In a significant strategic move, KOSDAQ-listed Neontech Co., Ltd. (306620) has announced an absorption merger with GIS, a specialized display equipment manufacturer. This Neontech merger is a pivotal event that could reshape the company’s future trajectory. For investors, understanding the nuances of this deal is critical. This in-depth analysis will explore the rationale behind the merger, its potential impact on financials and operations, and provide a comprehensive investment strategy to navigate this corporate milestone.

Breaking Down the Neontech Merger with GIS

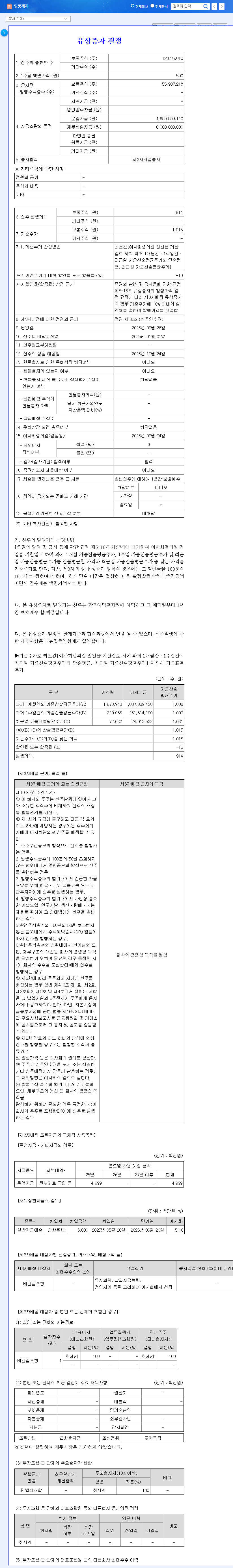

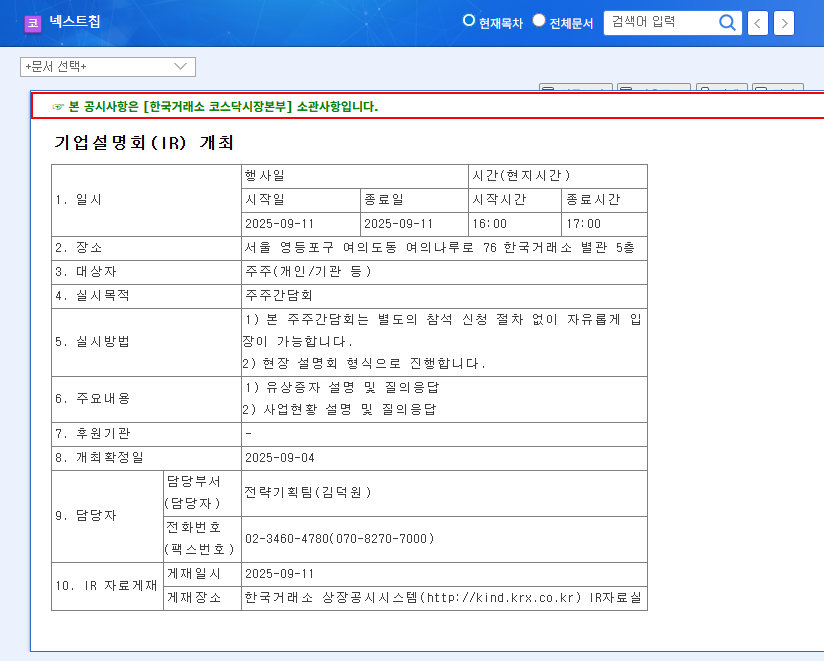

On October 28, 2025, Neontech’s board formally decided to absorb GIS, with Neontech remaining as the surviving entity and GIS being dissolved post-merger. This move aims to consolidate strengths and streamline operations. The trading of Neontech (306620) was suspended following the announcement to ensure a fair and orderly market. Here are the essential details of the transaction:

- •Surviving Company: Neontech Co., Ltd. (306620)

- •Dissolving Company: GIS (Global Industrial System)

- •GIS’s Core Business: Manufacturing machinery for advanced display production.

- •GIS’s Financials (H1 2024 est.): Sales of KRW 73.8 billion / Net Income of KRW 6.2 billion.

- •Scheduled Merger Date: January 1, 2026.

For a complete and verified breakdown of the transaction, investors are encouraged to review the Official Disclosure filed on the DART system.

The Strategic Rationale: Why This Merger Now?

Neontech’s decision is not arbitrary; it’s a calculated response to its current financial and market position. As of its H1 2025 report, the company reported an operating loss of KRW 2.216 billion on sales of KRW 31.579 billion. This underperformance, marked by a 49.66% year-over-year drop in consolidated sales, highlights significant challenges. Compounding these issues is a rising debt-to-equity ratio of 166.09%, creating concerns about financial stability.

In stark contrast, GIS demonstrates robust health, boasting impressive sales and a healthy net income of KRW 6.2 billion. The Neontech merger is therefore a strategic move to absorb GIS’s profitability, technology, and market position to counteract its own struggles, enhance management efficiency, and build a more resilient and competitive business entity.

By integrating GIS’s profitable display equipment business, Neontech aims to immediately bolster its financial statements and create powerful synergies with its existing electronics and automation divisions.

Impact Analysis for the Neontech (306620) Investor

The Upside: Potential Positive Impacts

The primary benefits of the GIS merger center on synergy and financial fortification.

- •Financial Structure Improvement: GIS’s substantial net income is expected to immediately improve Neontech’s consolidated profitability, helping to offset recent losses and stabilize the balance sheet.

- •Strengthened Competitiveness: Combining GIS’s leadership in display manufacturing equipment with Neontech’s automation division creates a more powerful, vertically integrated player in the electronics sector.

