1. KRW 150 Billion Share Buyback: What Does It Mean?

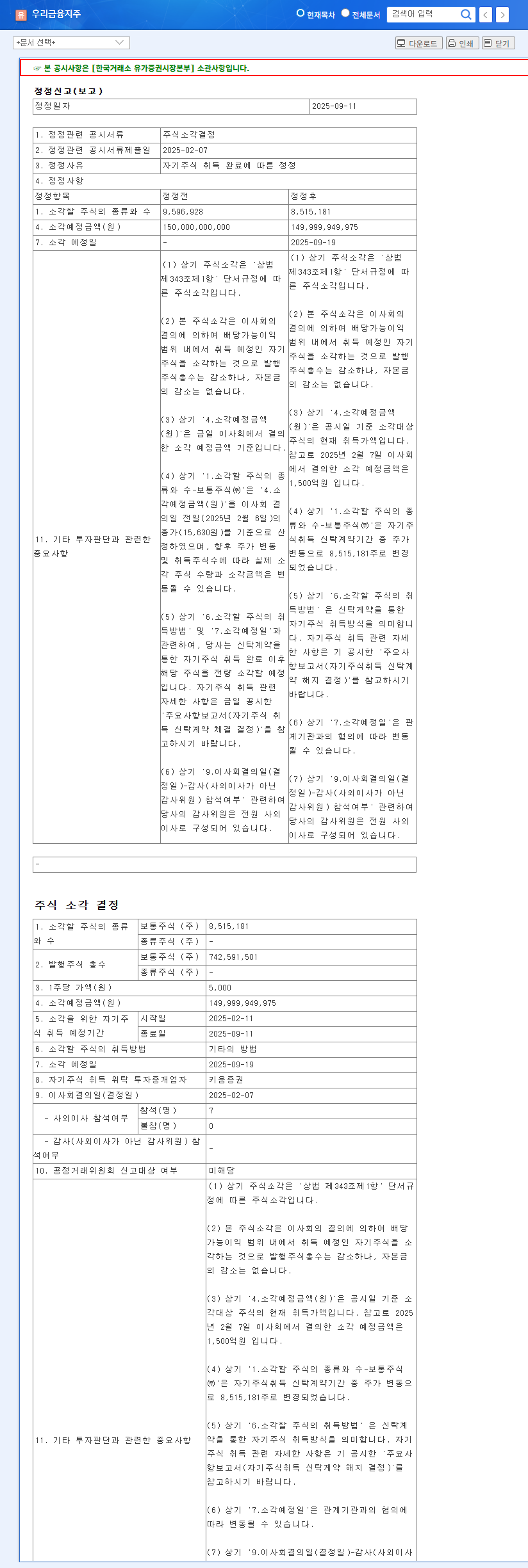

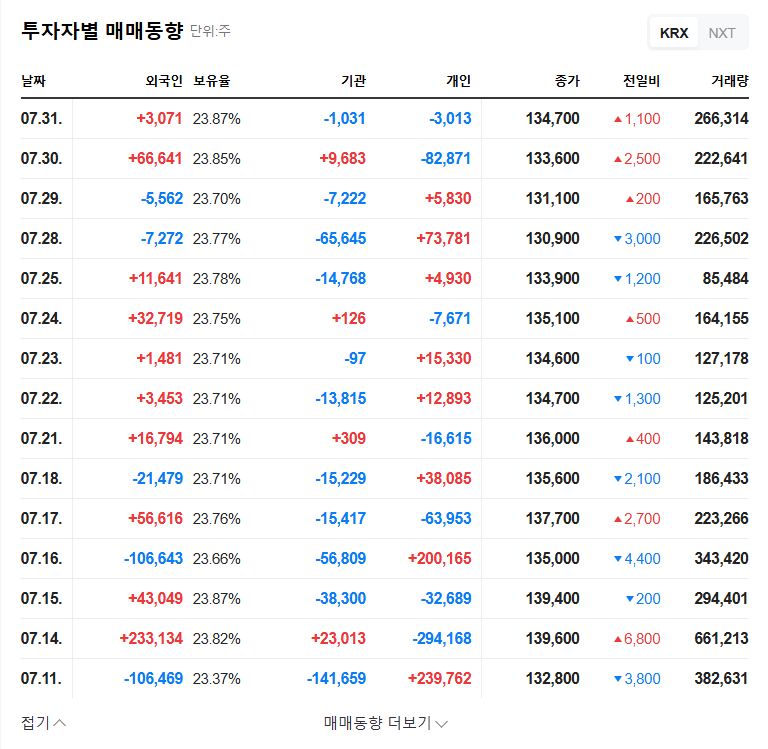

Woori Financial Group announced on September 19, 2025, that it will buy back 8,515,181 common shares, equivalent to approximately KRW 150 billion, representing 0.78% of its market capitalization. This move is expected to increase earnings per share (EPS) and book value per share (BPS), enhancing shareholder value. The reduced number of outstanding shares should also create scarcity, potentially driving up the stock price. Furthermore, it signals improved capital efficiency and demonstrates confidence in the company’s growth trajectory.

2. Woori Financial Group’s H1 2025 Performance: A Solid Foundation

The share buyback decision is backed by Woori’s strong H1 2025 performance. The group achieved a net profit of KRW 1.552 trillion, demonstrating stable profitability. The Bank of International Settlements (BIS) capital adequacy ratio also exceeded 12.8%, a 70bp increase compared to the end of the previous year. Low NPL (0.71%) and non-performing loan (0.61%) ratios indicate sound asset management capabilities.

3. Leaping Forward as a Comprehensive Financial Group: A Bright Future

With the integration of Tongyang Life Insurance and ABL Life Insurance, Woori Financial Group has become a comprehensive financial group, poised for greater growth through synergy among its subsidiaries. Growth strategies for each business unit, including the bank’s digital transformation, Woori Investment Securities’ ambition to become a mega investment bank, and Woori Card’s establishment of an independent brand system, are positive signs. Two consecutive years of achieving an AAA rating in the MSCI ESG assessment and inclusion in the DJSI World Index demonstrate Woori’s commitment to sustainable management.

4. Key Takeaways for Investors

- Maximizing Subsidiary Synergy: Growth potential through inter-group collaboration

- Digital Innovation: Leading the future financial market by utilizing AI and big data

- Risk Management: Proactive response to macroeconomic uncertainties

- Strengthening ESG Management: Sustainable growth and building investor trust

- Identifying New Growth Engines: Entering new businesses and strategic investments

- Shareholder-Friendly Policies: Continued efforts to enhance shareholder value through dividend increases and share buybacks

FAQ

How will Woori Financial Group’s share buyback affect the stock price?

Share buybacks typically reduce the number of outstanding shares, which can lead to an increase in earnings per share and potentially drive up the stock price. However, market conditions can influence the actual outcome.

How did Woori Financial Group perform in the first half of 2025?

Woori Financial Group demonstrated robust growth with a net profit of KRW 1.552 trillion. Capital adequacy and asset quality remain at healthy levels.

What are Woori Financial Group’s future investment strategies?

Woori Financial Group aims to pursue sustainable growth through maximizing subsidiary synergy, digital innovation, strengthening risk management, internalizing ESG management, and identifying new growth engines.