1. What Happened?: Q2 Earnings Shock, What’s the Cause?

Hyosung ONB’s Q2 2025 earnings recorded a significant decline year-on-year, with sales of KRW 2.9 billion, operating profit of KRW 200 million, and a net loss of KRW 600 million. The main cause of the sharp drop in earnings, especially compared to Q1, was the valuation loss on financial assets.

2. Why Did This Happen?: Double Whammy of Financial Asset Valuation Losses and Business Slump

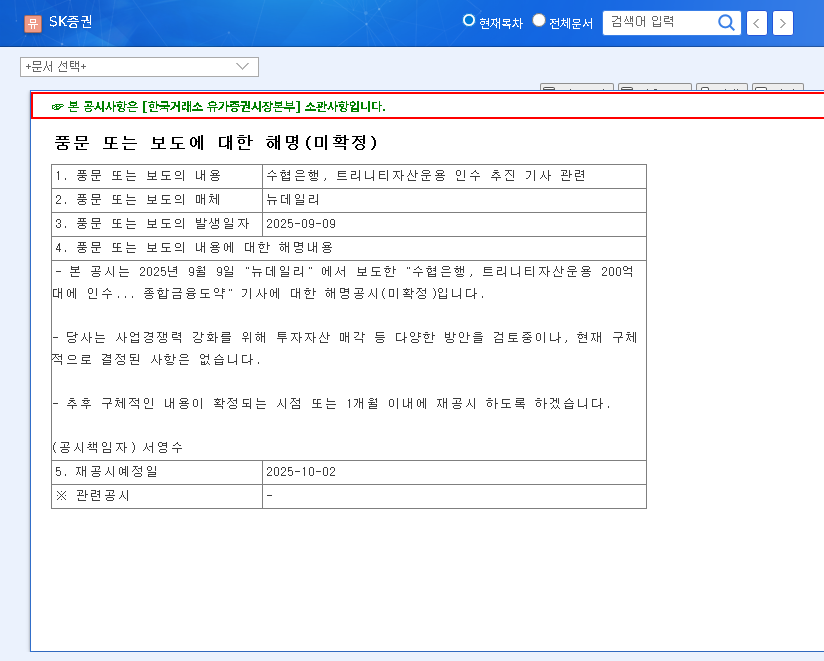

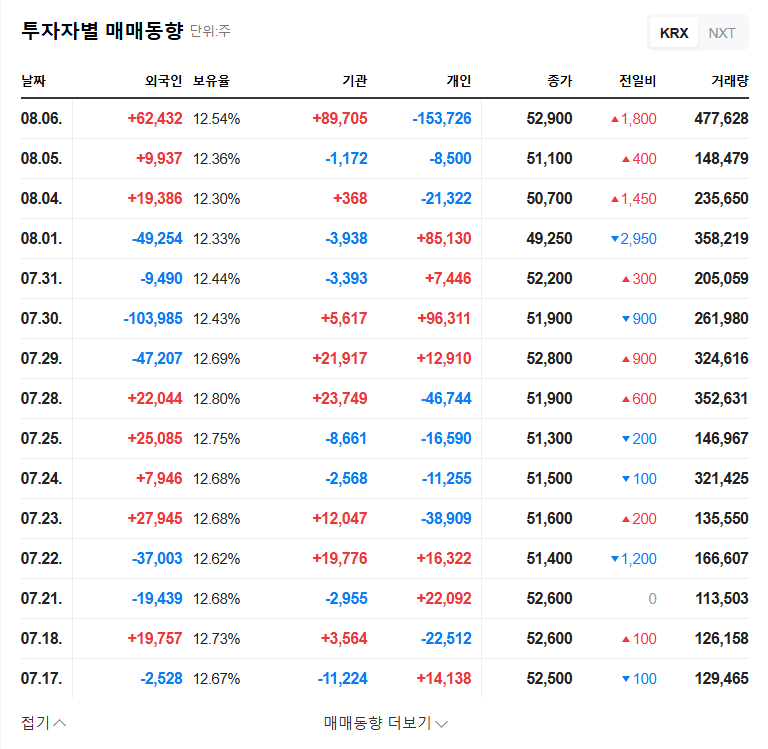

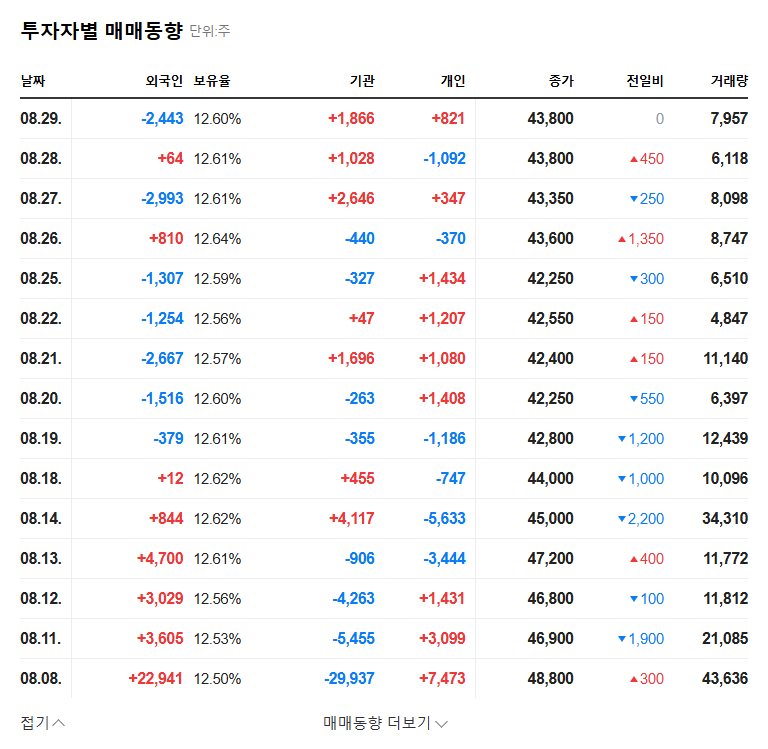

- Financial Asset Valuation Losses: The decline in the value of the investment portfolio directly impacted earnings.

- Business Slump: The sharp drop in sales at subsidiary HYOSUNG ONB (PVT) LTD (-39.5%) and the decline in domestic composted organic fertilizer sales (-13.4%) also contributed to the earnings deterioration.

3. What’s Next?: Positive Factors and Risks Amidst Uncertainty

Hyosung ONB has positive factors such as the eco-friendly agricultural trend and government policy support, but whether the financial asset valuation losses will recover and whether operating profit will improve after Q3 will be key variables in future stock price movements. Volatility in raw material prices and exchange rates can also act as risk factors.