- •Operational & R&D Synergy: The integration of technologies, sales networks, and production facilities can reduce redundant costs, streamline decision-making, and accelerate innovation for new business ventures.

The Downside: Potential Risks and Headwinds

Despite the potential benefits, investors must remain aware of the inherent risks. Merger integrations are complex and can face significant headwinds.

- •Integration Challenges & Costs: Merging corporate cultures, systems, and processes can lead to short-term inefficiencies and disruption. There will also be direct costs related to legal, accounting, and advisory fees.

- •Market Perception: Neontech’s existing underperformance may lead the market to remain skeptical until tangible positive results are demonstrated post-merger.

- •External Economic Factors: The combined entity will still be subject to macroeconomic risks, such as interest rate fluctuations and supply chain volatility, which could impact performance as detailed in many expert economic forecasts.

A Prudent Investment Strategy for Neontech

A successful stock analysis requires a dual-focus approach: cautious observation in the short term and diligent monitoring in the long term.

Short-Term Strategy: Observe and Analyze

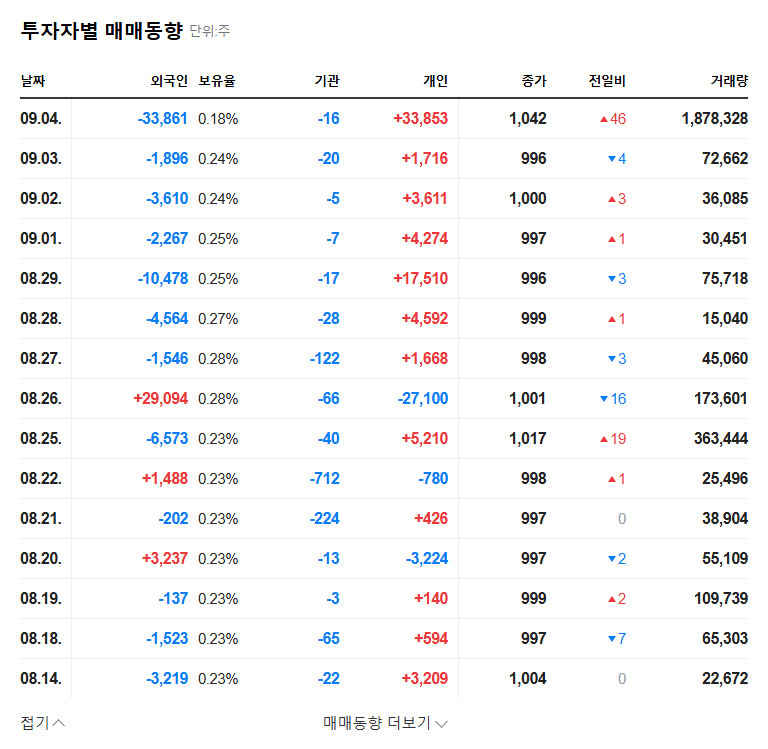

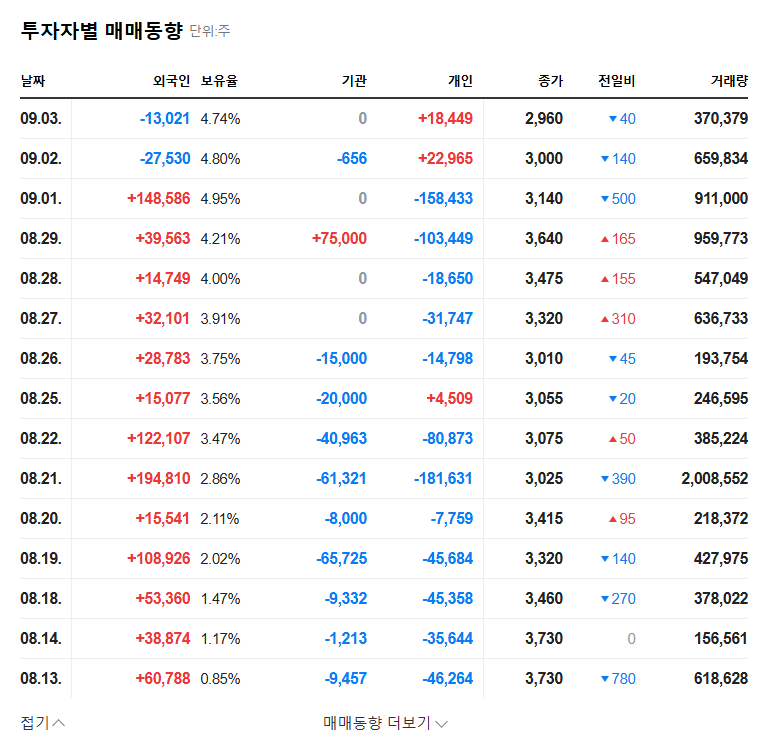

During the trading suspension and immediately after resumption, information gathering is key. Investors should carefully analyze the merger ratio and any new share issuance details. It is crucial to monitor the market’s reaction once trading resumes, as initial volatility is common. A wait-and-see approach is advisable until the post-merger landscape becomes clearer. For more on this, consider reading our guide to navigating M&A announcements.

Mid- to Long-Term Strategy: Monitor Key Performance Indicators

Long-term value will depend entirely on execution. Investors should track whether the promised synergies materialize into improved profitability and market share. Key financial health metrics to watch include the debt-to-equity ratio, operating cash flow, and gross margins. Furthermore, the performance of Neontech’s other ventures in smart farming, AI, and big data will be a critical indicator of its ability to innovate and diversify beyond the scope of this merger. The success of this Neontech merger will ultimately be written in these future financial reports.