Biopharmaceutical giant Celltrion, Inc. is making a significant leap forward in its mission to develop next-generation therapeutics. The recent announcement of a landmark joint research agreement with Portrai, Inc. centers on leveraging cutting-edge Celltrion spatial transcriptomics technology for advanced drug discovery. This partnership, valued at up to $87.75 million, signals a pivotal strategy shift, aiming to solidify Celltrion’s position as a leader in innovative new medicines. This in-depth analysis will explore the technology, the deal’s implications, and the potential impact on Celltrion’s future growth and market value.

The Landmark Agreement: Celltrion and Portrai Join Forces

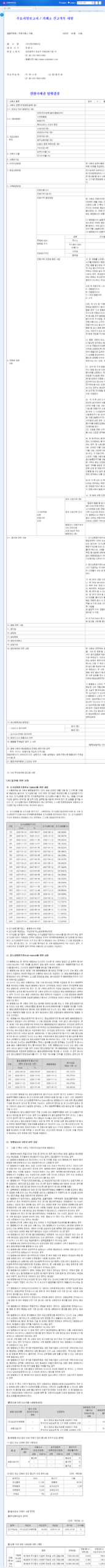

On October 29, 2025, Celltrion formalized a joint research agreement with Portrai, Inc., a specialist in spatial transcriptomics. The core of this collaboration is to utilize Portrai’s sophisticated database and analysis platform to pinpoint new disease targets and co-develop groundbreaking drugs. The agreement, which was detailed in an Official Disclosure, includes upfront payments and development milestones totaling up to $87.75 million (approximately KRW 125.9 billion). This substantial investment underscores Celltrion’s commitment to evolving beyond its biosimilar stronghold into a premier developer of innovative pharmaceuticals.

This partnership is more than a financial investment; it’s a strategic fusion of Celltrion’s development prowess with Portrai’s next-generation target discovery engine. The goal is clear: accelerate the creation of first-in-class therapies.

Why Spatial Transcriptomics is a Game-Changer

To grasp the significance of this deal, it’s essential to understand the technology at its heart. Traditional genetic analysis often involves grinding up tissue samples, losing all information about where specific cells were located. Spatial transcriptomics, however, is a revolutionary technique that maps gene activity within the precise anatomical context of the tissue. It’s like switching from a black-and-white photograph to a high-definition, interactive 3D map of a disease’s microenvironment. For more technical information, publications like Nature Methods provide extensive resources on this technology.

Strategic Advantages for Celltrion’s Drug Discovery

- •Innovative Target Identification: By visualizing gene expression patterns in diseased tissue, Celltrion can identify entirely new therapeutic targets that were previously invisible, especially in complex areas like oncology and immunology.

- •Pipeline Diversification: This technology is not limited to antibody drugs. It opens the door to developing new modalities, allowing Celltrion to build a more diverse and resilient long-term growth engine.

- •Increased R&D Efficiency: Collaborating with Portrai allows Celltrion to de-risk the costly early stages of research. Pinpointing more viable targets from the outset can significantly reduce failure rates and shorten development timelines.

Financial and Market Impact Analysis

While the total contract value represents a significant outlay, it’s a calculated investment. Celltrion’s robust financial health, as detailed in its Q2 2025 report, suggests the payments are manageable. Investors should monitor the timing of milestone payments and consider the potential risk from currency fluctuations in the dollar-denominated contract. This partnership reinforces the strategic vision following the merger with Celltrion Healthcare, which you can read about in our analysis of the integrated R&D strategy.