4. What Should Investors Do?: Focus on Risk Management and Fundamental Analysis

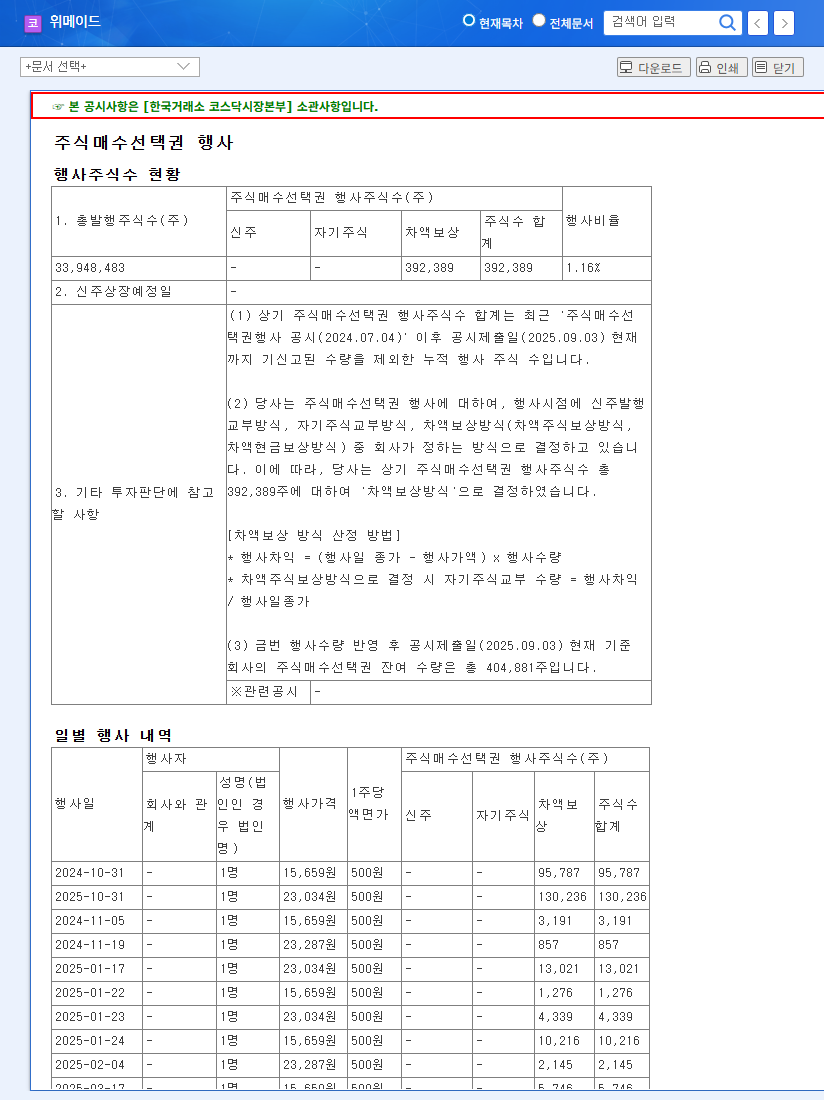

- Risk Management: Closely monitor the valuation trend of financial assets and strengthen risk management measures such as investment portfolio diversification.

- Fundamental Analysis: Continuously analyze changes in fundamentals, such as strengthening core business competitiveness and improving the performance of overseas subsidiaries.

