The financial markets are abuzz with speculation surrounding a potential SK Eternix sale by its parent holding company, SK Discovery Co.,Ltd. This development has captured significant investor attention, especially as the global focus on renewable energy intensifies. For any SK Discovery investor, understanding the nuances of this potential divestiture is critical. Why would a company consider selling a key subsidiary in a high-growth sector? This comprehensive guide provides an in-depth analysis of the rumors, the company’s official stance, and the strategic implications for your investment portfolio.

The Catalyst: Unpacking the SK Eternix Sale Rumors

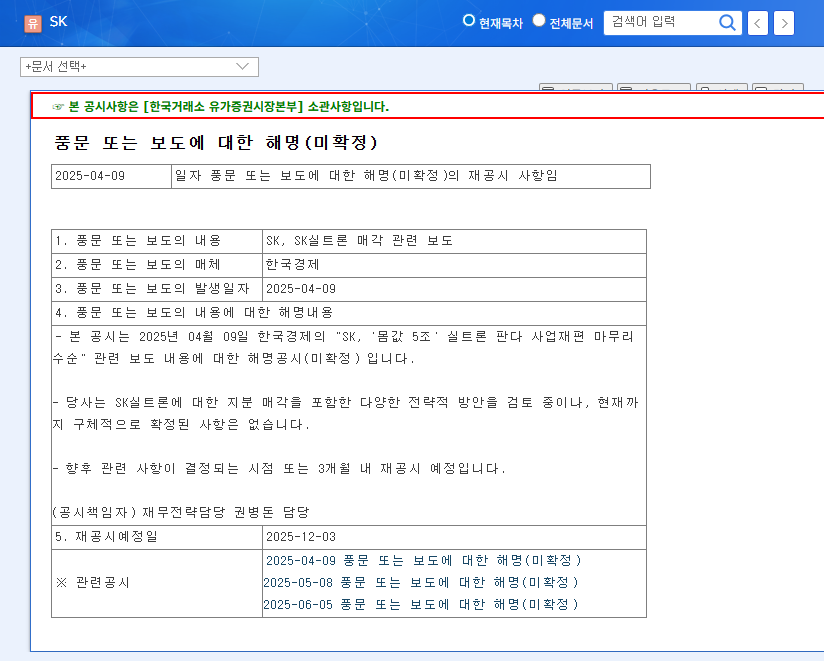

The speculation gained significant momentum on November 5, 2025, following a report from the Seoul Economic Daily suggesting that SK Discovery Co.,Ltd. was fast-tracking the sale of its stake in SK Eternix as a first step in a broader renewable energy business reorganization.

In response, the company issued a clarification disclosure to address the market chatter. According to their statement, while they are reviewing various strategic options to enhance corporate value—which includes a potential SK Eternix sale—nothing has been finalized. The company has committed to a re-disclosure by December 4, 2025, to provide a more definitive update. You can view the Official Disclosure (DART) for the precise wording.

Strategic Context: Company Fundamentals and Market Pressures

To understand the ‘why’ behind this potential move, we must look at the profiles of both companies and the challenging macroeconomic environment they operate in.

SK Discovery Co.,Ltd.: The Pure Holding Company

SK Discovery Co.,Ltd. operates as a pure holding company. This means its primary function is to own and manage shares in its diverse subsidiaries, deriving revenue mainly from dividends. Its portfolio is robust, including key players like SK Gas, SK Chemicals, and SK Bioscience. While its financial health is generally sound, with ‘A+’ and ‘A2+’ credit ratings, its debt-to-equity ratio stood at 164.24% in the first half of 2025. A significant cash injection from an SK Eternix sale could substantially de-leverage its balance sheet.

SK Eternix: The Renewable Energy Growth Engine

SK Eternix is undeniably a jewel in the portfolio. Operating in high-demand sectors like solar, wind, fuel cells, and Energy Storage Systems (ESS), it represents the future. The company is at the forefront of major projects, including Korea’s largest private offshore wind power initiative. The global transition to clean energy, a trend confirmed by authorities like the International Energy Agency (IEA), makes SK Eternix a highly attractive asset. This high valuation presents a strategic dilemma: hold on for future growth or capitalize now to fund other ventures?

For investors, the central question is not just the price of the SK Eternix sale, but the clarity and credibility of SK Discovery’s vision for the future without it.

Potential Impacts: A Double-Edged Sword for Investors

A divestiture of this magnitude carries both significant opportunities and risks. A savvy SK Discovery investor must weigh both sides carefully.

The Bull Case: Positive Outcomes

- •Strengthened Financials: The primary benefit would be a significant improvement in the financial structure, reducing debt and increasing liquidity.

- •Strategic Pivot: It allows management to realign the business portfolio, potentially exiting a capital-intensive sector to focus on higher-margin core businesses.

- •Capital for Growth: The proceeds could fund new M&A, enhance shareholder returns through dividends or buybacks, or pay down expensive debt.

The Bear Case: Potential Negatives

- •Weakened Growth Profile: Selling a key growth engine could lead the market to question SK Discovery’s long-term growth trajectory.

- •Valuation Concerns: If the market perceives the sale price as too low, it could negatively impact SK Discovery’s stock price.

- •Execution Uncertainty: The period of uncertainty until a deal is confirmed or denied can lead to stock price volatility.

Investor’s Action Plan: Navigating the Uncertainty

Given the complexity, a prudent approach is necessary. Focus on the official communications and fundamental business drivers. For those looking to deepen their knowledge, understanding how to approach complex corporate structures is key. You can learn more about analyzing holding company stocks in our related guide.

Monitor these key areas closely:

- •The Re-Disclosure: The update on or before December 4, 2025, is paramount. It will provide clarity on the company’s intentions.

- •Sale Terms: If a sale is confirmed, the valuation and terms will determine the financial impact on SK Discovery.

- •Future Vision: Pay close attention to management’s plan for using the proceeds and their strategy for future growth post-sale.

- •Core Subsidiary Performance: Keep an eye on the health of other key businesses like SK Gas, as their performance will be even more critical.

Frequently Asked Questions (FAQ)

Why is SK Discovery considering the SK Eternix sale?

The company is exploring strategic options to enhance shareholder value. An SK Eternix sale could achieve this by improving its financial structure, allowing it to focus on core businesses, and providing significant capital for new investments or debt reduction.

How might this sale impact SK Discovery’s stock price?

The impact is twofold. In the short term, the stock could react positively to the prospect of a healthier balance sheet. However, the long-term reaction will depend on whether investors believe the sale compromises future growth. The final sale price and the company’s subsequent strategy will be the ultimate drivers.

What is SK Discovery’s official stance?

Officially, SK Discovery Co.,Ltd. has confirmed it is reviewing options, including a sale, but states that nothing has been decided. They are legally obligated to provide a follow-up disclosure within one month of their initial statement (by Dec 4, 2025).