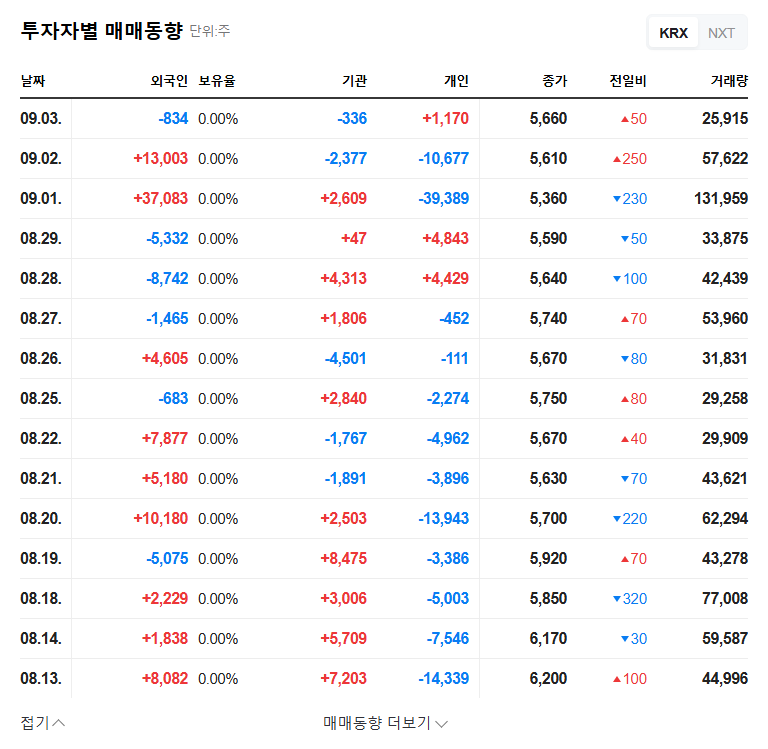

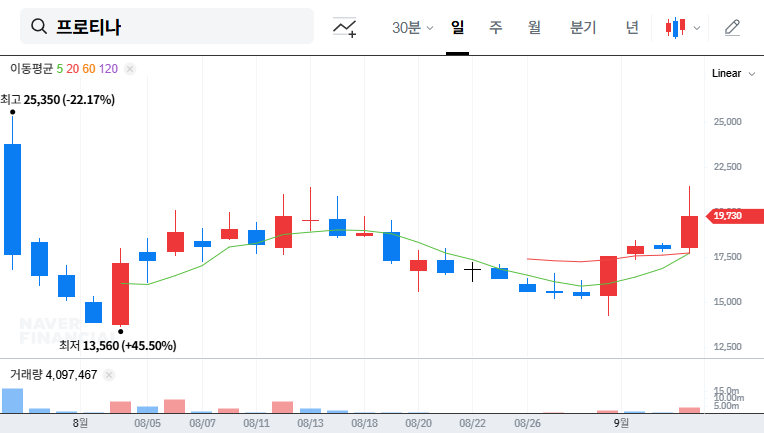

Stock Price Outlook: Short-Term Optimism, Long-Term Performance

- •Short-Term: The market is expected to react positively to the news, driven by enthusiasm for Celltrion’s adoption of innovative technology and the strengthening of its R&D pipeline.

- •Mid-to-Long-Term: The ultimate impact on corporate value and stock price will hinge on tangible results. Successful clinical trials and drug approvals stemming from the Celltrion spatial transcriptomics platform could lead to substantial, sustained appreciation.

Investor Action Plan & Final Thoughts

The Celltrion-Portrai partnership is a profoundly positive development that secures a critical future growth engine. While the inherent risks of new drug development—long timelines and high failure rates—remain, Celltrion’s strong fundamentals and commitment to R&D position it well for long-term success. The adoption of spatial transcriptomics provides a distinct competitive advantage in the crowded biopharmaceutical landscape.

Therefore, we maintain a positive, long-term outlook and reiterate a “Buy” recommendation for investors with a multi-year horizon. The key is to view this not as a short-term catalyst, but as a foundational investment in Celltrion’s next decade of growth.

Frequently Asked Questions

Q1: Why did Celltrion choose to partner with Portrai?

A1: Celltrion aims to leverage Portrai’s specialized expertise and advanced platform in spatial transcriptomics to accelerate its drug discovery efforts, identify novel targets, and strengthen its evolution from a biosimilar leader to an innovative drug powerhouse.

Q2: How does spatial transcriptomics improve drug development?

A2: It provides a detailed map of gene activity within tissue, allowing scientists to understand the complex microenvironment of a disease. This helps identify new, more effective therapeutic targets that traditional methods might miss, increasing the probability of success.

Q3: What is the long-term stock price impact of this agreement?

A3: While a short-term positive reaction is likely, the long-term impact is entirely dependent on R&D success. If this partnership leads to successful clinical trials and approved drugs, it could significantly increase Celltrion’s corporate value and stock price over the long term.