What Happened?

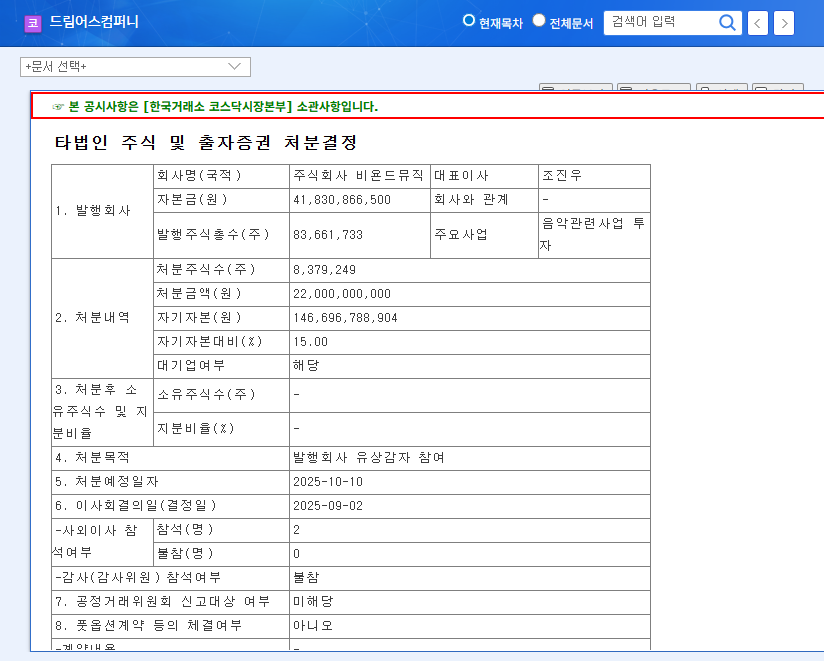

Dreamus Company, the operator of music streaming service ‘FLO,’ has decided to sell its entire 15% stake in Beyond Music for ₩22 billion. The purpose of the sale is to participate in Beyond Music’s capital reduction. This divestiture marks the complete separation of Dreamus Company from Beyond Music.

Why the Divestiture?

The official reason is participation in Beyond Music’s capital reduction. However, this move aligns with Dreamus Company’s strategy to focus on its core business. Following the divestiture of its iRiver business and share buybacks, Dreamus Company is demonstrating its commitment to concentrating resources on its music platform, ‘FLO.’

What Does This Mean? – Opportunities and Threats

- Positive Effects: Improved financial structure, core business focus, enhanced shareholder value

- Negative Effects: Short-term liquidity decrease, increased stock volatility, reduced new business investment capacity

The significant cash outflow of ₩22 billion could be a burden in the short term, but it could also strengthen the company’s financial health and allow for greater focus on core operations in the long run. However, the possibility of hindered investment in new businesses cannot be ruled out.

What Should Investors Do?

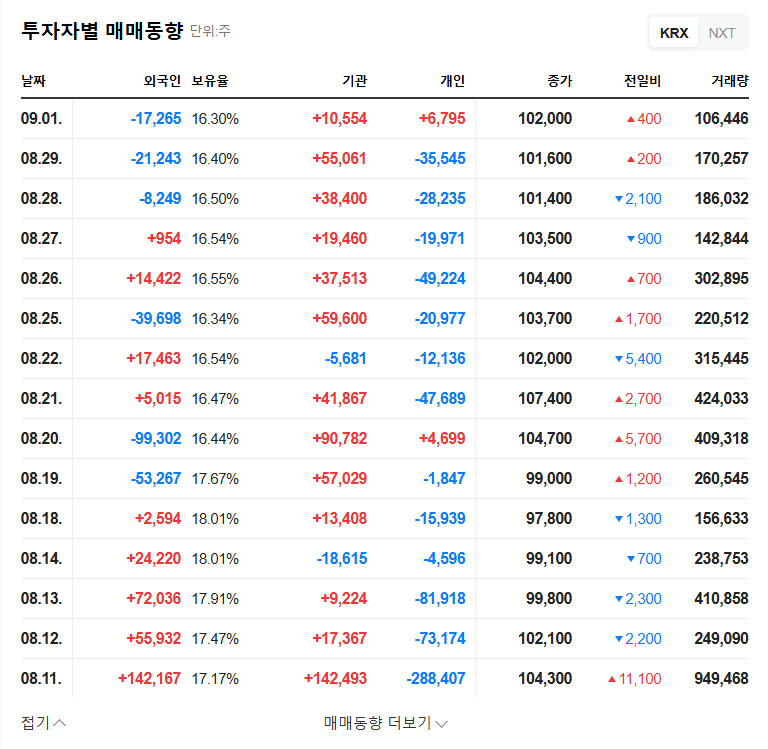

A ‘cautious wait-and-see’ approach is recommended rather than making immediate investment decisions. Investors should closely monitor future stock fluctuations, changes in Beyond Music’s investment strategies, the growth of the FLO platform, and the performance of Dreamus Company’s new businesses to identify potential investment opportunities.

FAQ

What is Dreamus Company’s main business?

Dreamus Company operates the music streaming service ‘FLO.’ They are also involved in other music-related businesses, such as MD and concert production.

How will this divestiture affect Dreamus Company’s stock price?

In the short term, stock volatility may increase. However, the long-term impact will depend on the growth of Dreamus Company’s core business and improvements in its financial health.

What should investors pay attention to?

Investors should closely monitor the growth of the FLO platform, new business development progress, and the company’s ability to maintain financial stability.

Leave a Reply