Alux Inks $7.3M Drone Supply Deal

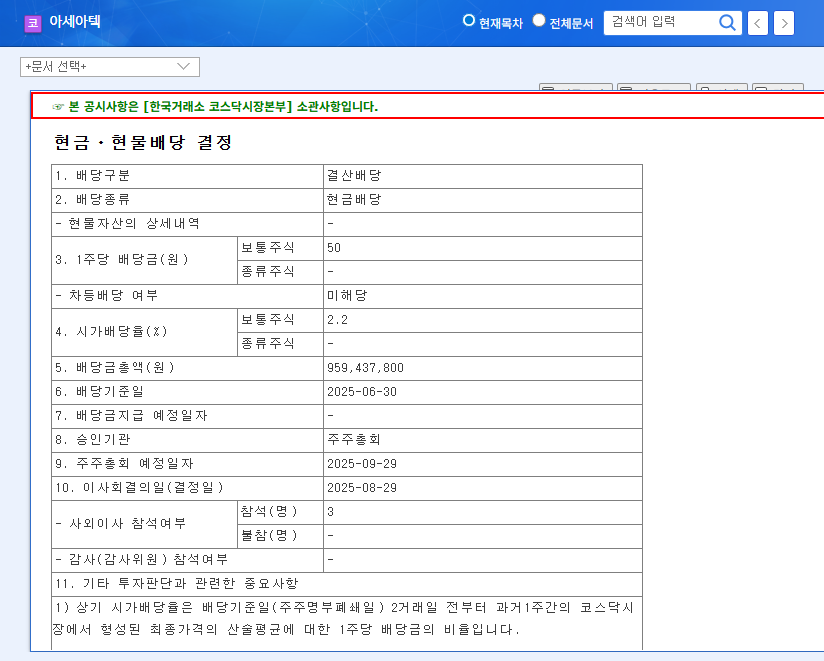

On September 5, 2025, Alux announced a $7.3 million drone supply contract with US-based Robolink. This represents 25.32% of Alux’s recent annual revenue and will run for two years, from September 8, 2025, to September 7, 2027.

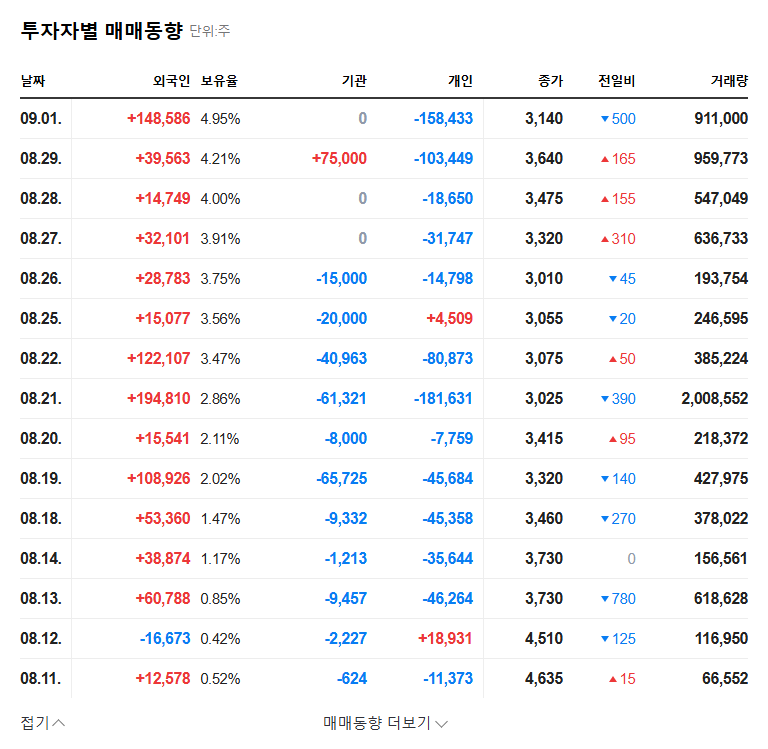

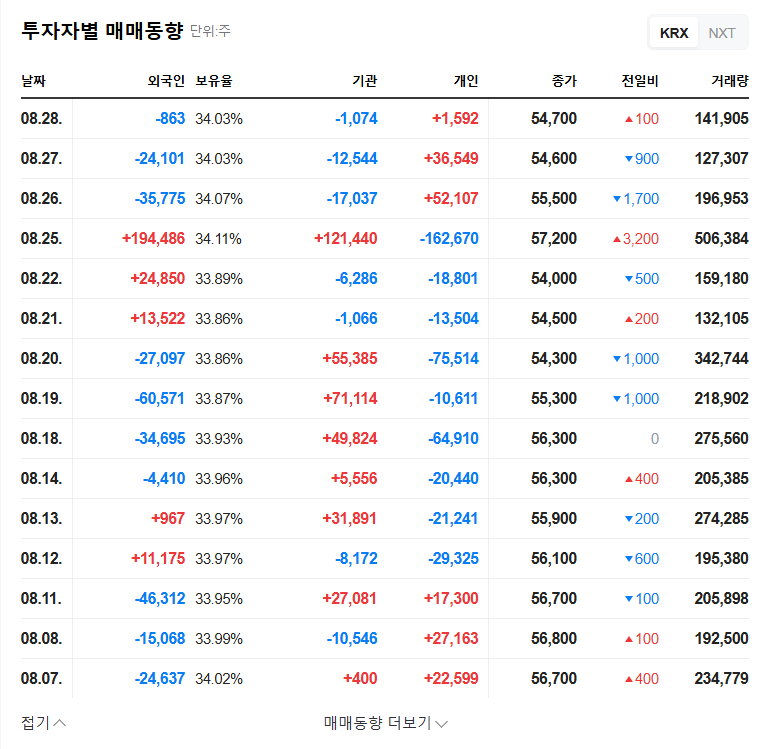

Contract Implications and Market Impact

This contract is expected to provide positive momentum for Alux. It secures stable revenue for two years and establishes a foundation for enhanced global competitiveness through entry into the US market. Alux’s proprietary FC technology, which offers a cost advantage, and its CES Innovation Award win are key testaments to its technological prowess. However, the operating loss reported in the first half of 2025 highlights the ongoing challenge of improving profitability.

Key Considerations for Investors

- Profitability Improvement: Investors should monitor not just revenue growth but also improvements in profitability metrics like operating margin and gross profit margin.

- SG&A Expense Management: Continued monitoring of increasing SG&A expenses, including R&D, salaries, and stock compensation costs, is crucial.

- US Market Competition: Alux’s strategies for navigating increasing competition and market changes, such as the DJI Tello discontinuation, should be observed.

- Exchange Rate Volatility: The potential impact of fluctuations in the USD/KRW exchange rate on the contract value should be considered.

Conclusion: Growth Potential and the Path to Profitability

This contract is a positive sign for Alux’s growth potential. However, achieving true increases in company value hinges on addressing the challenge of profitability. Investors should carefully analyze the key indicators mentioned above and make informed investment decisions.

Frequently Asked Questions

Will this contract positively impact Alux’s stock price?

In the short term, a positive impact is likely. However, the long-term stock performance will depend on improvements in profitability.

What are Alux’s main business areas?

Alux is engaged in the manufacturing of robots and drones, as well as educational services. The growth of its drone business, particularly in exports, is noteworthy.

What are the key risks to consider when investing in Alux?

Investors should consider factors such as declining profitability, intensifying competition, and exchange rate volatility. Also, this analysis is not investment advice, and investment decisions are the sole responsibility of the investor.