Tech giant Samsung Electronics recently made headlines with a significant ₩1.15 billion donation to the Korea Athletics Federation. While this act of corporate social responsibility (CSR) is commendable, astute investors are asking a crucial question: What does this mean for SAMSUNG ELECTRONICS stock and the company’s long-term value? This news, though seemingly minor against Samsung’s massive scale, offers a valuable window into its strengthening commitment to ESG (Environmental, Social, and Governance) principles—a factor of growing importance in modern investment analysis.

In this comprehensive analysis, we will move beyond the headlines to dissect the real impact of this donation. We’ll explore the immediate (and likely minimal) effect on stock volatility, the significant long-term benefits for Samsung’s corporate image and ESG profile, and how this fits into a broader Samsung investment strategy based on its robust financial fundamentals and the current macroeconomic landscape.

The Event: A Strategic Donation to National Athletics

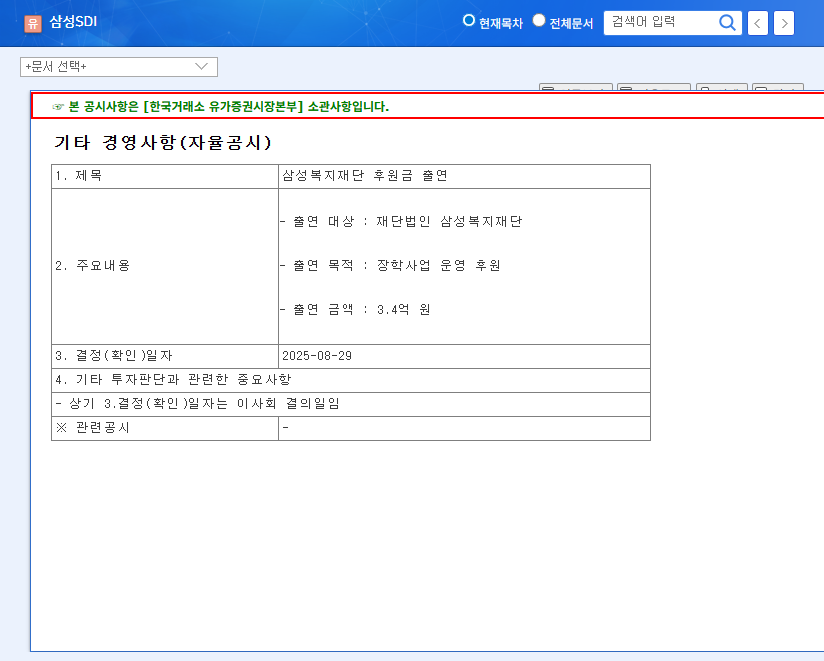

On October 30, 2025, Samsung Electronics formally announced its ₩1.15 billion contribution to the Korea Athletics Federation. According to the company’s official disclosure, this funding is earmarked to bolster the entire track and field ecosystem in Korea. The support will cover hosting national competitions, facilitating participation in international events, and directly funding athlete training programs. This is a clear move by Samsung to reinforce its role as a key corporate citizen in its home country. You can view the Official Disclosure (DART) for more details. While a positive public relations move, its true investment value lies deeper.

Analyzing the Impact on SAMSUNG ELECTRONICS Stock

Short-Term Volatility: A Non-Event for the Market

For a behemoth like Samsung, a donation of ₩1.15 billion (approximately $850,000 USD) is financially negligible. It will not materially affect the company’s quarterly earnings, cash flow, or balance sheet. Consequently, the direct, short-term impact on the SAMSUNG ELECTRONICS stock price is expected to be minimal to non-existent. The market is far more concerned with semiconductor demand, smartphone sales, and global economic indicators. Any positive sentiment from the news is unlikely to translate into a sustained stock price movement on its own.

Long-Term Value: The Growing Power of Samsung ESG

The real story here is the contribution to Samsung’s ESG profile. ESG investing is no longer a niche strategy; it’s a mainstream requirement for many of the world’s largest institutional investors. This donation directly strengthens the ‘S’ (Social) pillar of Samsung’s ESG rating.

Consistent and visible social contributions enhance corporate reputation, build brand loyalty, and attract long-term, stable capital from ESG-focused funds. This, in turn, can reduce investment risk and support a higher valuation for the company over time.

Furthermore, this partnership could create marketing synergies, aligning the high-performance image of athletics with Samsung’s technology brand. For investors, a strong Samsung ESG track record is a proxy for good governance and forward-thinking management, making it a more attractive long-term holding.

Beyond the News: A Look at Samsung’s Core Fundamentals

A sound Samsung investment strategy must be rooted in its fundamental financial health, not single news events. The H1 2025 report reveals a resilient and forward-looking company. While the semiconductor (DS) division faced headwinds, the mobile and home appliance (DX) division showed strong growth, powered by premium AI-integrated products. Crucially, demand for AI server components like DRAM and SSDs is a powerful tailwind for the future.

The company’s financial position is exceptionally strong:

- •Rock-Solid Balance Sheet: A minuscule debt-to-equity ratio of just 0.264% indicates immense financial stability and low risk.

- •Massive Cash Generation: Operating cash flow stood at an impressive ₩33.9 trillion, providing ample capital for R&D, strategic investments, and shareholder returns.

- •Shareholder Commitment: A clear policy of returning 50% of free cash flow, alongside annual dividends of ~₩9.8 trillion, underscores its investor-friendly stance.

These fundamentals are the true drivers of the SAMSUNG ELECTRONICS stock value. For a broader view on market conditions, investors often consult sources like global economic reports from Reuters to understand macroeconomic trends.

Investment Strategy & Recommendations

Given this analysis, the donation news should be viewed as a positive but minor data point. It reinforces the qualitative strengths of the company but does not alter the quantitative investment thesis. A prudent strategy involves:

- •Focus on the Core Business: Base investment decisions on the outlook for the semiconductor cycle, AI-driven demand, and competition in the mobile device market. These factors will have a far greater impact on revenue and profit. For more on this sector, see our complete guide to investing in semiconductor stocks.

- •Monitor ESG as a Long-Term Catalyst: Continue to track Samsung’s ESG initiatives. An improving score can attract more institutional capital and de-risk the investment over the long haul.

- •Watch Macroeconomic Indicators: Keep an eye on currency fluctuations (USD/KRW), global interest rate policies, and raw material costs, as these external variables significantly influence Samsung’s profitability.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. All investment decisions should be made with the consultation of a qualified financial advisor.