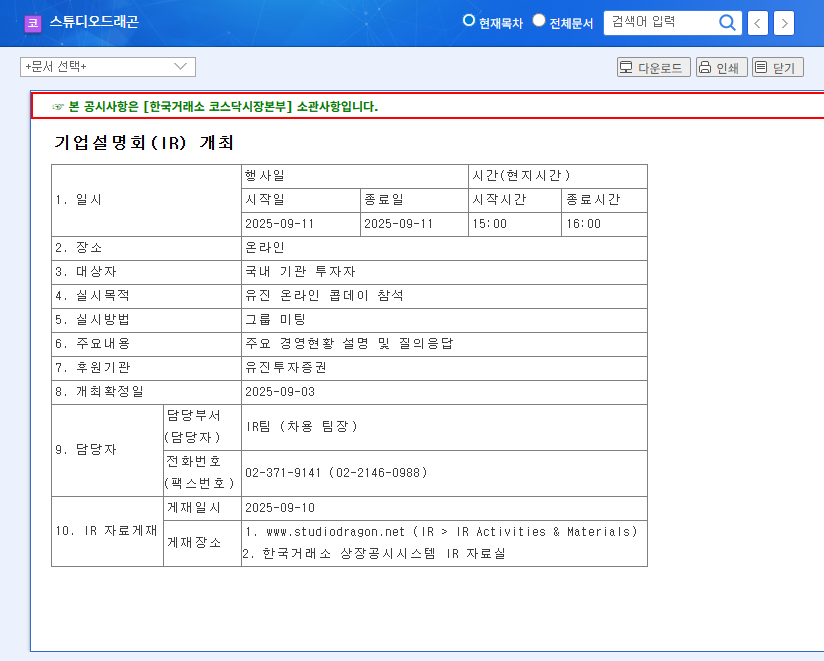

On November 6, 2025, the global content powerhouse Studio Dragon Corporation will hold its highly anticipated Investor Relations (IR) conference to announce its Q3 2025 financial results. This event is far more than a routine update; it represents a critical inflection point. Following a challenging first half of the year, the upcoming Studio Dragon Q3 earnings report and subsequent discussion will signal whether the company is poised for a powerful rebound or facing continued headwinds. This deep-dive analysis will explore the key factors investors must watch, dissecting the company’s financial health, global strategy, and future growth prospects.

For those invested in the dynamic world of K-drama production and global streaming, understanding the nuances of this IR call is essential. We will provide a clear, comprehensive overview to help you formulate a well-informed investment strategy for Studio Dragon.

