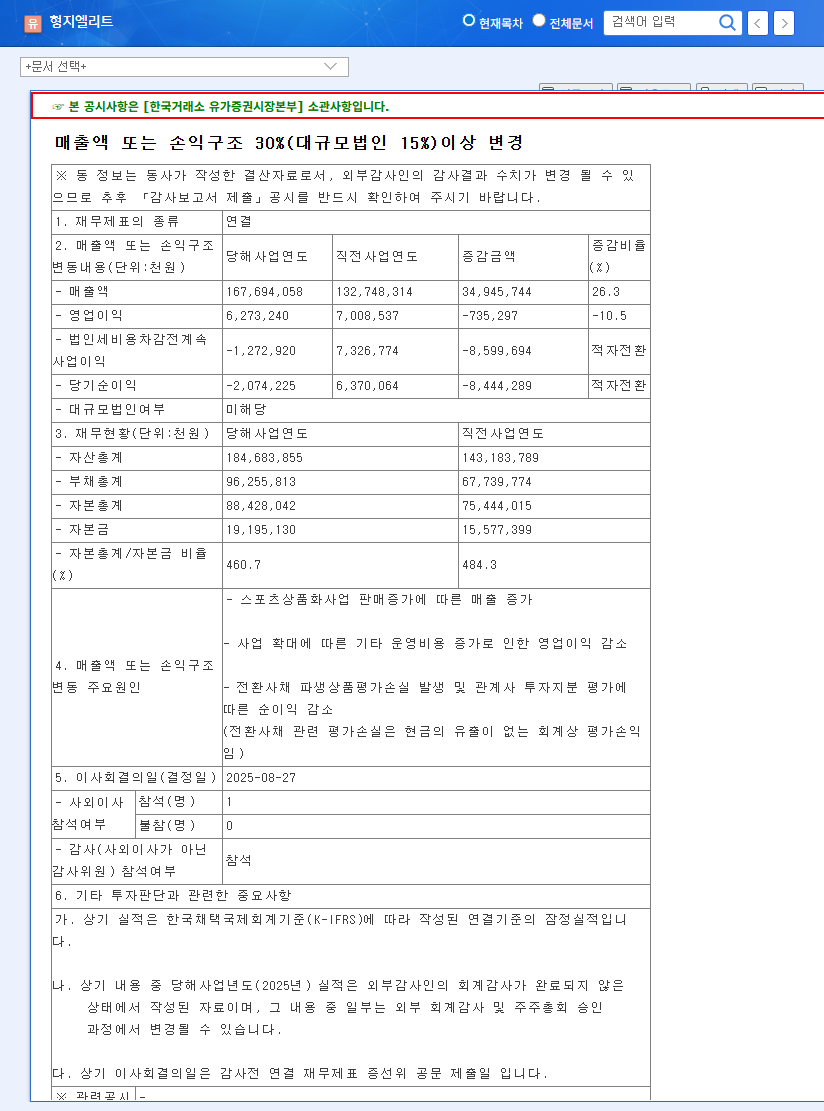

What were Hyundai Motor Securities’ recent financial results?

As of December 2024, the company reported revenue of KRW 400.5 billion, operating income of KRW 0, and net income of KRW 20.5 billion, marking a return to profitability compared to 2022.

What are the key considerations for investing in Hyundai Motor Securities?

Investors should consider the announced financial performance, future outlook, and market expectations before making investment decisions.