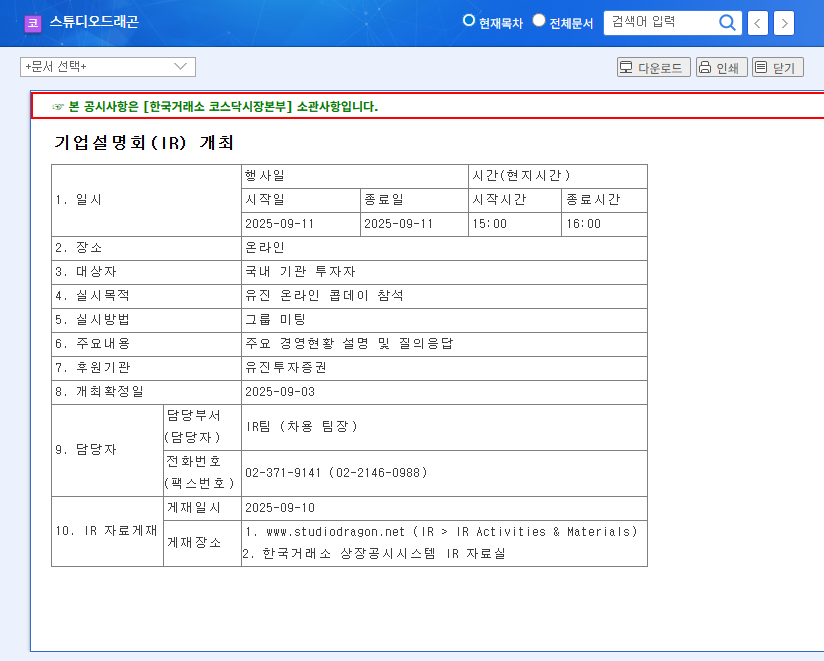

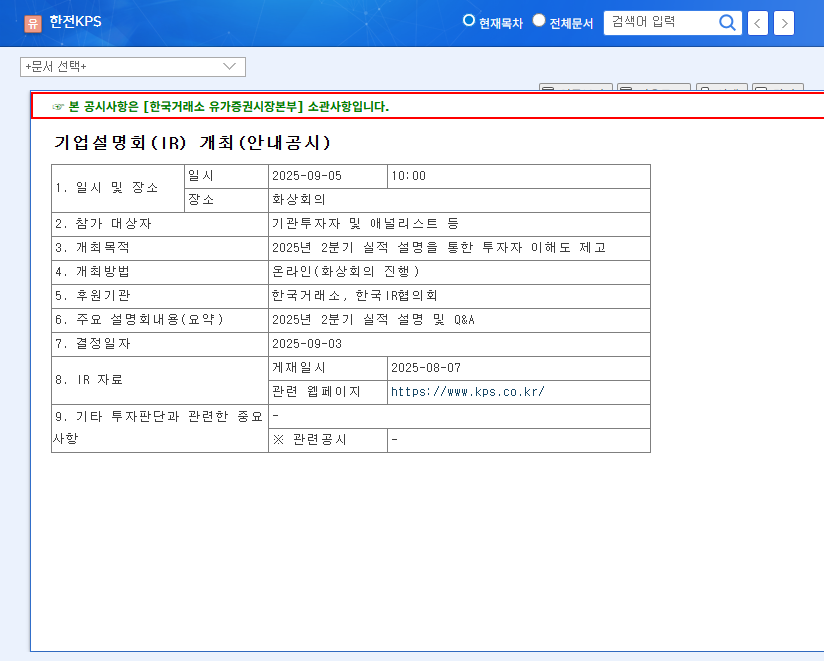

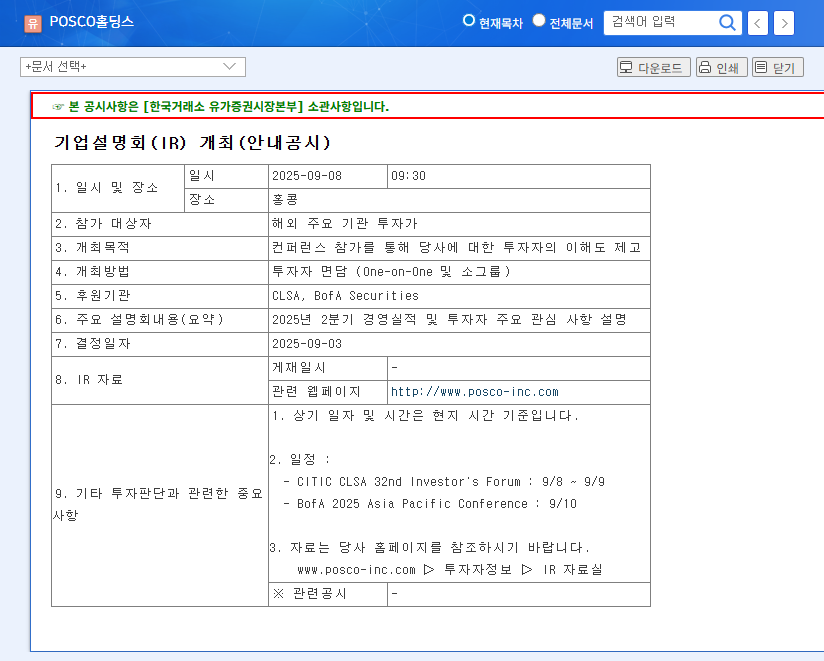

- Information Acquisition: Consistently acquire information necessary for investment decisions through corporate disclosures and market analysis data.

Hyosung ONB Investment, Solve Your Questions with FAQs!

Q: What caused the sharp decline in Hyosung ONB’s Q2 earnings?

A: The main cause was the valuation loss on financial assets. The decline in the value of the investment portfolio directly impacted earnings.

Q: What is Hyosung ONB’s main business?

A: Their main business is manufacturing and selling organic and byproduct fertilizers. They operate 5 domestic factories and a subsidiary in Sri Lanka. ‘Mixed oil cake (pellet)’ accounts for the largest portion of sales.

Q: What should investors be aware of when investing in Hyosung ONB?

A: Investors should pay close attention to the recovery of financial asset valuation losses, improvement in operating profit after Q3, and volatility in raw material prices and exchange rates. Risk management, such as investment portfolio diversification, is also important.