Analyzing the Current Landscape: H1 2025 Performance

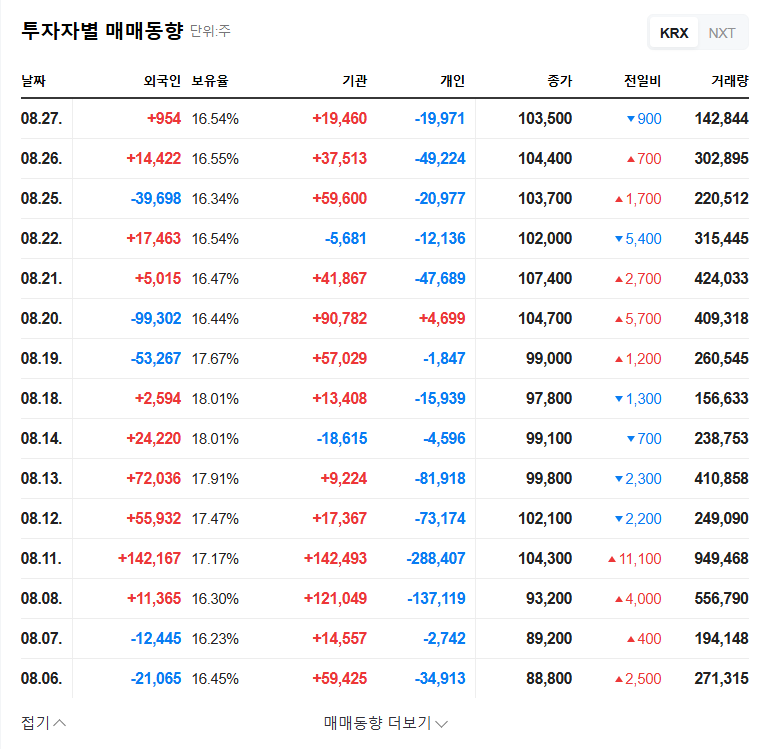

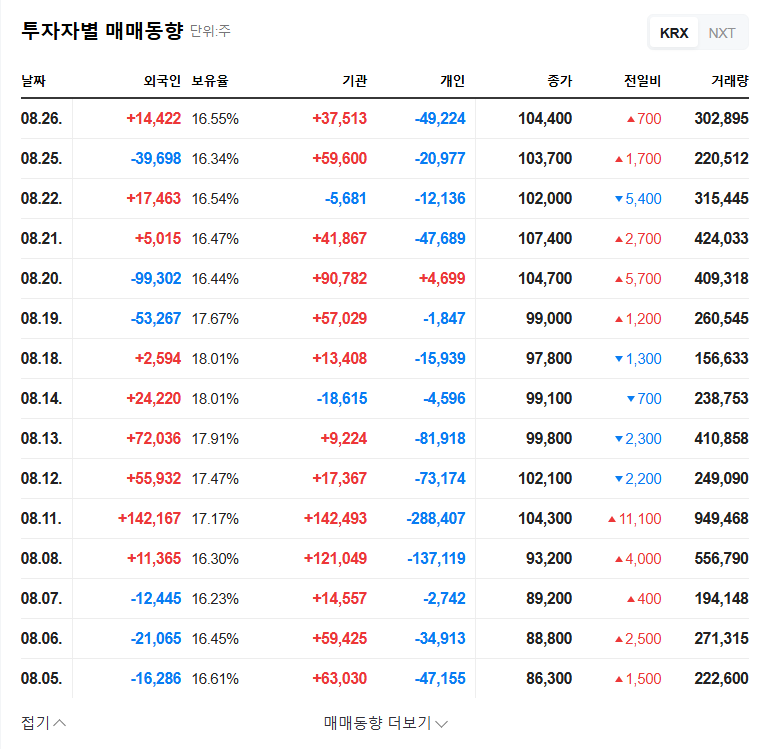

To understand the significance of the Q3 report, we must first look at the context set by the first half of 2025. Studio Dragon reported revenues of KRW 248.3 billion and a lean operating profit of KRW 1.4 billion. This marked a substantial year-on-year decline, primarily driven by a smaller content lineup, underwhelming performance from new titles, and a high base effect from a stronger prior year. The global streaming market has also become increasingly competitive, a factor detailed in reports by industry analysts like Bloomberg on the state of OTT platforms.

Despite the short-term profitability pressures, Studio Dragon’s financial structure remains stable with a debt-to-equity ratio of just 27.59%, providing a solid foundation to navigate market turbulence and fund future growth.

Dissecting the Studio Dragon Q3 Earnings Call: An Investor’s Checklist

The upcoming IR is a chance for management to restore investor confidence. Success will depend on their ability to present a clear, credible strategy for a second-half rebound. Here are the core areas investors should scrutinize.

1. Financial Health and Profitability Metrics

While top-line revenue is important, the key focus will be on profitability. Fixed cost burdens weighed heavily in H1, so any commentary on cost optimization and margin improvement will be critical. For a direct look at the official filings discussed, investors can review the Official Disclosure on DART.

- •Revenue Growth: Has the 24.6% YoY decline from H1 started to reverse?

- •Operating Profit: Are margins improving from the thin KRW 1.4 billion seen in H1?

- •Forward Guidance: What is the outlook for Q4 and the full year 2026?

2. Global Strategy and Production Competitiveness

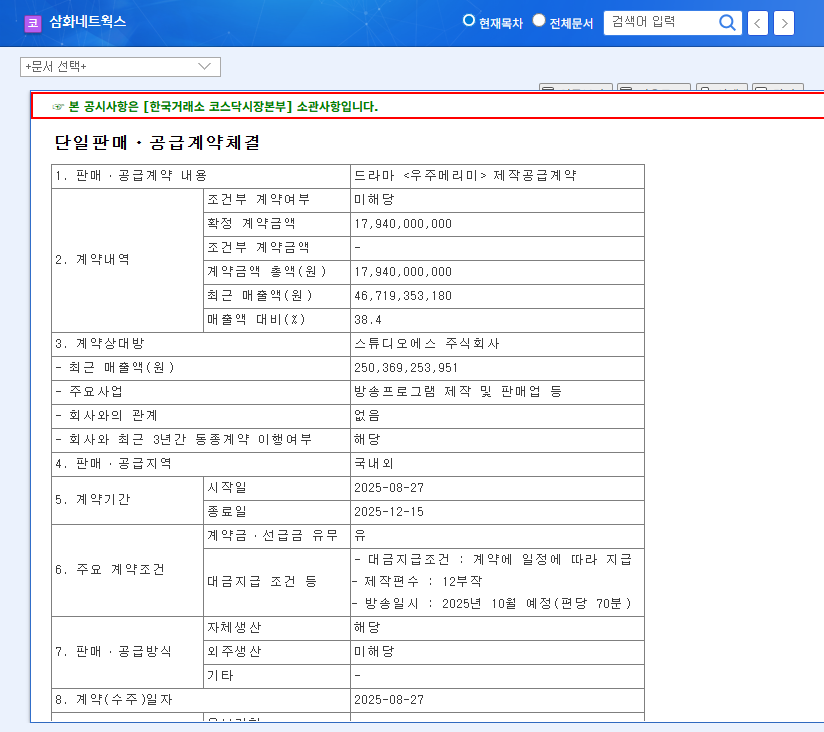

Studio Dragon’s key advantage is its world-class K-drama production engine. The global success of titles like <Marry My Husband: Japanese Version> on Amazon Prime Video is a testament to this strength. The IR must detail how the company plans to leverage this capability further. For more on this, see our previous analysis of global content trends.

- •OTT Partnerships: Updates on deals with global players like Apple TV+ and Netflix.

- •U.S. & Japan Expansion: Concrete progress on U.S. projects and plans to build on success in the Japanese market.

- •Content Pipeline: Details on the H2 lineup, including the number of broadcast episodes and potential tentpole releases.

3. New Business Ventures and IP Monetization

To secure long-term growth, Studio Dragon is venturing into next-generation technology, including blockchain, NFTs, and the metaverse through a partnership with “The Sandbox.” While these are promising, investors will be looking for tangible progress and a clear path to monetization. Vague promises won’t be enough; the market wants to see signs of real revenue generation from these initiatives.

Overall Assessment and Investment Strategy

The Studio Dragon Q3 earnings IR is a make-or-break moment. A positive outcome would involve evidence of a Q3 performance rebound, a robust and exciting H2 content slate, and a clear, detailed strategy for winning in an increasingly competitive global market.

Potential red flags would be a continuation of H1’s sluggish performance without a credible turnaround plan, vague commentary on new business ventures, and a failure to address competitive pressures. Investors should maintain a long-term perspective, as the company’s core IP and production capabilities remain valuable assets. However, a cautious approach is warranted until management provides concrete evidence that their strategy is delivering results. This IR will be the first major test.